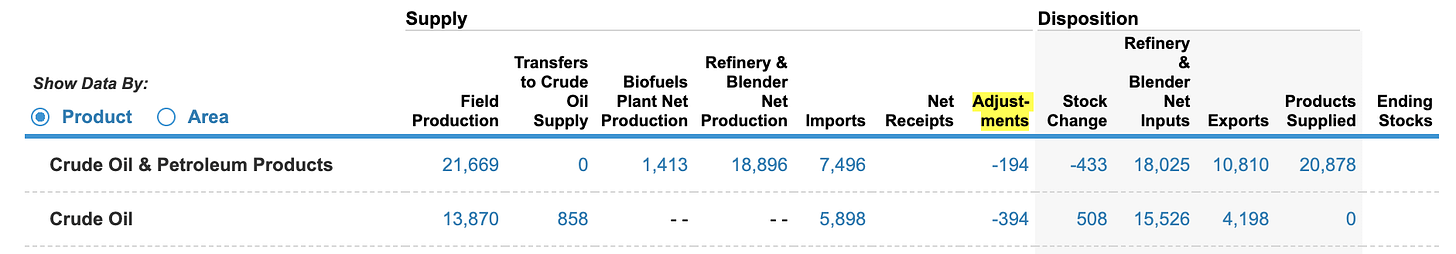

Headline wins again: US crude oil production reached an all-time high of 13.87 million b/d for October 2025!

But the reality underneath is different. The adjustment factor was reported at -394k b/d, suggesting that the real US crude oil production figure was 13.476 million b/d (13.87 - 0.394).

Source: EIA

Now, it’s important to keep in mind that the US government shutdown impacted US crude export data. Using our physical tanker movement and adjusting for the difference, the trued-up adjustment was -294k b/d (100k b/d lower). As a result, the “real” US crude oil production figure was 13.576 million b/d.

In October 2024, the same methodology produced a “real” US crude oil production figure of 13.312 million b/d. The increase y-o-y is +264k b/d.

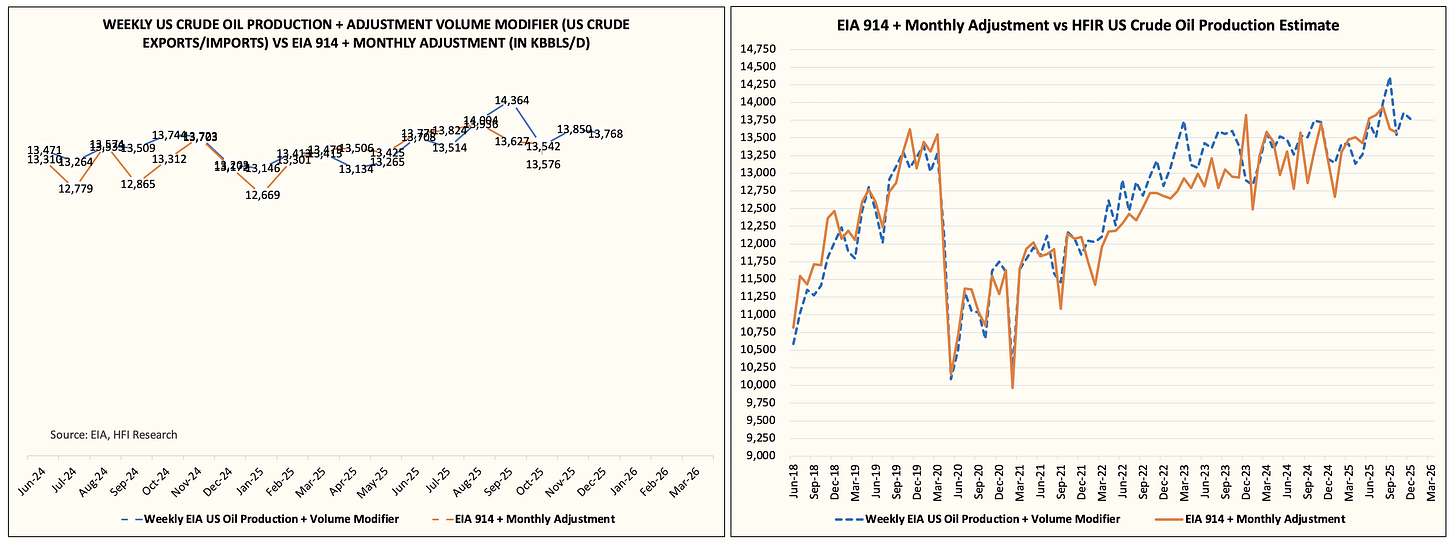

At HFIR, we track US crude oil production in real-time, and this is how we did:

Our estimate for October was 13.542 million b/d vs 13.576 million b/d.

Looking ahead, US crude oil production is expected to rebound in November and December. Our real-time production tracker shows 13.85 and 13.768 million b/d, respectively.

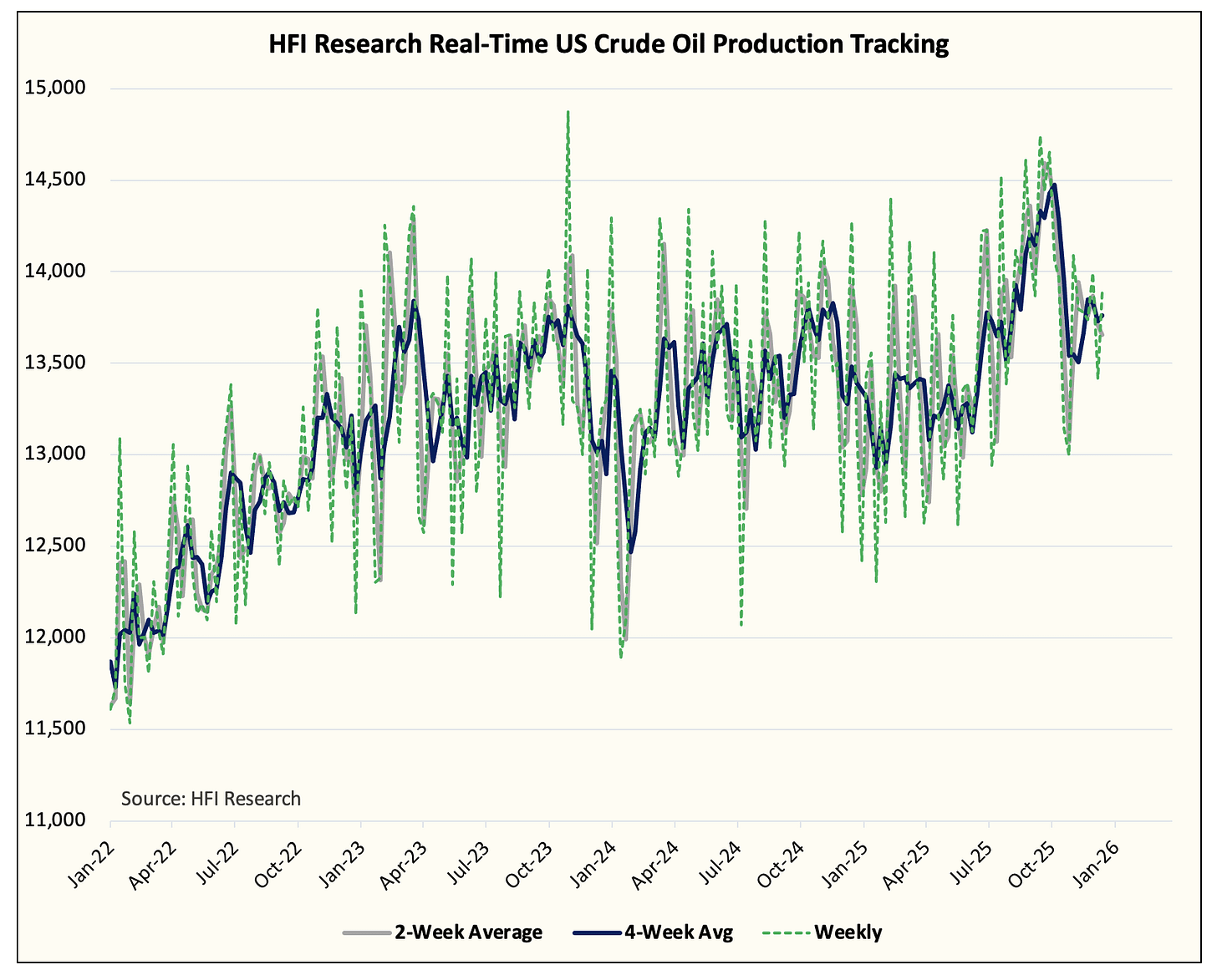

Our real-time US crude oil production tracker suggests that overall production peaked in September, and we should expect to see further weakness ahead. We assume that with WTI where it is today ($58), US crude oil production will decline back to ~13.3 million b/d by the middle of 2026.

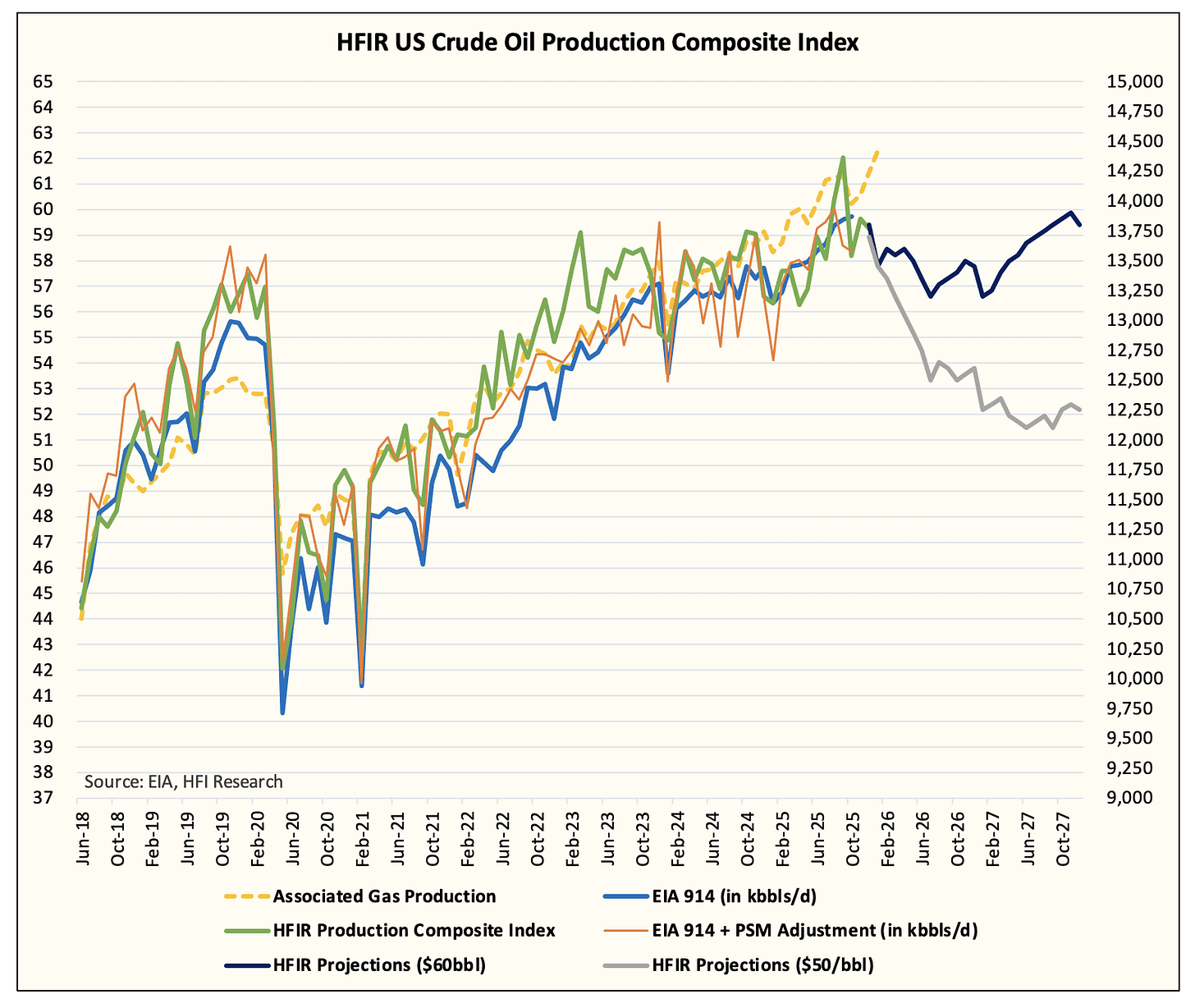

Now, the interesting datapoint you can see in our composite index is the strength we are seeing in associated gas production. This was a clear trend throughout 2024 to 2025, and we suspect a higher gas-to-oil ratio will continue to contribute to this widening trend.

From a supply & demand standpoint, the weakness in implied US crude oil production is a good sign, but not enough (at the moment) to dramatically change the calculus.

The consensus is still expecting global oil inventories to build in Q1, so any meaningful uptick in oil will be muted with this fundamental backdrop. The decline in US crude oil production won’t meaningfully impact global oil balances until H2 2026, and if global oil demand remains healthy, we should see the oil market tip into a small deficit.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Hey Wilson, could you remind me what the conclusion was on the Real-Time tracking spiking so high in Sept? Happy New Year!