As The Market Advances To New Highs, It's Prudent To Hold Cash

By: Jon Costello

Markets have reached a point where it’s difficult to find attractive investment opportunities—even for small investors. With the market hitting new highs, I believe it’s time for investors to start trimming positions as they become overvalued and to build cash.

In this article, I’d like to outline my broader approach and explain my reasoning for holding more cash.

My Investment Approach

My policy for managing a portfolio is to stay fully invested as long as I can find attractive investments. The second part of that policy is a problem today.

I operate with the well-worn value philosophy that avoiding loss is paramount. The best way to prevent loss is to estimate a stock’s value, buy at a lower price to embed a margin of safety, and hold long enough for the investment thesis to play out. Buying with a margin of safety provides assurance that if I’m wrong about an investment thesis or if unexpected adverse conditions intervene, I won’t lose a significant amount of money. In today’s market, margins of safety tend to be nonexistent.

In the 18 years I’ve been investing full-time for clients, I’ve learned the hard way that I get into trouble when I stray from buying stocks with a margin of safety. I make the most mistakes when I try to get fancy, invest in situations with binary outcomes, or invest when I feel compelled to do so because I’m holding cash. The risk of making mistakes is highest when I can’t find attractive investment opportunities.

With margins of safety difficult to obtain in today’s market, I’ve become more focused on playing defense and avoiding loss.

Attractive Opportunities Have Become Scarce

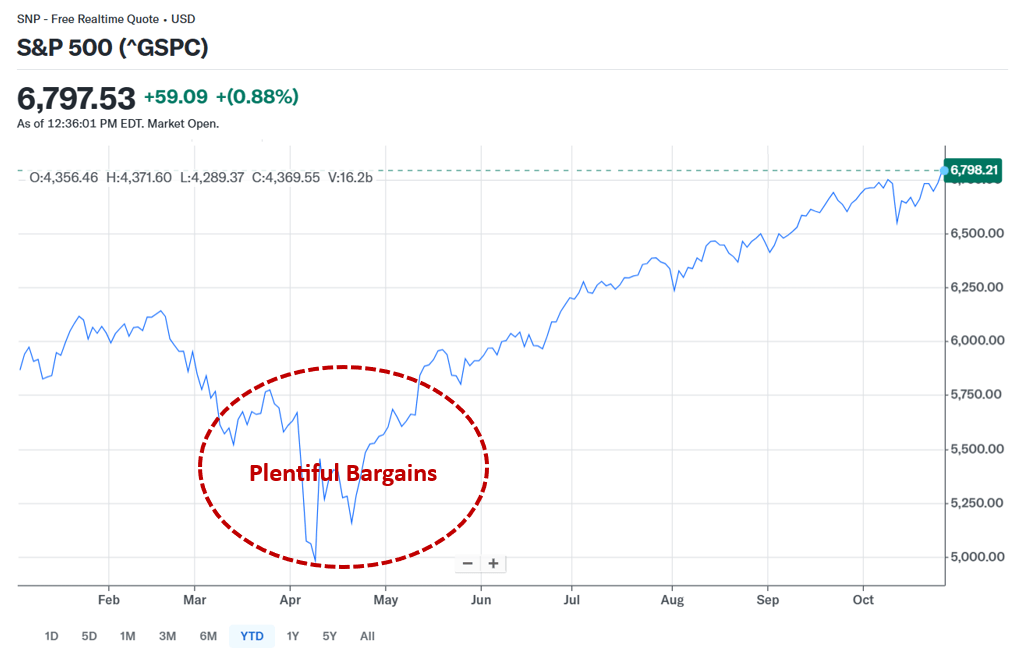

Today’s investing environment is a remarkable turnabout from the fearful environment of just six months ago. Back then, the stock market plunged by 21% over three weeks, and there were more attractive investment ideas than I could count.

Source: Yahoo! Finance, Oct. 24, 2025.

What was then abject panic has transitioned to unrestrained optimism, which has driven prices higher and, in turn, increased downside risk.

The situation is particularly dangerous for cyclical stocks, which I favor for their volatility and the greater uncertainty among investors about their prospects. Like most, I would rather invest in less-cyclical compounders, but these days, everyone and their brother is on the hunt for them. Those I can understand and value have been widely identified as compounders and therefore trade at premium prices that eliminate any margin of safety.

Today’s macro conditions are particularly challenging for cyclical investing. This is because, first, market valuations are high, and second, the risk of a recession is increasing.