(Public) EIA's Oil Data Is Creating More Confusion Than Clarity

Here we go again. EIA published its monthly US oil data for August today and the only figure gaining headline attention is the "record" US oil production, which came in at 13.053 million b/d.

But there is so much more to this report. In fact, EIA's attempt at creating clarity is creating more confusion. First, people are now assuming US oil production magically grew ~1 million b/d from December to August. This is factually incorrect. For starters, US oil production was meaningfully impacted by colder-than-normal weather in December, which resulted in production shut-ins. Second, EIA changed its methodology in how it is counting crude production, which in turn, has spiked US crude production, but made the adjustment figure more volatile than before.

Instead of the adjustment being a consistent positive, now you have a consistent negative in the adjustment. The July adjustment came in at +65k b/d and the August adjustment came in at -632k b/d. If you average the two out, the adjustment came in at -283.5k b/d. June adjustment came in at -200k b/d.

What this tells me is that EIA has fixed the consistent adjustment problem, but it is now overstating US oil production, which is causing the adjustment to be a consistent negative.

What does this mean for US oil production?

Our approach to US oil production has always been to add reported oil production and include the adjustment to true-up the real production figure. Thankfully, EIA is providing transfers to crude oil supply (blending), which helps us in determining how much of the adjustment was related to blending.

Taking the last two months of reported production into account, we get an average of 13.426 million b/d (crude production + transfers to crude oil supply + adjustment).

Transfers to crude oil supply for July and August came in at 617 and 758, respectively. The average is ~688k b/d. We can subtract this from the average total supply to get the "real" US crude production.

The net result is 12.738 million b/d.

This is where US oil production is today. The reported US oil production from EIA is overstating production, which is why the adjustment is negative.

To further validate our assumption that US oil production has grown, but not as much as EIA is reporting. We can look at our high-frequency US oil production tracker. You can see that since the end of 2022, US oil production has grown, but only at a modest pace. We pegged US oil production at the end of 2022 at around 13 million b/d of total supplies. Excluding transfers to crude oil, it's around ~12.4 million b/d.

This means that since the end of 2022, US oil production has grown ~400k b/d or so. This is in stark contrast to the ~1 million b/d growth reported on the headline.

But it gets worse, it's not just supplies, it's demand also...

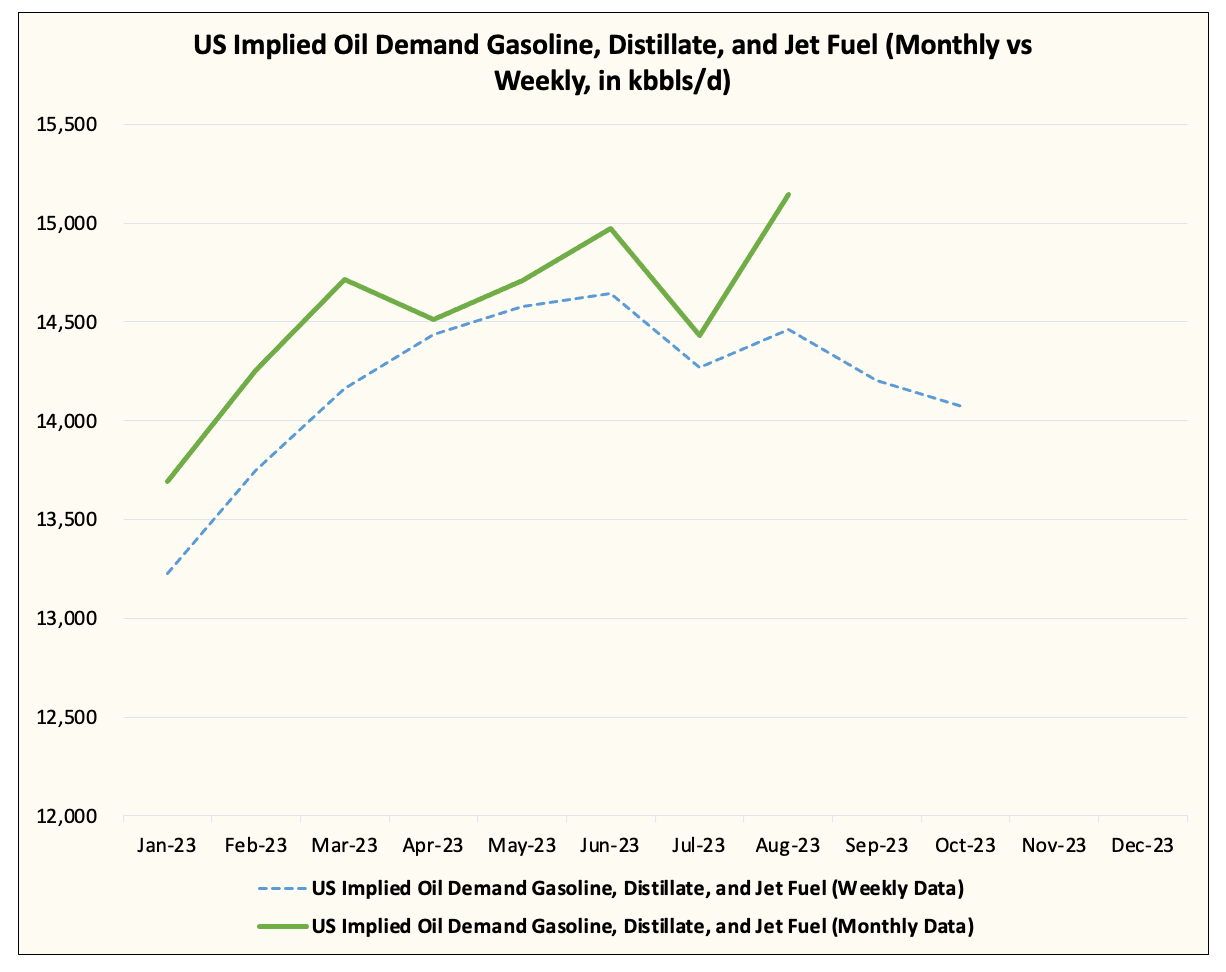

Now that we've explained the problem behind US oil production reporting, the problem gets worse. EIA has a real problem in tracking US implied oil demand. It has the most issues in the big 3 (gasoline, distillate, and jet fuel). As for total implied oil demand, it also has a problem, but it's not nearly as bad.

Here's a look at the big 3:

The problem appears to be persistent.

So where is the problem coming from? Other oils.

Notice how the other oils category appears to make a record high around the August timeframe?

EIA's monthly PSM pegs the "other oil" category around ~2 million b/d. And it has been around ~2 million b/d YTD. This means that EIA's weekly implied oil figures fail to capture what's going into each category accurately. This makes sense given that the weekly survey does not capture the data perfectly, but the startingly differences should prompt EIA to revisit their methodology.

For readers, EIA's inability to capture demand correctly means that you have to look at the other oils category as a "plug" for demand variables elsewhere. We knew something looked off when the big 3 demand variables kept trending lower during summer, but other oils kept going up. Now that the difference is shown via our charts, we hope that explains some of it.

More confusion than clarity

We applaud the EIA for trying. But in its latest attempt at eliminating the adjustment factor, it is now overstating US oil production. We also hope that EIA fixes its erroneous weekly implied oil demand figures. Readers should start using other oils as a plug in attempting to figure out the whole demand picture.

We hope this article is giving you more clarity. US oil production is not as high as the headline states and US oil demand is not as bad as the weekly data suggests. We hope there's more clarity from the EIA going forward.

Thank you for this explanation, even though this is still not perfectly clear to me.

Funny enough in 2010 I was carrying a multi energy study on China. Everyone told me at the time that their stats were incorrect and tweaked. Thanks to IHS CERA, we had a full data set pulled from ministry websites, detailed region by region . Trends, drivers vs GDP and infrastructures appeared very clearly with a perfect consistency. The beauty of multi energy analysis is that you cannot lie because if you do you get noticed immediately. Believe me the Chinese were extremely serious with their energy and economic stats, you could rely on them, and if you think about it it makes perfect sense for a dirigist country.

Now let us talk about the US stats. I invite anyone reading these lines to go back to the EIA reports in the 2021 fall and see their forecasts at the time for the spring 2022. To put it simply: on the eve of the the Russian invasion of Ukraine, they were predicting aboundant oil supply for 2022 .

There was only one problem: they were the only organization with this view, and all other organizations were sending alarming signals. I remember reading their reports and asking myself, what are they trying to do here?

I am not pretending to convince anyone , but my opinion is that EIA data are manipulated and do not represent the truth. They represent a picture to manipulate opinions and hopefully the market to favour the government agenda.

Now the end of the story, when I saw with much surprise all sanctions against Russian oil right after the invasion of Ukraine, I remembered their reports 3 months before. My guess it that in the previous fall they were trying to prepare the opinion to the idea that the oil market was balanced enough to support these sanctions.

The result was WTI at $129 in March 2022.

Sorry I am over interpreting, but HFI paper is clearly giving today food for thought, because it is not that complicated to publish coherent energy stats.

Thank you for this piece. Much appreciated. You have spoken about production figures being off before and I've followed that reasonably closely. I found the stuff on the problems with demand figures very interesting. Seems a lot of people might be making decisions with faulty data.