By: Jon Costello

This is the third article in a four-part series reviewing the macro energy sector backdrop.

Few investors understand the paradigm shift underway in the oil market. The shift is bound to have far-reaching implications for the economy and all stock market sectors.

Over its 175-year history, the oil market can be divided, more or less, into distinct supply paradigms. In more recent decades, the 1998-to-2010 paradigm was characterized by increasingly constrained supply in global onshore oil production. Most of the major onshore discoveries were made in the 1940s to 1960s. By the late 1990s, these fields were well into their terminal decline phase, the ultimate fate of all oilfields. At the same time, China’s rapid economic growth turbocharged global demand growth. Global oil supply was challenged to meet rising demand, causing WTI to surge to $134 per barrel in 2008. After the 2008-to-2009 recession, WTI recovered and consistently traded above $100 per barrel for three consecutive years, from 2011 to 2014.

With onshore prospects looking increasingly dim, the consensus view at the time was that offshore was the new supply frontier.

Enter U.S. shale.

U.S. shale production took off around 2010. Its growth was spurred by horizontal drilling and hydraulic fracturing techniques pioneered over decades by entrepreneurial wildcatters. These drilling techniques opened up new sources of previously untapped oil and natural gas.

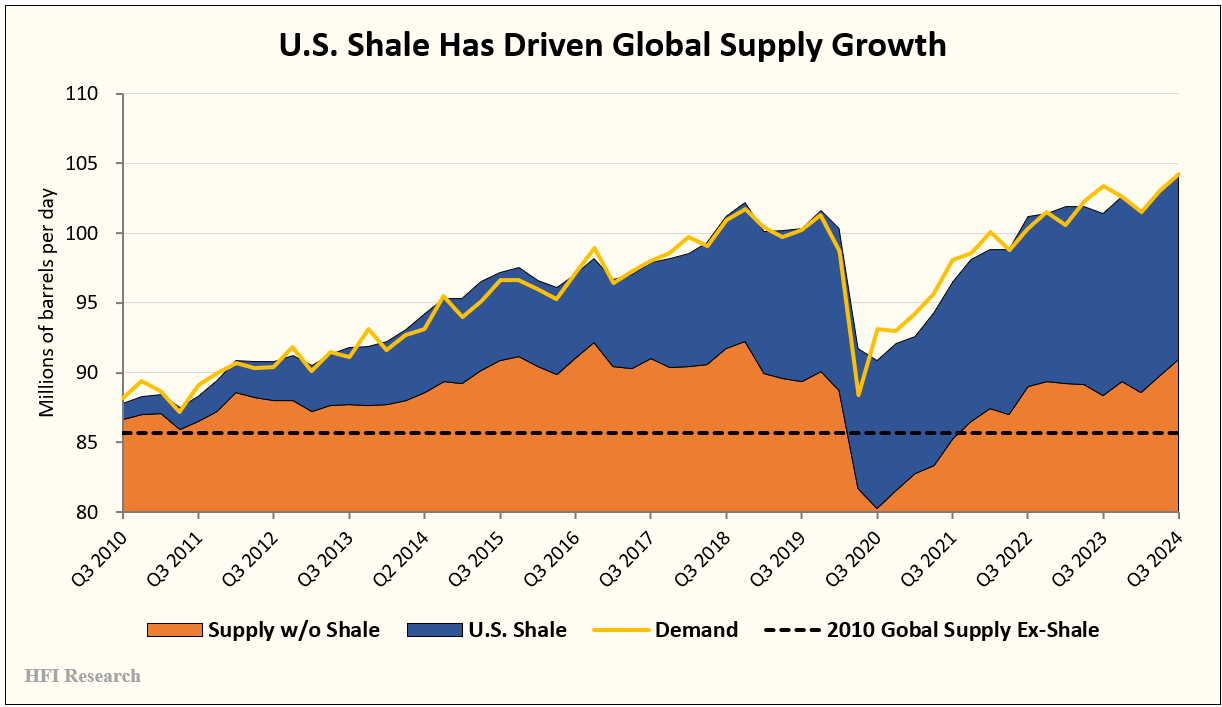

From 2010 to 2019, shale production experienced a significant surge. By 2019, it exceeded the daily production of Iraq, the fifth largest oil-producing country outside the U.S. Over this period, U.S. shale production met nearly 90% of the supply necessary to satisfy increasing global demand.

Source: Data sourced from EIA and IEA.

The remaining 10% of supply growth outside of U.S. shale was produced by OPEC. While U.S. shale and OPEC+ production increased, production outside these regions declined. The oil market’s supply side was divided into the “haves” who could grow production—the U.S. and OPEC—and the “have-nots” everywhere else that saw their aggregate net production fall.

The Twilight of U.S. Shale Production Growth

The U.S. shale growth paradigm that began around 2010 is now over. The emerging new paradigm is one of “post-U.S. shale” as far as production growth is concerned.