Analyzing the oil market today is like walking on a tight rope; you can't be too biased on either side. The bulls and bears both make valid points, so it's important to balance what you see with a sense of skepticism and realism.

The prevailing views from both camps are as follows.

Oil Bears:

Global oil supply & demand models point to a massive surplus into year-end. The unwinding of the voluntary production cuts will result in large storage builds, so oil prices need to remain low to reduce non-OPEC supplies. But multi-year mega oil projects are coming, which will boost non-OPEC supplies higher this year. Oil prices will go lower.

Reality:

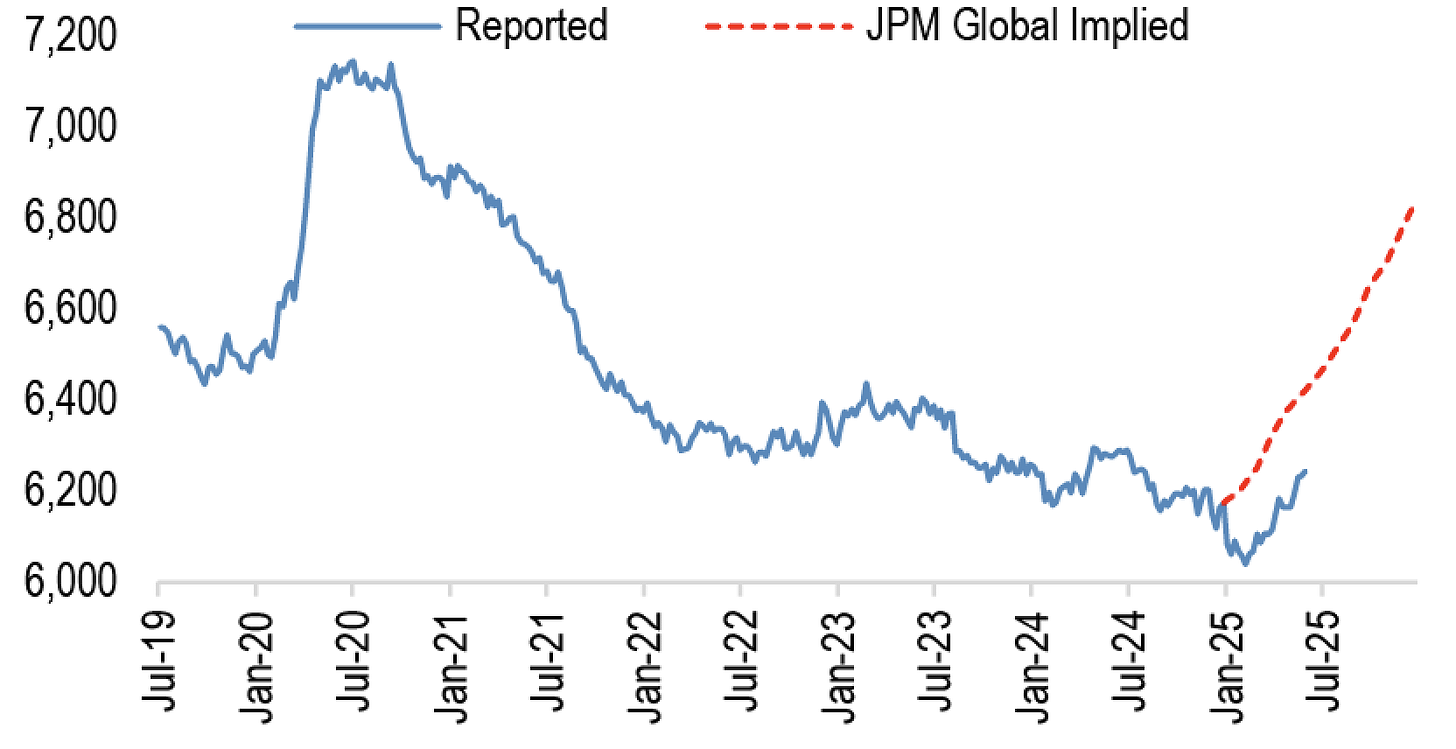

Yes, Excel spreadsheet models show large surpluses, but the mistake oil bears are making is extrapolating the implied surplus into actual changes in inventories. JPM is one of the sell-side firms that have made this notable mistake:

Source: JPM

But the reality will be far different. High-frequency data shows the recent global oil inventory builds we saw since late March are starting to wane.

We expect global oil inventories to decline in the coming months, making the above chart that much more laughable. This will come despite OPEC+ increasing production.

Oil Bulls:

Low oil prices today are unsustainable. US shale is already showing materially lower drilling activities in the coming months. The decline in frac spread count will lead to lower production. OPEC+ production increase will be far lower than headline figures suggest. OPEC+ crude exports are flat despite May being the first month of the truncated production increase. Oil demand is holding steady. Oil prices should rally from here.

Reality: