Q4 2025 is coming to a close soon, and there’s one thing all oil market participants must acknowledge: this quarter was not as oversupplied as initially thought. As a matter of fact, and let me be blunt about it, it’s not that oversupplied at all.

Source: IEA

In the IEA’s oil market report published in November, it estimated that the global imbalance for Q4 2025 is 3.5+ million b/d.

Where’s the oil?

Well, if you take oil-on-water (crude + products), and you add it to global satellite onshore crude storage, you get this chart.

That’s a pretty shocking chart, right?

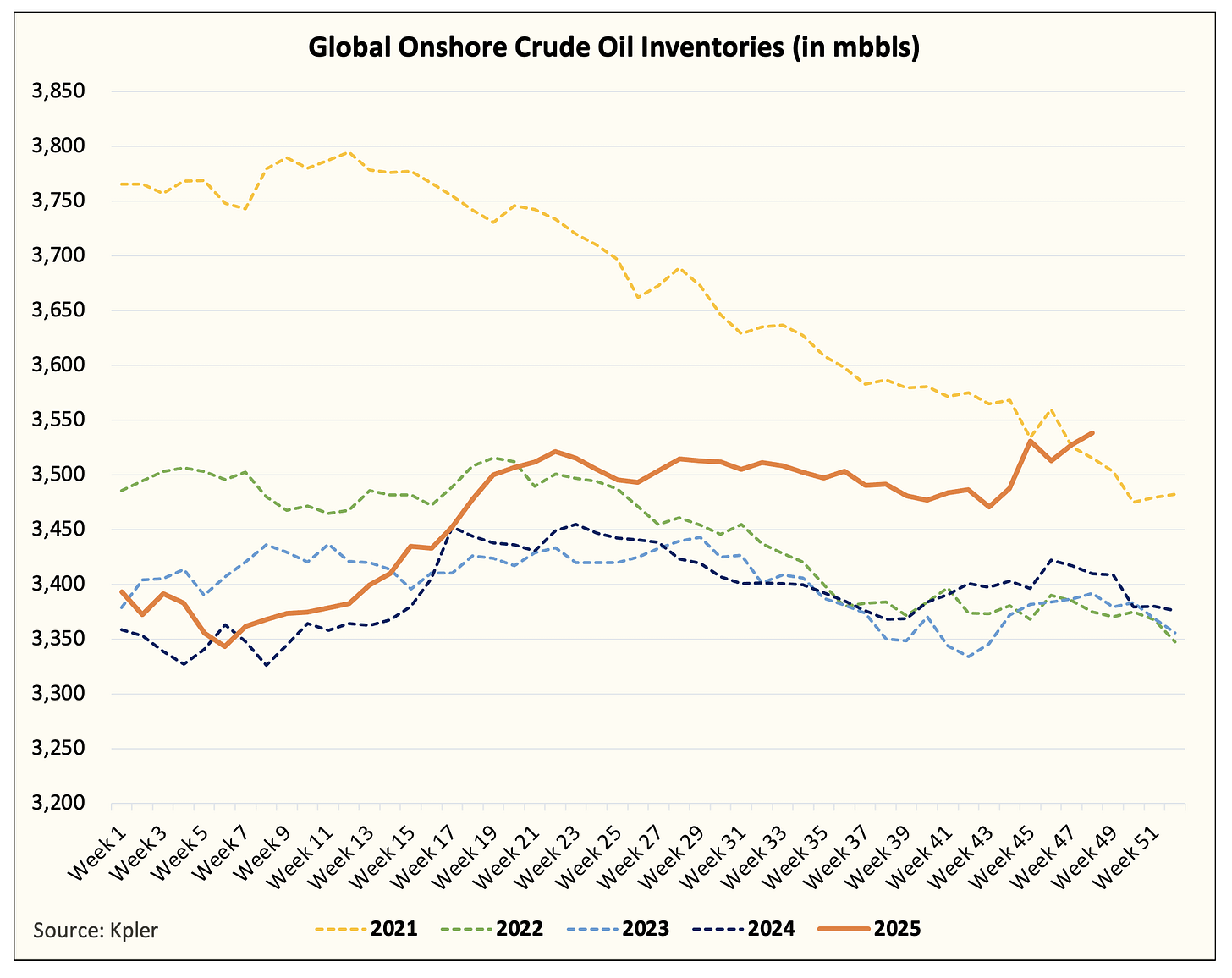

Here’s what it looks like using onshore crude storage:

And here’s what it looks like using oil-on-water:

As you can see, most of the “surplus” is via oil-on-water, but there’s more to this data that we need to show you.

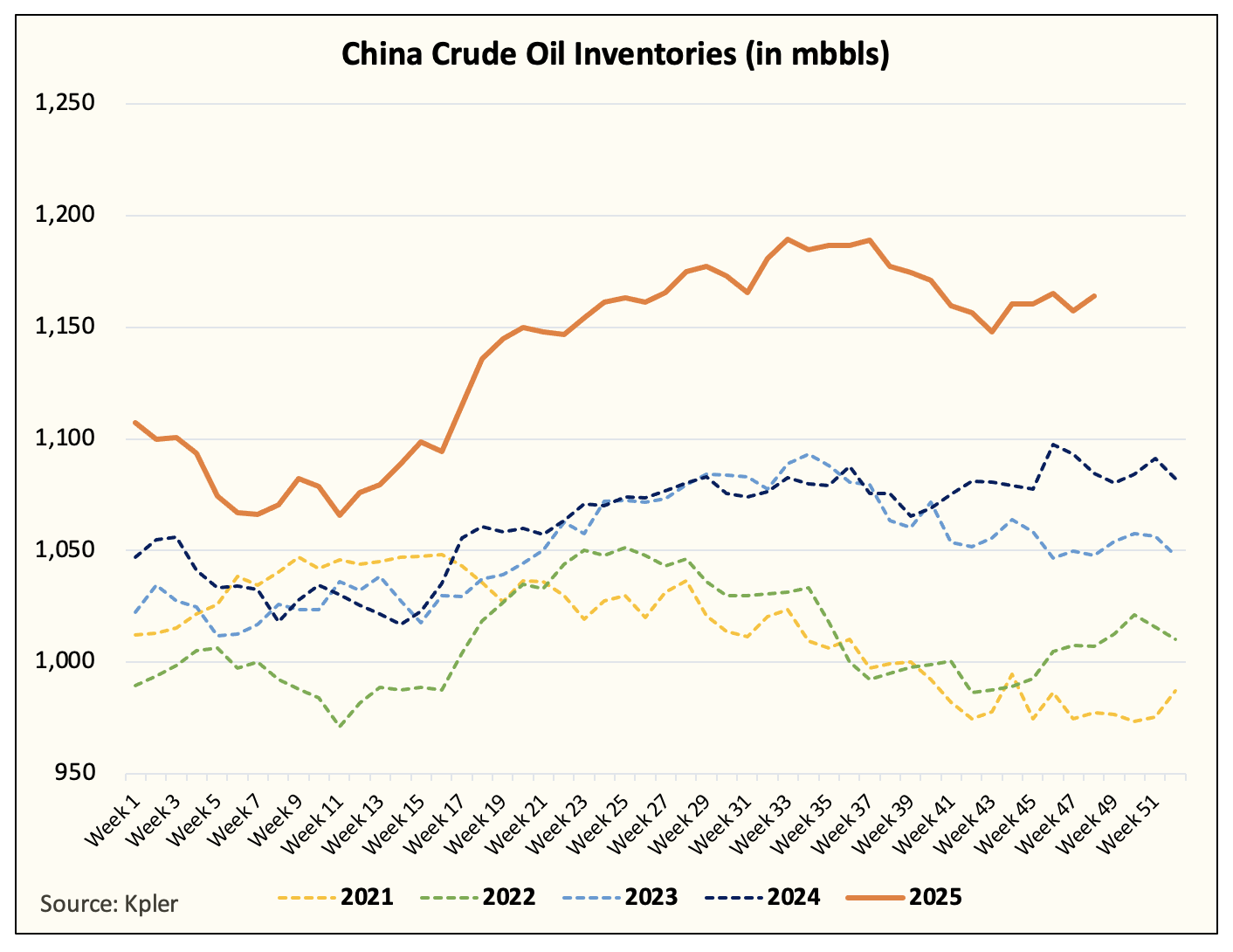

The China Variable

Chinese onshore crude oil inventories have increased materially this year. The surplus that’s in everyone’s Excel model is largely due to this material increase (coupled with the increase in oil-on-water). But here’s a question I want you to think about: if China’s crude buying is due to 1) national security and 2) geopolitical strategy, should this still be counted via the balance?

Inversely, oil watchers should remember that in 2022, the Biden administration coordinated with the IEA to release nearly ~300 million bbls of crude from the SPR. That was a supply increase, so why wouldn’t China’s stockpiling of SPR be considered a demand increase?