The consensus is universally bearish on oil today, and that, in itself, is worthy of a discussion.

In this article, I will dive deeper into the things that could ruin the bear view and what would make us revise our cautious stance on oil (next 3-9 months) to a more bullish one. I will give readers the signals they need to know if we are moving on the right track and whether being a contrarian here (on oil) makes sense.

The Consensus View

Every oil analyst today is somewhere between a large and very large oil inventory build for the next two quarters. You can thank these variables for that view:

OPEC+ voluntary production increase.

Non-OPEC supply growth from Brazil and Guyana.

Global oil demand concerns (arising from US trade wars).

According to the various sell-side reports we've read, global oil inventory builds are on track for ~160 million bbls YTD. China accounts for more than half of that thanks to the SPR buying spree, while other more visible countries account for the rest.

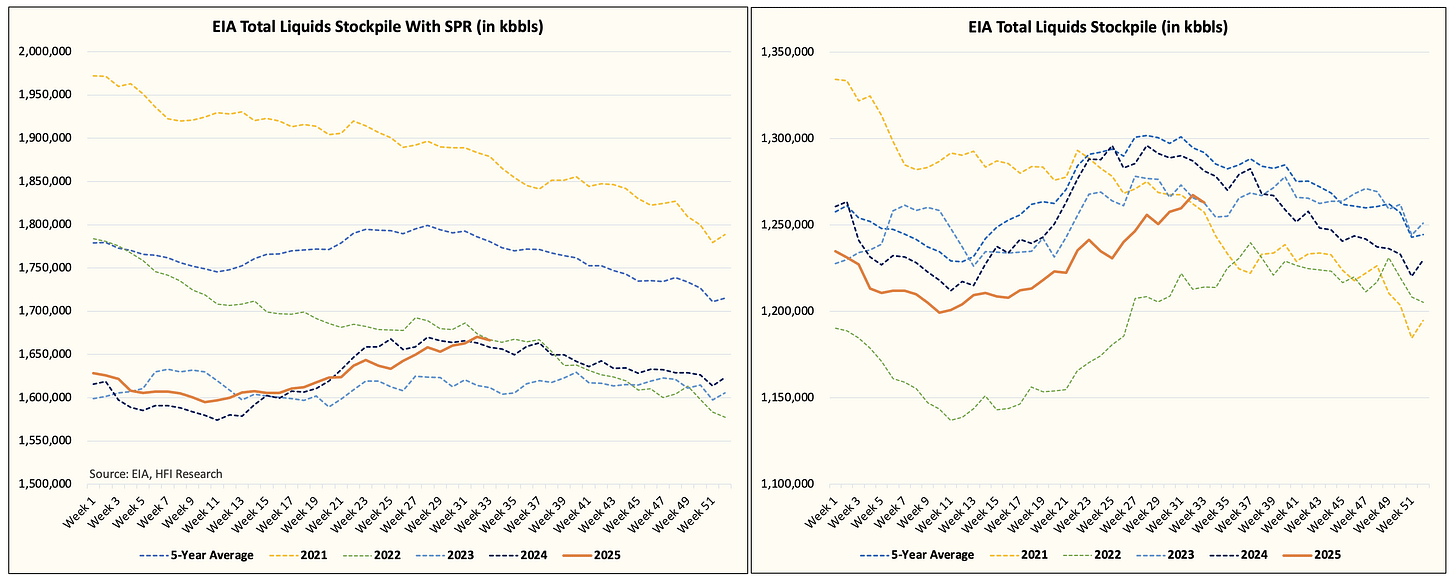

In the US, total oil liquids increased by 43.177 million bbls.

But the entirety of those builds is in the other categories (NGLs, etc).

The big 4 (crude, gasoline, distillate, and jet fuel) decreased 7.455 million bbls. In addition, if you look at the relative inventory balance, we are below 2023 and 2024 despite the OPEC+ production increase.

So this divergence in inventory data begs the question, what's right?