Cenovus Energy Turns The Corner

By: Jon Costello, HFIR Energy Income

Cenovus Energy’s (CVE) third-quarter results demonstrated why its shares presented such an attractive buying opportunity when they were out of favor in the first half of the year. The results show our investment thesis—which we detailed in earlier articles—playing out as expected.

CVE fired on all cylinders from improved refinery operations and a rebound in production that had been temporarily curtailed. The operating improvements drove financial outperformance, with Adjusted Funds Flow per share of $1.81 beating analyst estimates of $1.63 by an impressive 11%.

CVE's improvement during the quarter can be seen in the table below. The standout items are highlighted.

The quarter's $4.4 billion of Adjusted Funds Flow was a full 81.5% higher than the previous quarter due to improved performance across the company’s operations.

Adjusted Funds Flow outperformed Q3 of 2022 by 16.2%. The results were attributable to higher production and a significant boost in refinery throughput. This year’s results also benefitted from a decline in the average WTI-WCS differential from $19.86 last year to $12.91 this year. The decline caused WCS prices to be essentially flat in both quarters.

We consider the Q3 average WTI-WCS differential of $12.91 to be more or less representative of the differential going forward once the Trans Mountain pipeline expansion (TMX) is online. CVE has volumes committed to the pipeline, and management expects to begin delivering volumes to the TMX in the first quarter of 2024. A sustained lower differential bodes well for CVE’s future results amid higher oil prices.

CVE generated $2.3 billion of free cash flow. It allocated $1.3 billion of free cash flow toward paying down debt, $361 million toward open-market share repurchases, and $600 million toward warrant purchases. Altogether, $961 million was allocated to share repurchases.

Capital distributions to shareholders were among the highest in company history. The chart below shows the results over recent quarters.

Management made the right decision in purchasing $600 million of warrants during the quarter. The warrant purchase agreement stipulates that $711 million by January 5, 2024. The agreement implies a CVE share price of $22.18, so with the share price averaging $25.64 during Q3, it made sense to do so. After the $600 million purchase, CVE is likely to use $111 million of free cash flow to fulfill its purchase obligation in the fourth quarter.

With regard to open-market repurchases, management believes it has a good handle on the company’s intrinsic value at $60 per barrel WTI, which is the price it uses as a benchmark for evaluating repurchases. We expect the repurchases to remain in effect until the stock trades significantly higher.

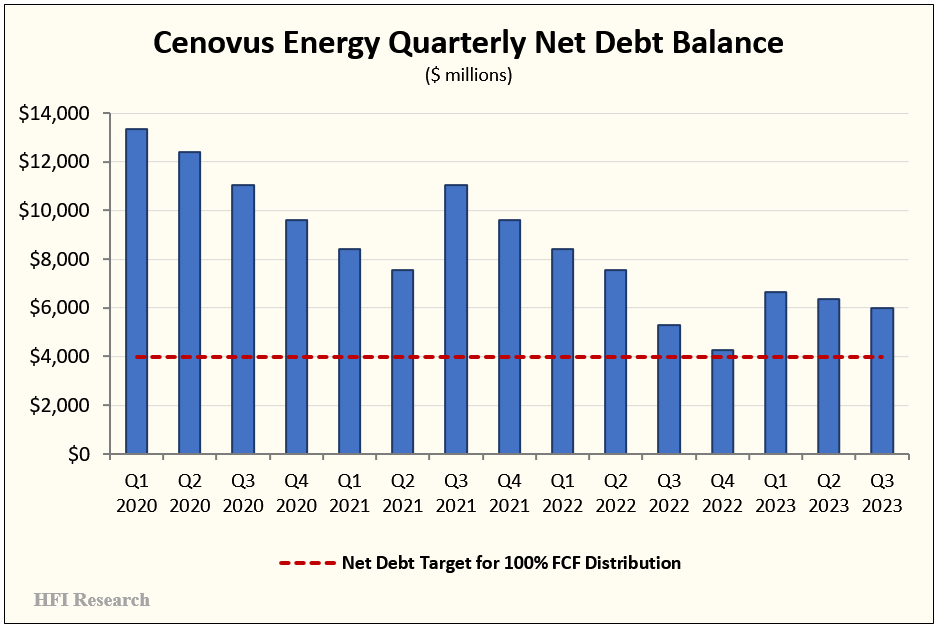

After the $1.3 billion of debt reduction during the quarter, CVE’s net debt stands at $6 billion. The figure is $2 billion above management’s target for pivoting away from debt repayment and toward distributing 100% of its free cash flow to shareholders. The company’s progress in reducing debt is shown below.

Management reiterated its commitment to achieving the debt target as soon as possible. With the company capable of paying down debt at a rate of $1 billion per quarter amid $80 per barrel WTI, mid-2024 now appears the most probable timeframe for reaching the target.