Emotions Run Wild As Oil Bulls Question Their Existence

Ok, fine. The article title is probably an over-exaggeration, but it sure got your attention. In all seriousness, I'm seeing a lot of people question whether or not the OPEC+ cut thing is a good thing, then I see panic over the reported US oil production figures, and I can't type fast enough to calm some of those fears. So to be efficient, I will break this article into multiple parts.

US oil production

Supply & demand balance

OPEC+ production cut

Where the hell are we headed?

US oil production

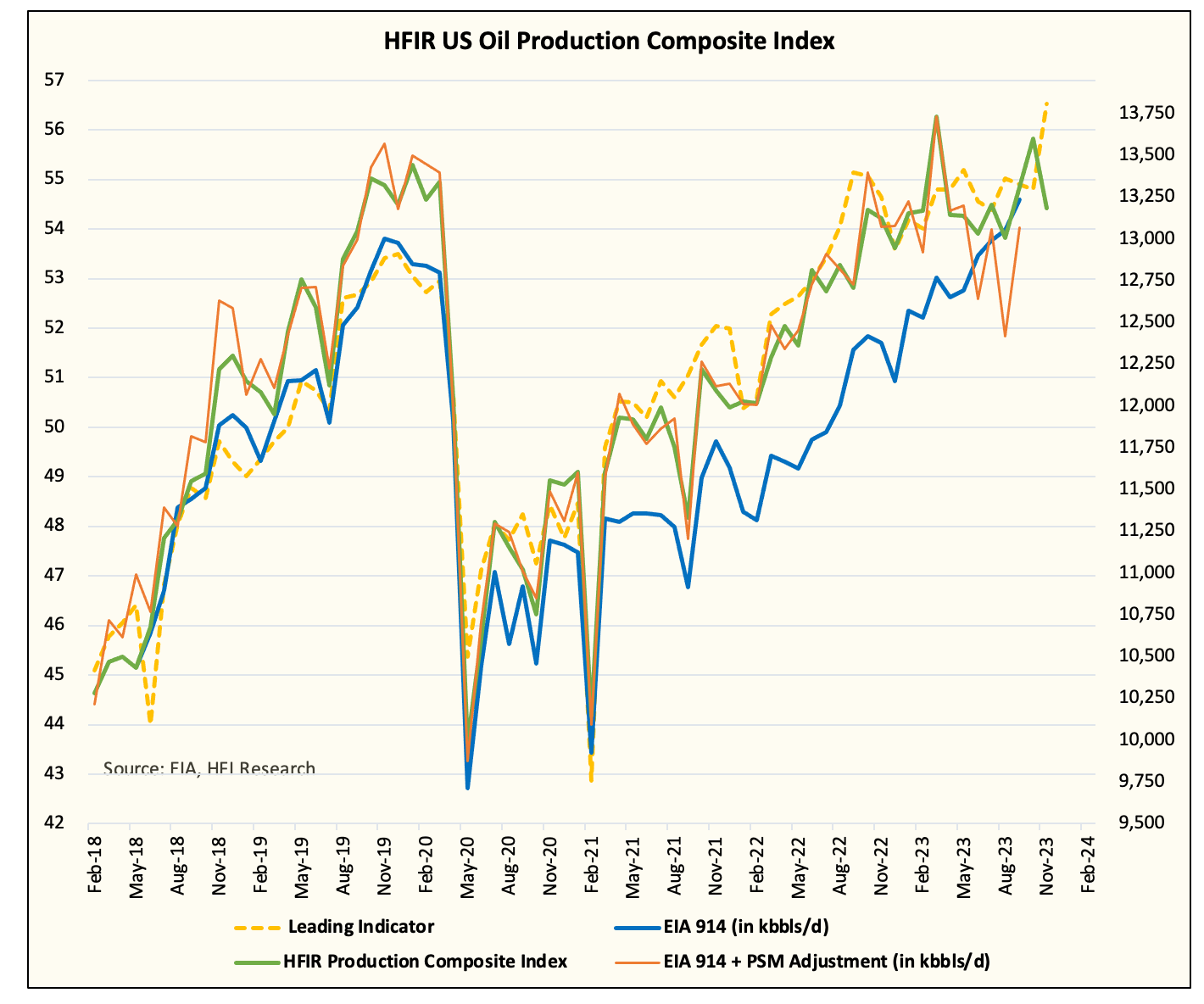

This is the easiest one to cover because we've been doing it for way too long. EIA's monthly oil production figure came out and to everyone's surprise, it's another month of growth. September US oil production was reported at 13.236 million b/d. But it's always the things in the finer details that you have to pay attention to. The adjustment factor, which has always been a consistent positive since the US shale revolution began, came in yet again at a negative. At -168k b/d, implied US oil production for September was 13.068 million b/d. Transfers to crude oil supply came in at ~725k b/d or consistent around the ~650 to ~750k b/d range. (For more info on transfers to crude oil supply, please read our US oil production-specific article.)

So was US oil production really 13.236 million b/d? No, it was 13.068 million b/d. EIA was successful in segmenting out the adjustment factor, but what it wasn't successful in (just yet) is differentiating what's crude production and what's not. As we wrote in our OMF, this will be resolved in March 2024 in EIA's phase 3 (of tackling the adjustment).

At 13.068 million b/d, US oil production has already exceeded what we expected at the start of the year (~12.9 million b/d). And looking at our real-time US oil production tracker, we have ~13.2 million b/d for November.

For readers, what you should readily expect is either EIA show a higher US oil production figure (higher than 13.2 million b/d) and show a similar negative adjustment figure, or EIA could show ~13.2 million b/d and show an adjustment coming in at zero. Either way, total supplies don't change.

Now is US oil production surprising to the upside? Yes, but to the point that warrants OPEC+ to announce another ~696k b/d cut? No, not at all (more on this later).

Our forecast shows US oil production will gradually fall in H1 2024. Our estimate shows US oil production falling back to ~12.8 to ~12.9 million b/d before growing to ~13.4 to ~13.5 million b/d by the end of 2024. After that we see production growth hitting ~13.7 million b/d in late 2025 before completely stalling out. We are ~500k b/d away from the permanent plateau.

So while US oil production on a marginal basis impacts global supply & demand, it is not the reason OPEC+ needs to cut again.

Supply & Demand Balance

Now looking at supply & demand balances, what exactly went wrong that required the extra production cut from OPEC+?

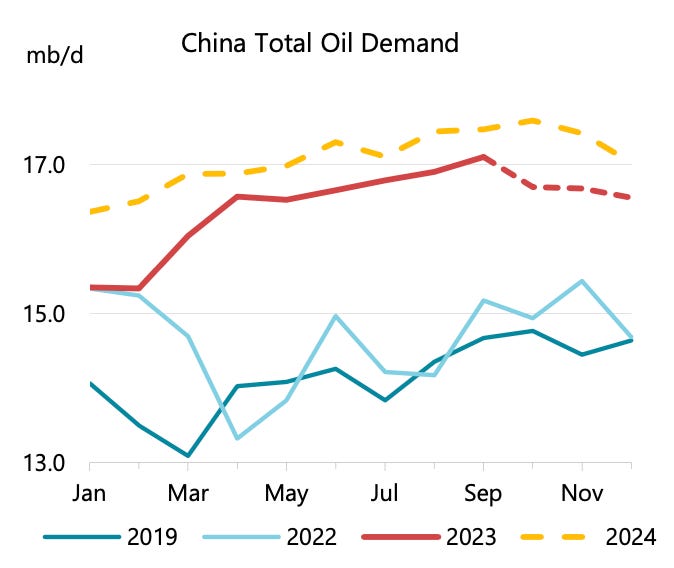

First, global oil demand growth is not as good as people think. IEA, notorious for its underestimation of global oil demand, may finally be overestimating global oil demand this year. IEA expected global oil demand to climb ~2.4 million b/d this year, but as we explained in our WCTW, "Swing Buyer vs Swing Producer." China's oil demand, which is expected to increase by 1.778 million b/d or nearly ~74% of global oil demand growth this year, is ~400k b/d overstated.

Source: IEA

India, which is marginally growing this year vs 2022, is also not growing enough to move the needle. Other countries in the non-OECD do not provide enough visibility to accurately gauge demand.

Source: IEA

As for OECD, 2023 demand was no better than 2022, so this leaves another black eye on the demand picture.

Source: IEA

In aggregate, demand growth this year was closer to ~1.5 to ~1.7 million b/d versus IEA's ~2.4 million b/d.

Now you couple that with IEA's estimate of non-OPEC+ production growth of ~1.7 million b/d (crude + NGL) and Iran pushing higher production by ~600k b/d, you get a scenario where the oil market would be in oversupply if it wasn't for the Saudi's voluntary production cut.

And if you look at total observable oil inventories, you can see that it is flat y-o-y.

In conclusion, this is what happened:

Demand is ~700k b/d to ~900k b/d below what IEA is estimating.

Supply-side surprises from Iran (+600k b/d), US (+250k b/d), and Brazil (+100k b/d) have pushed the total supply side higher by 950k b/d.

To offset the supply side surprise, Saudi's 1 million b/d voluntary cut does the job, but the demand side surprise will require others to step in.