Elevated Natural Gas Production Will Cap The Upside

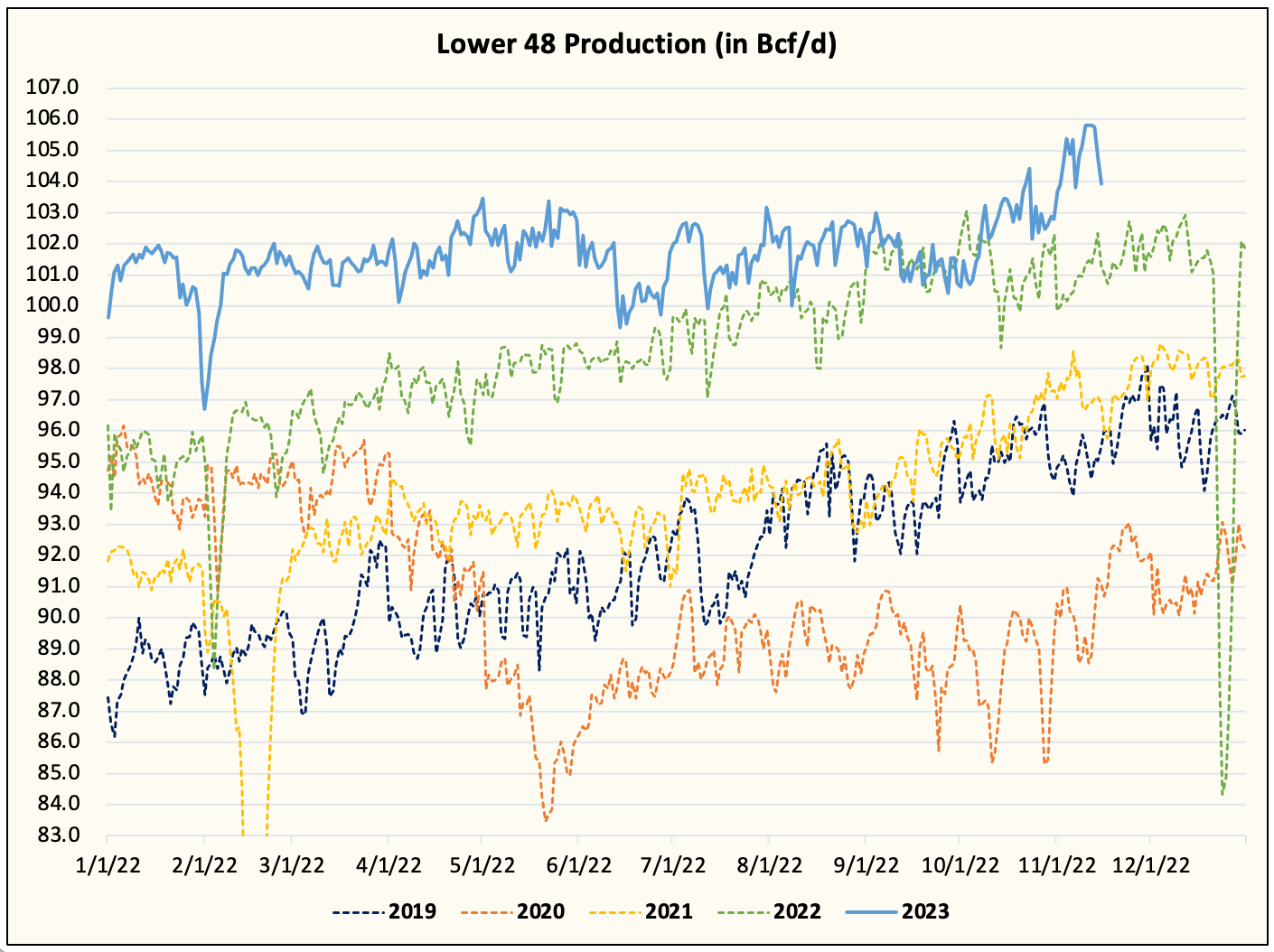

Strong Lower 48 gas production has been gaining all the attention on Twitter. However, according to the latest data, Lower 48 gas production was not able to maintain the hefty ~106 Bcf/d level.

But despite the recent drop, production is well ahead of our expectations. We did not expect 106 Bcf/d to be sniffed until late 2025. With production capable of ramping to this level, it means that balances for 2024 are almost certainly going to lean to the bearish side.

Now there's a big difference between what's sustainable. So perhaps we saw max capacity, but the sustainable production level may be around ~104 Bcf/d. Either way, production was supposed to trend downward throughout the winter months, so with production going in the complete opposite direction, our stance on natural gas has also turned sour.

Keep in mind that winter gas trading will be heavily influenced by the latest weather model updates. And at this moment in time, the 10-15 day period is expected to be colder than normal.

TDDs

6-10 Day

10-15 Day

15-Day Cluster

If bullish weather continues, it can certainly push prices higher. But for the market that's forward-looking, we don't think prices can rally much, especially when both storage and production remain elevated.