I've been through some turbulent times in my years of covering the oil markets, but the recent bout of bearishness is up there in terms of magnitude. We've had some interesting events unfold this week, and despite all of these mildly positive developments, WTI can't even break $70/bbl. Either the fundamentals just no longer matter, or sentiment is just so bearish that nothing will shake momentum in the near term.

Take a step back a minute and look at what happened:

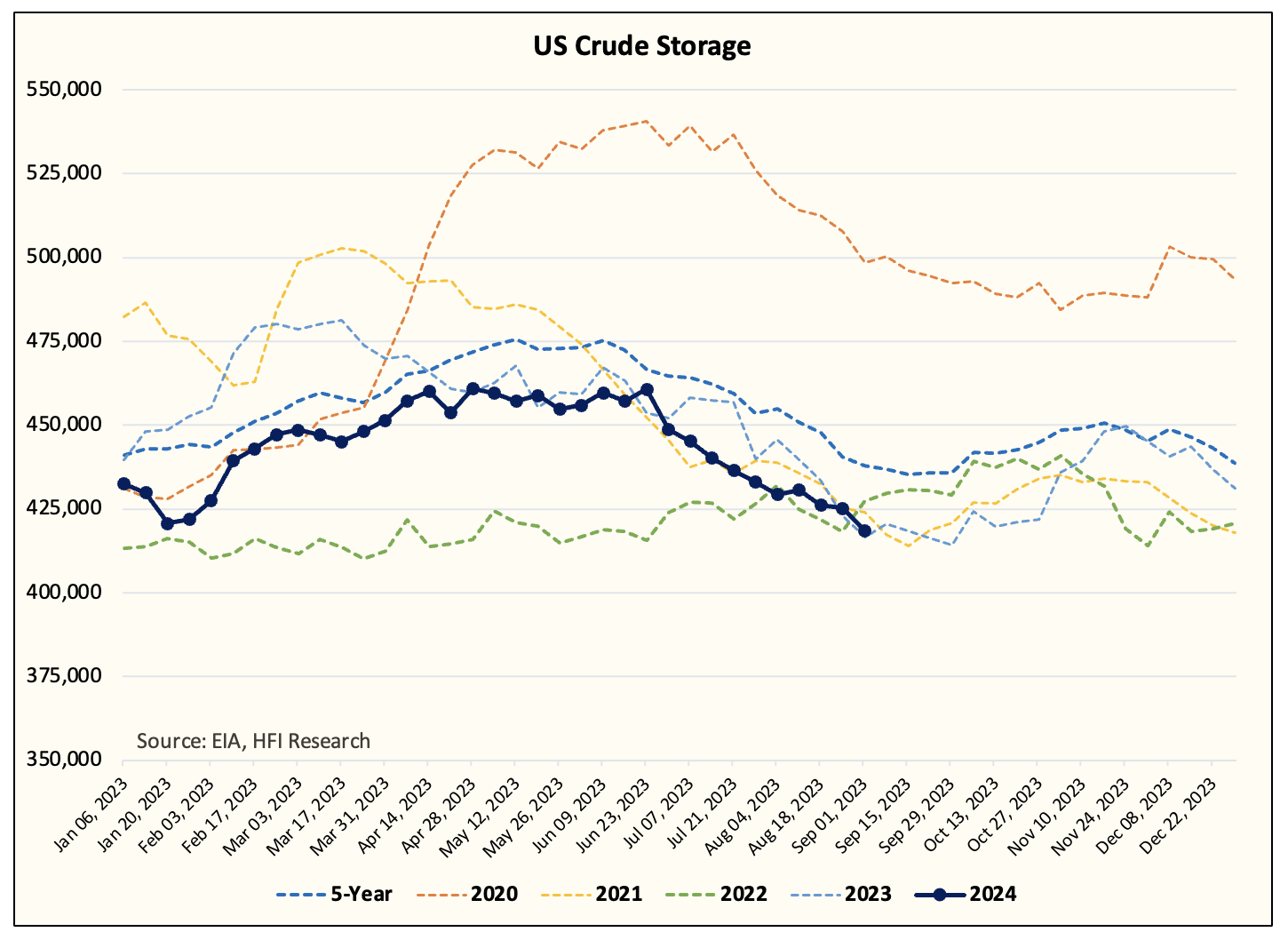

US commercial crude inventories are sitting at 5-year lows.

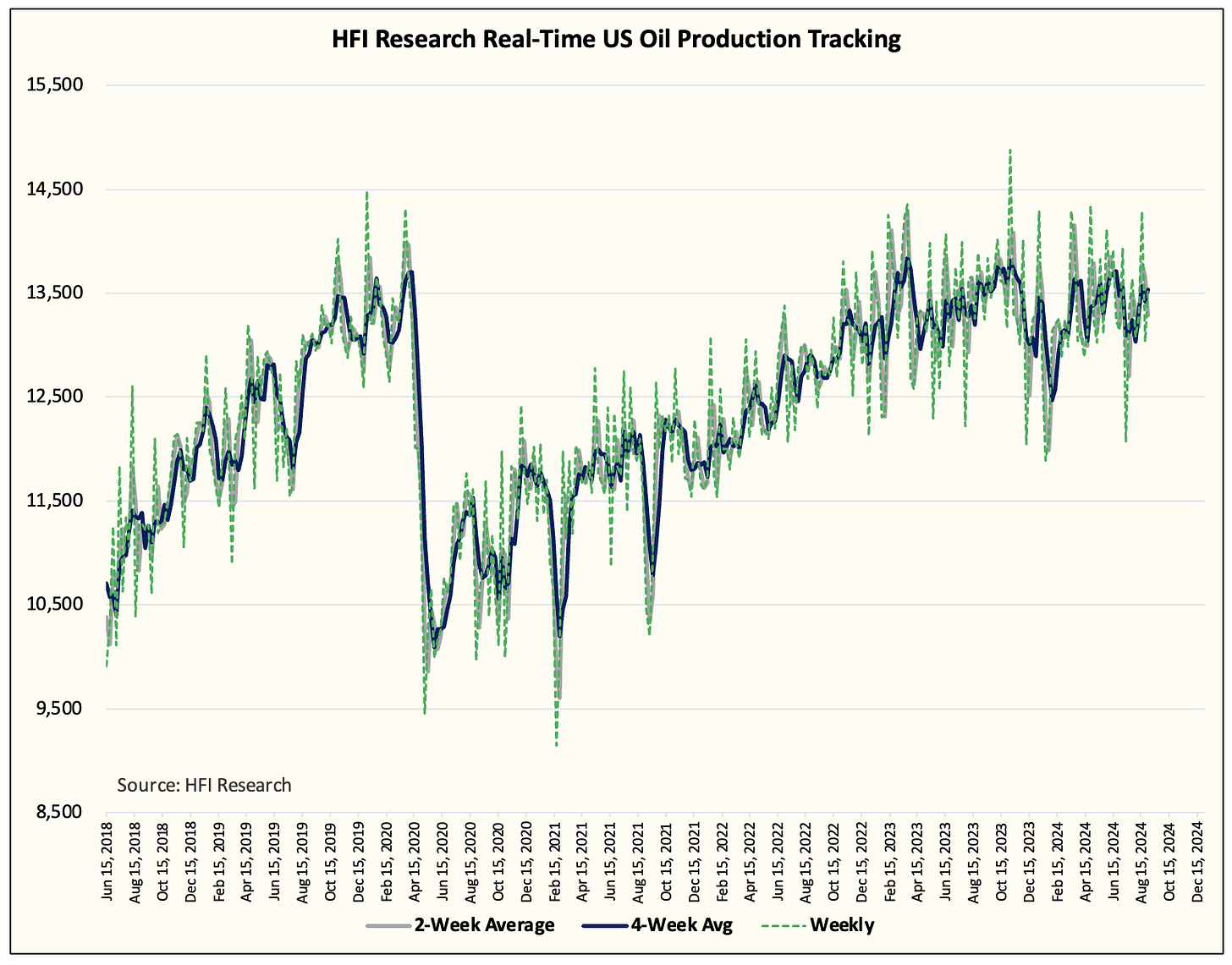

Implied US oil production has flatlined since Q4 2022.

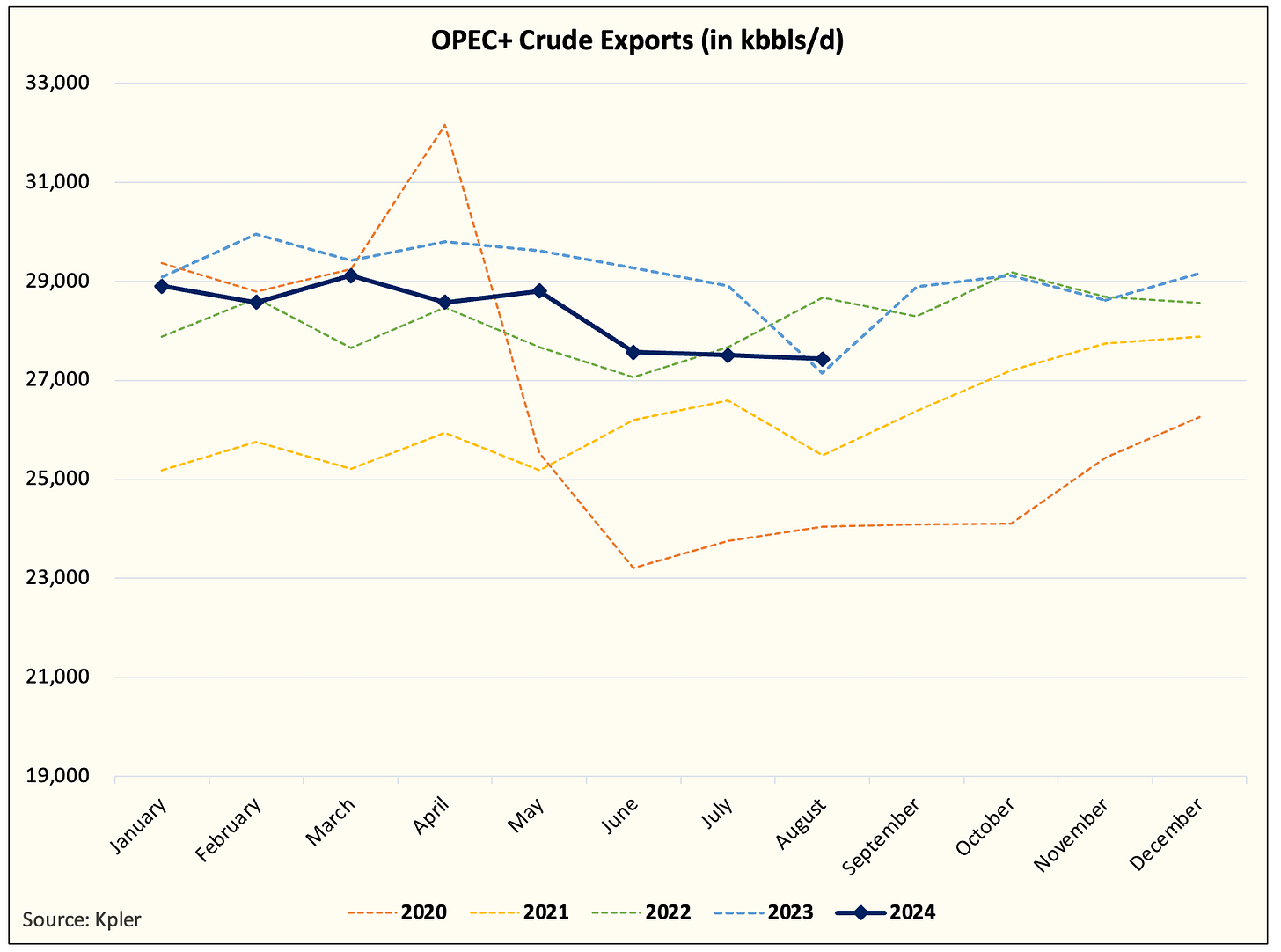

The 8 countries that voluntarily cut production are extending the production cuts until December 2024. OPEC+ crude exports also remain low.

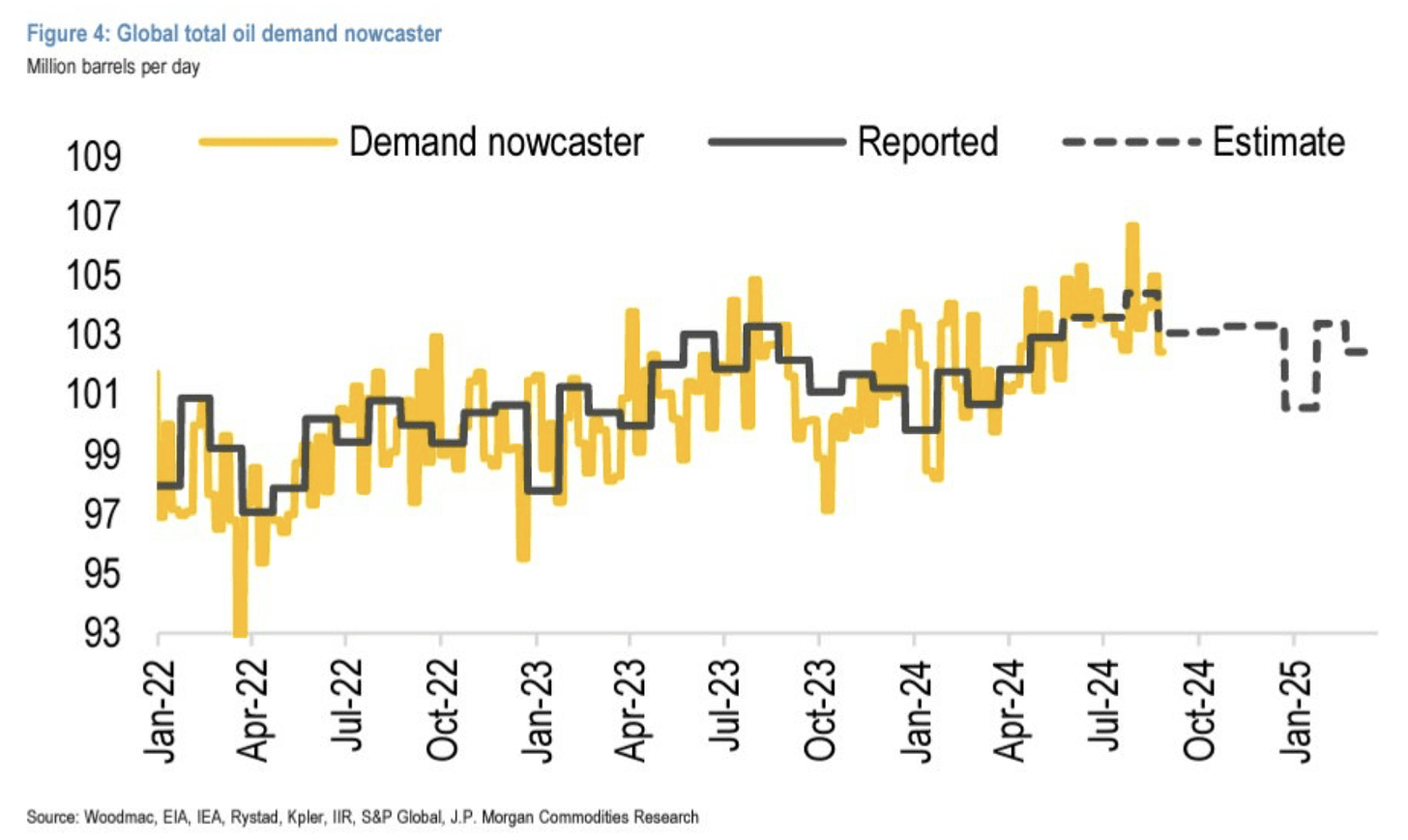

Global oil demand, while China remains weak, continues to show growth y-o-y.

Finally, Libya production outage continues, and crude exports are now being impacted, which would reduce global light crude supplies.

And yet, despite all of these things we mentioned, WTI still trades below $70/bbl, and market sentiment has never been more bearish. What gives?