A Green Light Signal Flash For The Oil Market

As we wrote in our 3rd inning WCTW report, we have our first three crappy hitters up first (Q1 2023). Luckily for us, the first crappy hitter has made it on base by bunting. It wasn't pretty, but it got the job done. In the case of the oil market, we've somehow managed to change the market's perception that Q1 will be nonstop builds to one that is transitory.

How do we know this?

Brent 1-2

Here is a chart of the Brent 1-2 timespread. As the prompt month approaches expiration soon, this is no longer as good of a signal as it used to be. But regardless, if we can close out this month in backwardation, it would send a clear signal to me that crude tightness is on the horizon.

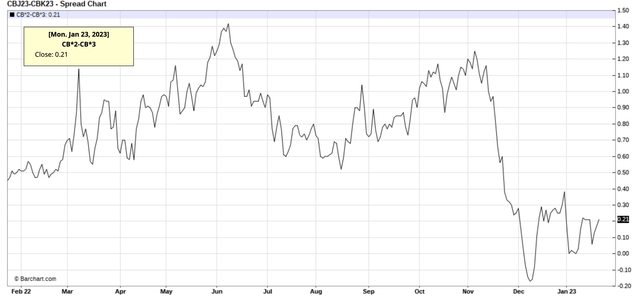

Brent 2-3

In addition, the signal we said to keep a close eye on remains in backwardation. Although we have not seen any material improvement just yet, it is a positive signal.

But the reason for the title of this article is the recent price move we are seeing in refining margins. You can see here the vanilla 3-2-1 crack spread: