After posting our WCTW yesterday titled, "It's Time To Play Defense." We had a longtime subscriber of ours point out that 1) the call for a recession appears to be in line with consensus and 2) energy stocks have recently traded very poorly almost reflecting the call for a recession already.

His points are extremely valid and deserve a separate article to address. For starters, we have seen large tech stocks materially outperform energy stocks.

In 2022 when the S&P 500 exhibited a massive price drop, energy stocks actually outperformed materially. Similar concerns of an impending recession loomed true during that period as well prompting the dramatic outperformance in energy to really baffle market participants. The Fed was also hiking interest rates, which coincided with the rapid rise in crude oil. The combination of the two also prompted many market watchers to call for a recession.

Fast forwarding to today, I think the argument that energy stocks are already pricing in some form of a recession is partially true.

Source: HFIR E&P Valuation Sheet

Looking at our FCF yield chart of all the energy stocks we cover, you can see the average FCF yield is in the mid-teens using ~$87.50 WTI.

If we use $80/bbl WTI, the FCF yield would be in the low teens. So while I wouldn't consider energy stocks to be especially cheap in light of concerns of an impending recession, they are certainly not pricing in a lot of upside in oil prices today.

Upside vs Downside

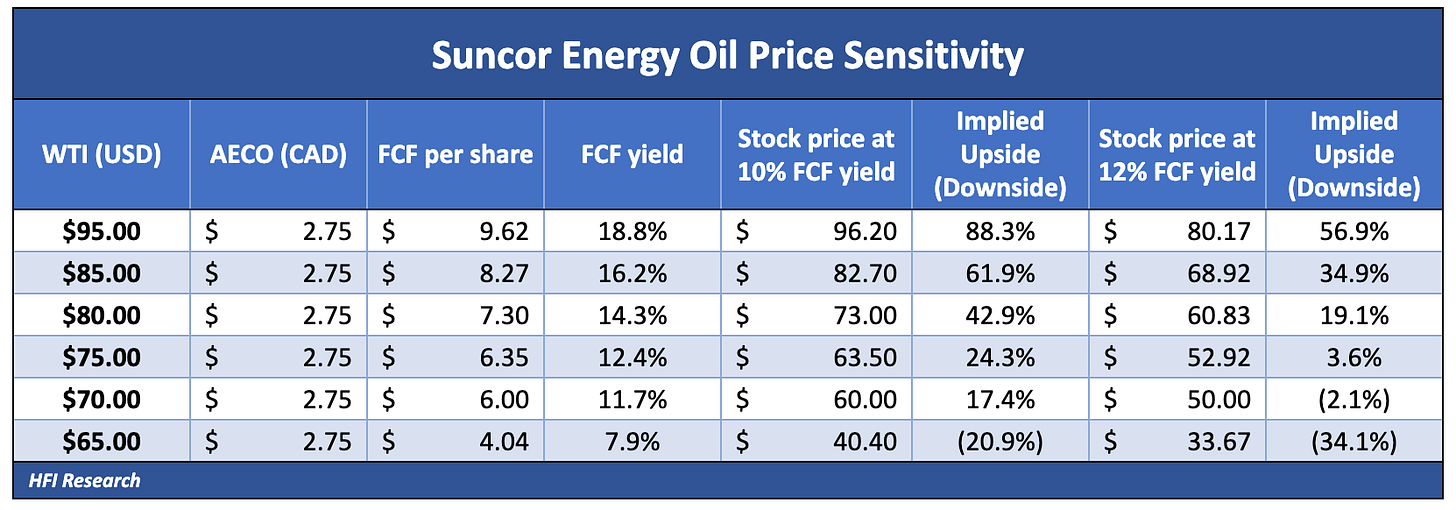

I think the best way to think about energy stock valuation is by looking at a sensitivity analysis. We are going to use Suncor and Cenovus Energy as examples.

Suncor

Cenovus

As you can see, current stock price assumption for Suncor is between $65 to $70/bbl WTI, while Cenovus is pricing in between $70 to $75/bbl WTI.