For the week ending Dec 6, we have a crude build of 5.8 million bbls. The build is the result of a steep drop-off in crude exports. Tanker activities show crude exports close to ~3.06 million b/d, while crude imports remain elevated.

Looking at our US crude storage forecast, this is what we see:

For this week, the 5-year average shows a build of 3.48 million bbls. If EIA confirms a build of 5.8 million bbls, this would be considered bearish.

More importantly, the drop in US crude exports this week does not appear to be an anomaly just yet. Tanker activities for this week also show low crude exports, while crude imports are elevated. We suspect this is a timing issue with how tankers have been delayed in offloading crude, while crude exports lag.

This means the last 2-weeks should see elevated crude draws. In addition, tax purposes also incentivize refineries to reduce crude storage as much as possible before year-end.

We expect US commercial crude storage to finish the year around ~415 million bbls.

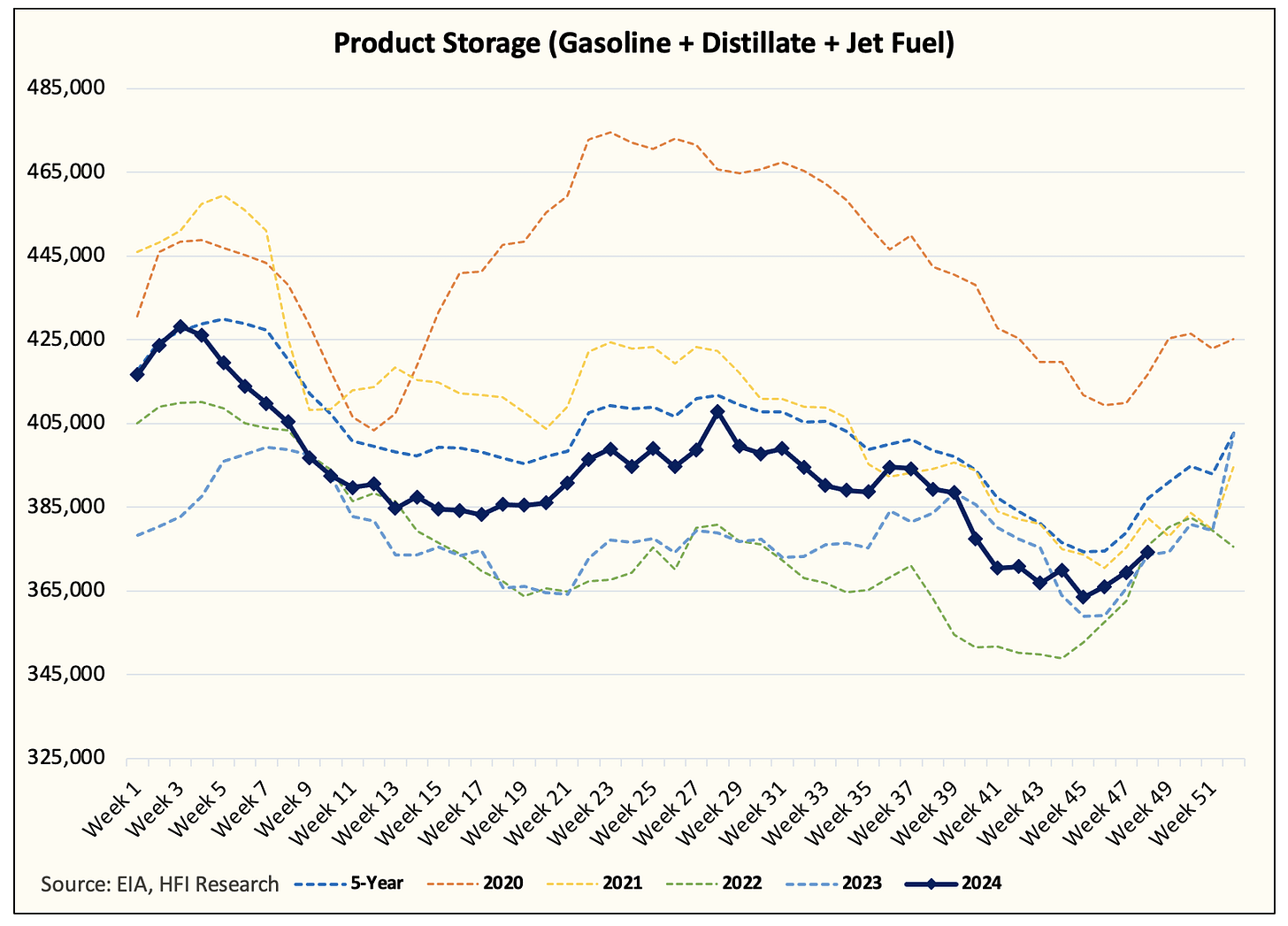

Looking at products, we are seeing builds matching that of 2022 and 2023. The important question will be how much we build going into year-end. As you can see in 2023, the last two weeks saw sizable builds, while 2022 saw builds fall resulting in a bullish start to 2023.

The 3-2-1 crack spread has been lackluster indicating that the market doesn't expect extreme tightness or any further loosening.

I expect product storage to finish right around the ~390 million bbl area.

If this is the case, both crude and product storage will have trended right around the 2021 level going into year-end.

In terms of oil price, this should, in theory, give WTI a fair value of around $76 to $78. However, with the market still expecting a surplus in 2025, inventories will have to trend bullish in Q1 to invalidate those bearish concerns.

API vs EIA

API vs EIA running error is ~8 million bbls above zero. This means API will be biased to the bear side relative to EIA.

For our crude estimate to be right, API would have to report +6 to +8 million bbls. If API reports below this level, then EIA crude build will be less than our estimate.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

The API data looks better than projected. What do you think?