China's Oil Demand Recovers But More Is Needed

For oil bulls, the China reopening story was one of the key themes coming into 2023. It's safe to say with 5 months behind us that this story did not pan out the way we wanted.

So are demand figures surprising to the downside?

No, here's a look at the latest OPEC oil market report data.

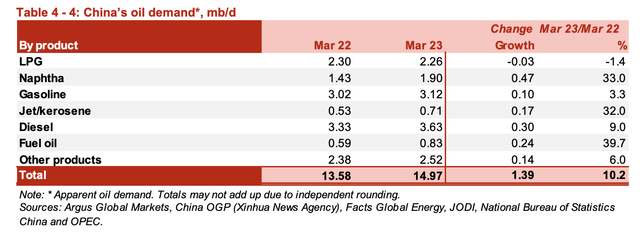

As you can see, China's apparent oil demand almost reached ~15 million b/d. This is up ~1.39 million b/d y-o-y. But more interestingly, OPEC's OMR had material revisions for China's oil demand since last year. Here's what the OPEC OMR May report showed for China's oil demand:

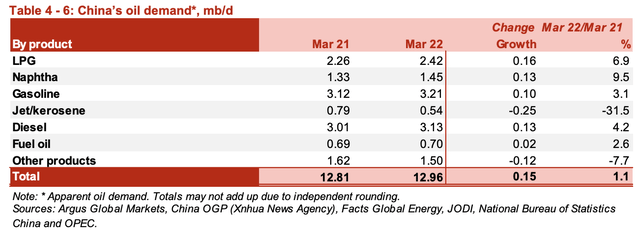

There was a positive 600k b/d revision to China's March 2022 oil demand, but most came from the other products category.

Looking ahead, April Chinese oil demand will show the most apparent y-o-y gain.

April last year was when Shanghai lockdowns began, so from an oil demand perspective, April, May, and June will show just how much oil demand has recovered.