Crowded Trades, All Correlations Go To One

I think what we are seeing in the market today is the unwinding of a massive macro trade that's rippling across all asset classes. The short Yen trade has been extremely popular with hedge funds, and with the Yen suddenly strengthening (from 157 to 146), we are seeing a massive unwinding happening.

While I initially believed that the unwinding of the short Yen trade would only result in tech stocks selling off, it is "obviously" evident today that everything is being impacted. Couple that with the disappointing jobs report and other indicators showing that the US economy is "definitely" headed for a recession, we are seeing cyclical assets (like energy) get pummeled along with everything else.

The market is now expecting a 50 basis point rate cut from the Fed in September, and I wouldn't be surprised if expectations for a 75 basis point cut start to increase as well. There are major implications for this on the trading front.

The Yen, which has been an extremely popular short on the currency front, will likely keep strengthening resulting in a cascading effect across the market. Hedge Funds that borrowed the Yen, turned it into the Dollar, and invested in sectors like tech, will see a massive reversal. The reflexive feedback loop would force more funds to cover the short Yen trade and sell down tech. This will become a vicious cycle and one we think we should partake once we see a "short-covering" rally in tech names.

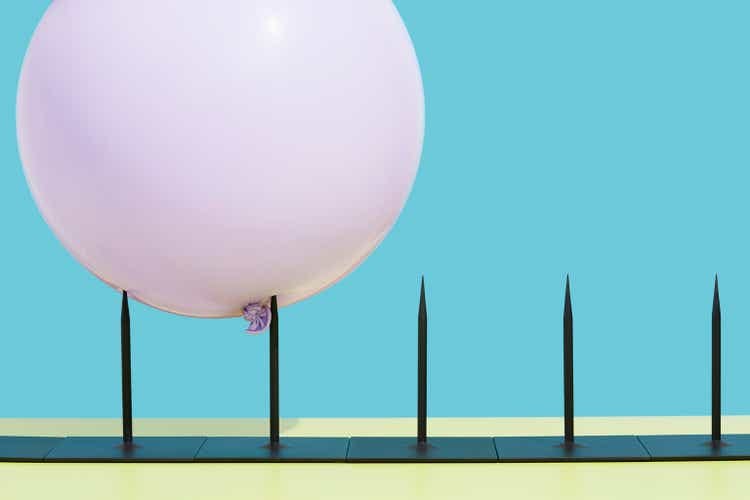

What's clear to me is that the tech bubble frenzy powered by AI is nearing the end.