The natural gas market opened on Sunday with a bang. February contracts, set to expire soon, opened up over 16%, while March contracts were only up ~6%.

For most people trading natural gas, it would be suicidal to trade the February contracts as the expiry this Wednesday (Jan 28) will likely be one for the record books. Henry Hub cash averaged $28.565/MMBtu over the weekend, and with the cold expected to last until January 30, how the February contracts expire with cash so elevated will be something to watch.

For this article, we are not discussing what will happen to February contracts. Instead, we will focus our view on March and the rest of 2026.

Fundamentals, Where Are We?

Some highlights from this weekend:

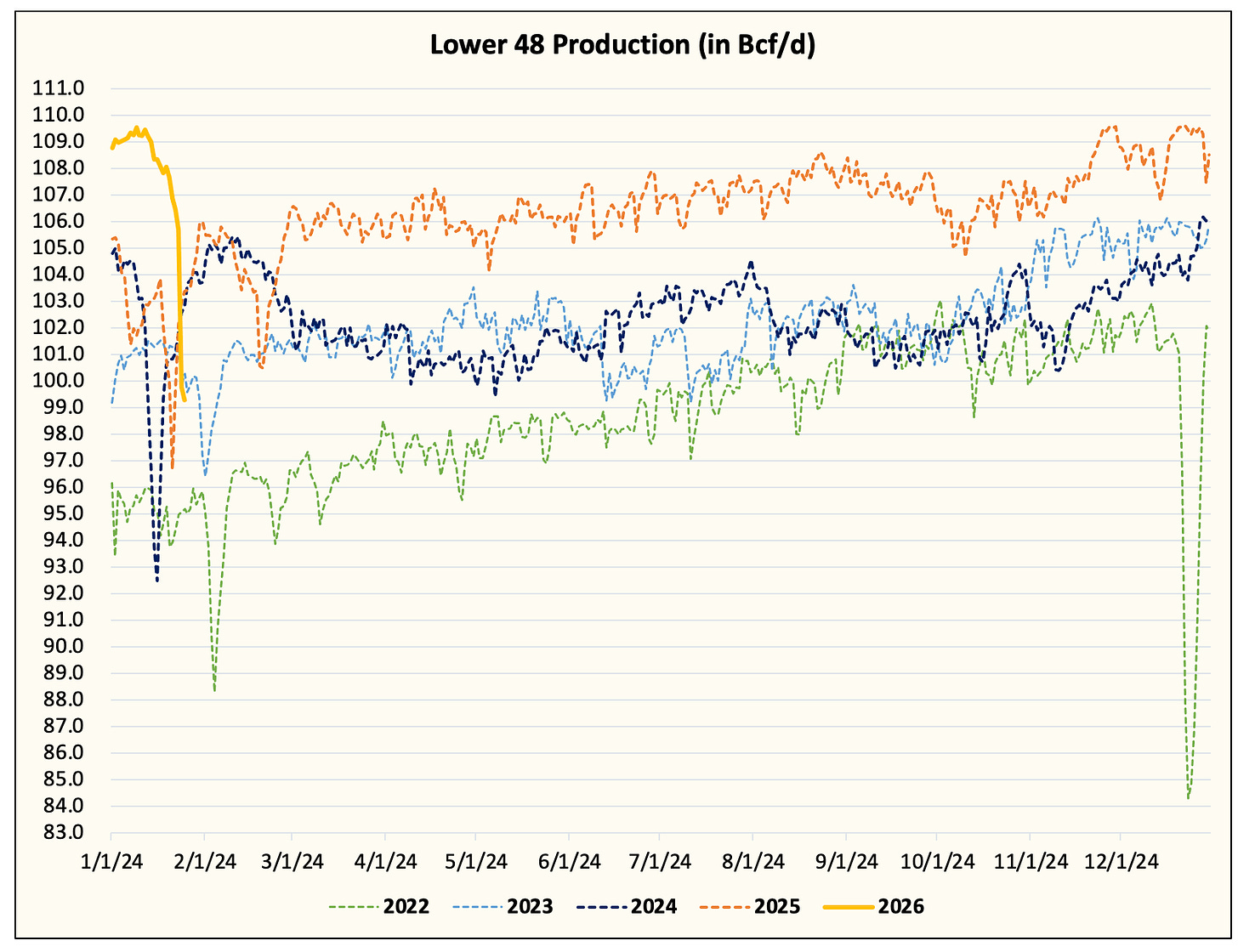

Lower 48 production dropped to ~99.4 Bcf/d.

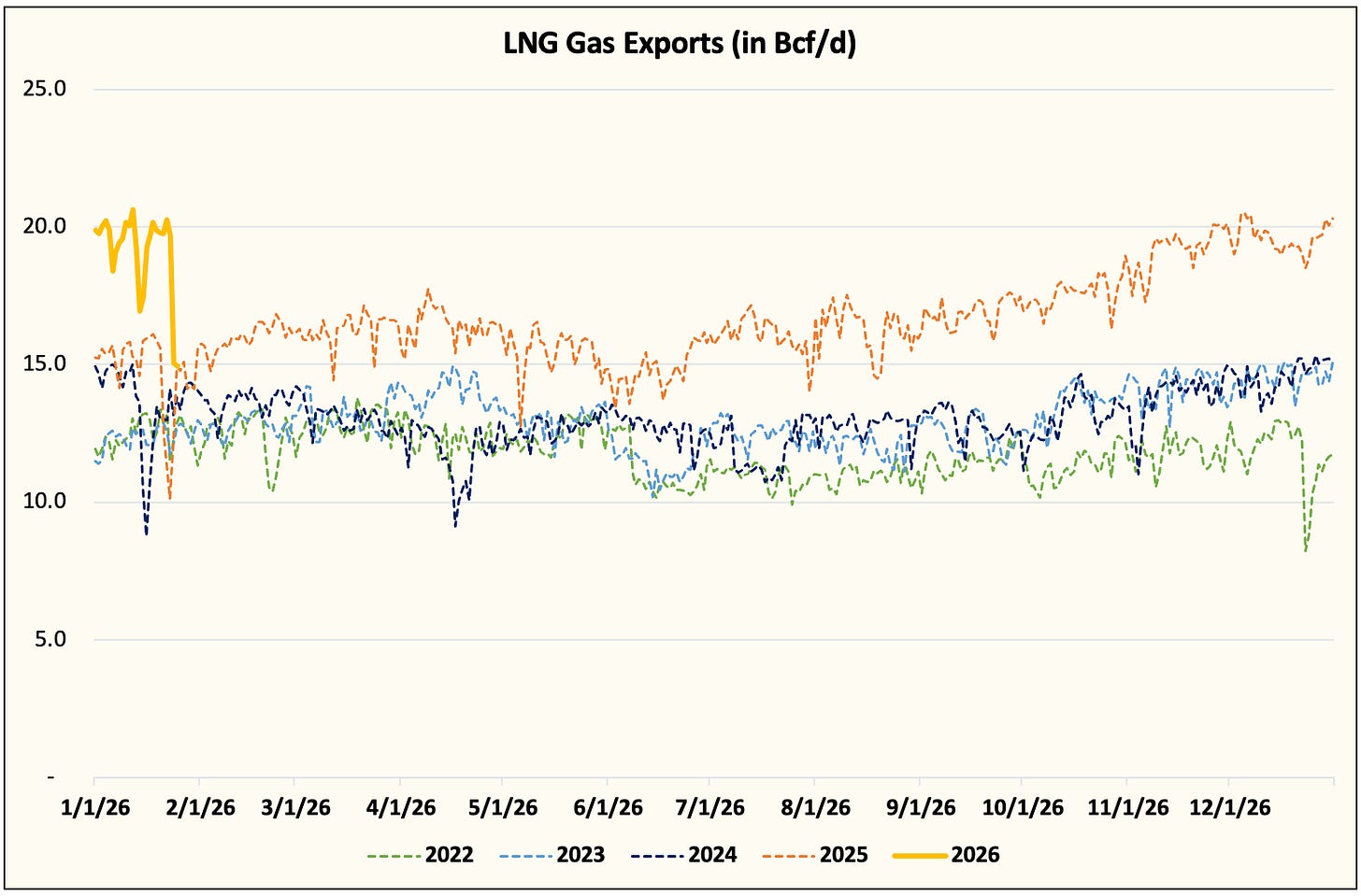

LNG gas exports dropped ~5 Bcf/d.

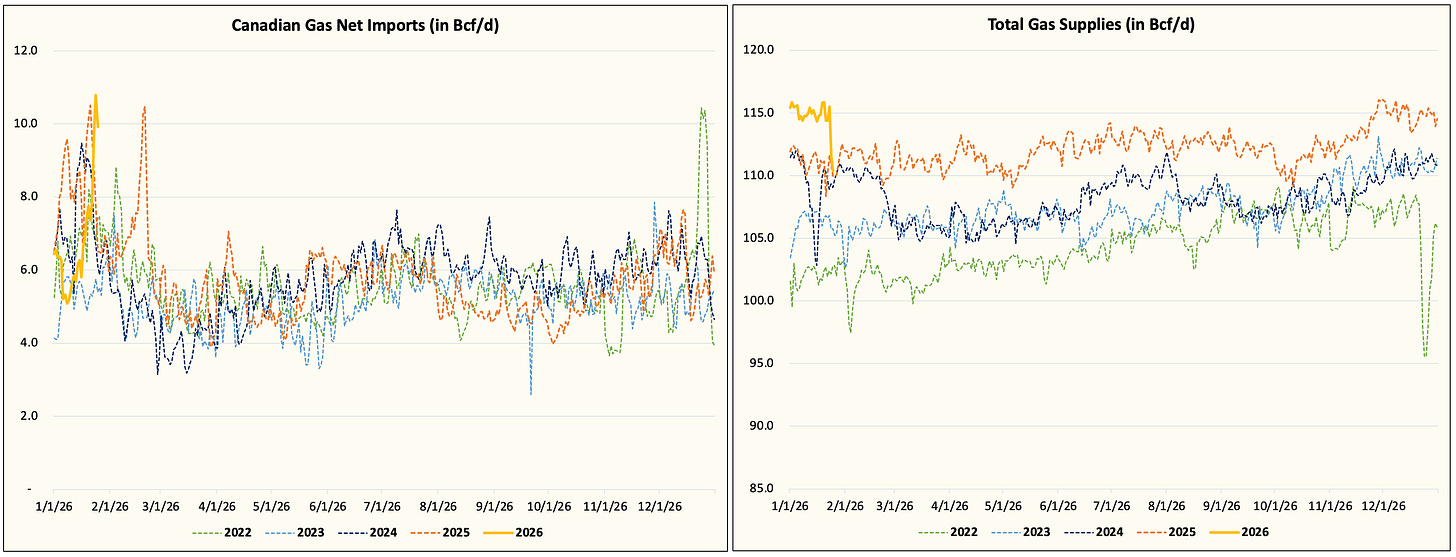

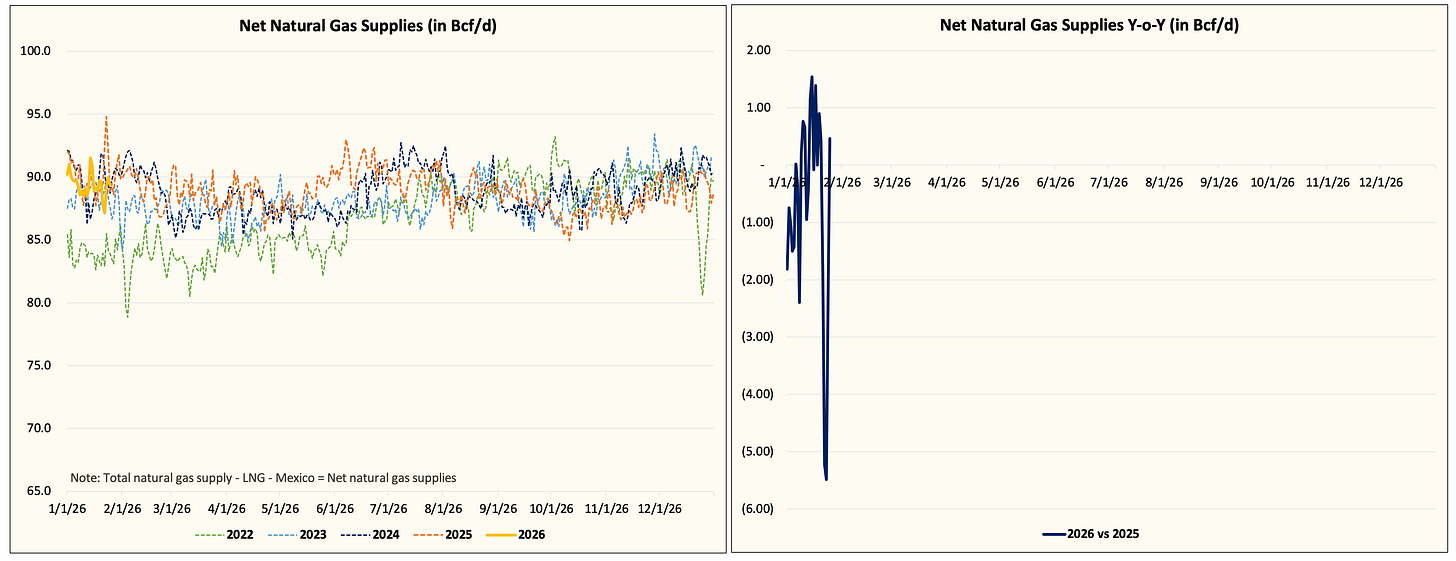

Net gas supplies are flat due to the significant jump in Canadian gas net imports.

Total Gas Supplies

Net Gas Supplies

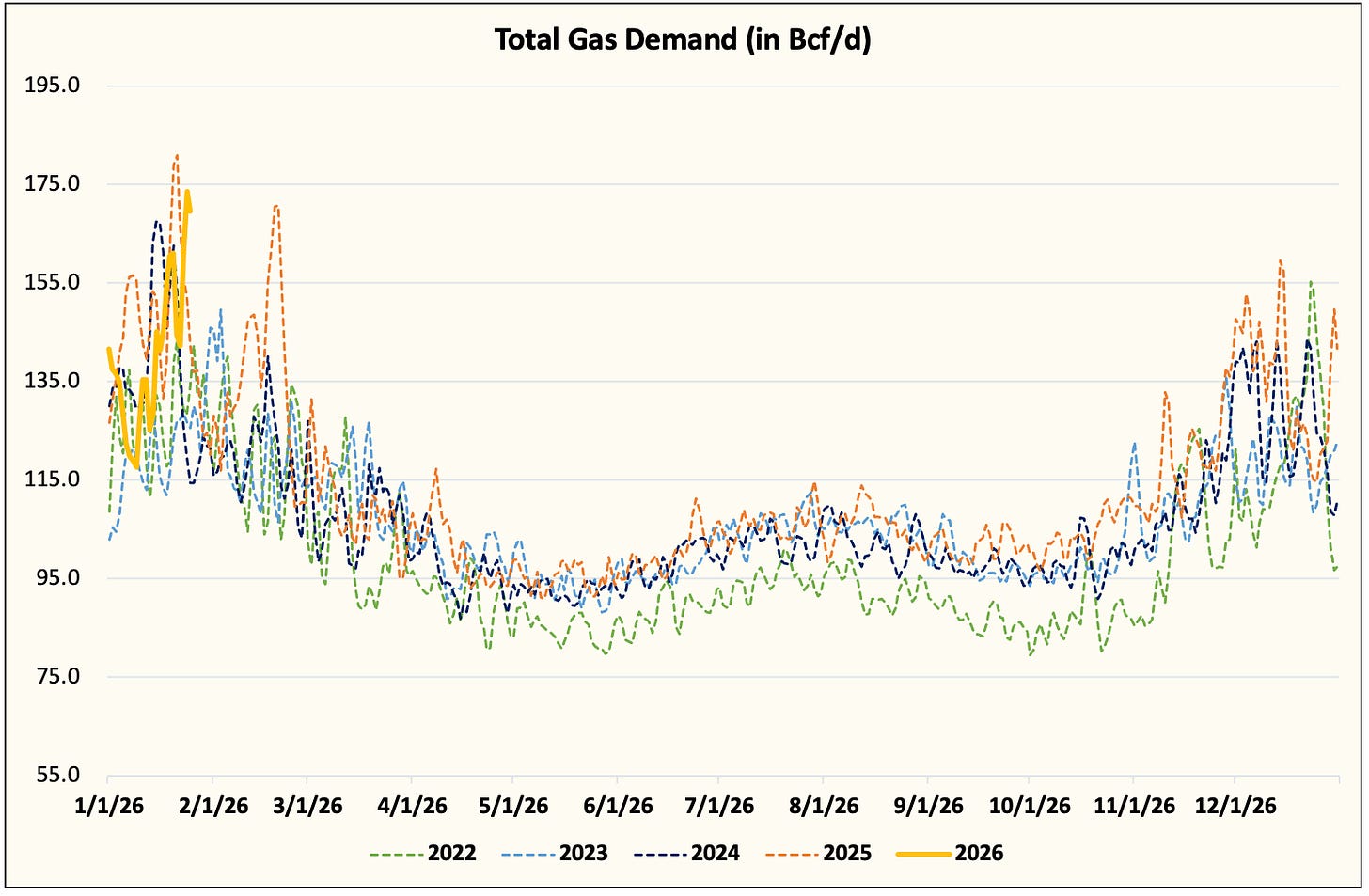

Total gas demand was just shy of the record we saw in 2025, but elevated demand will keep gas withdrawal elevated.

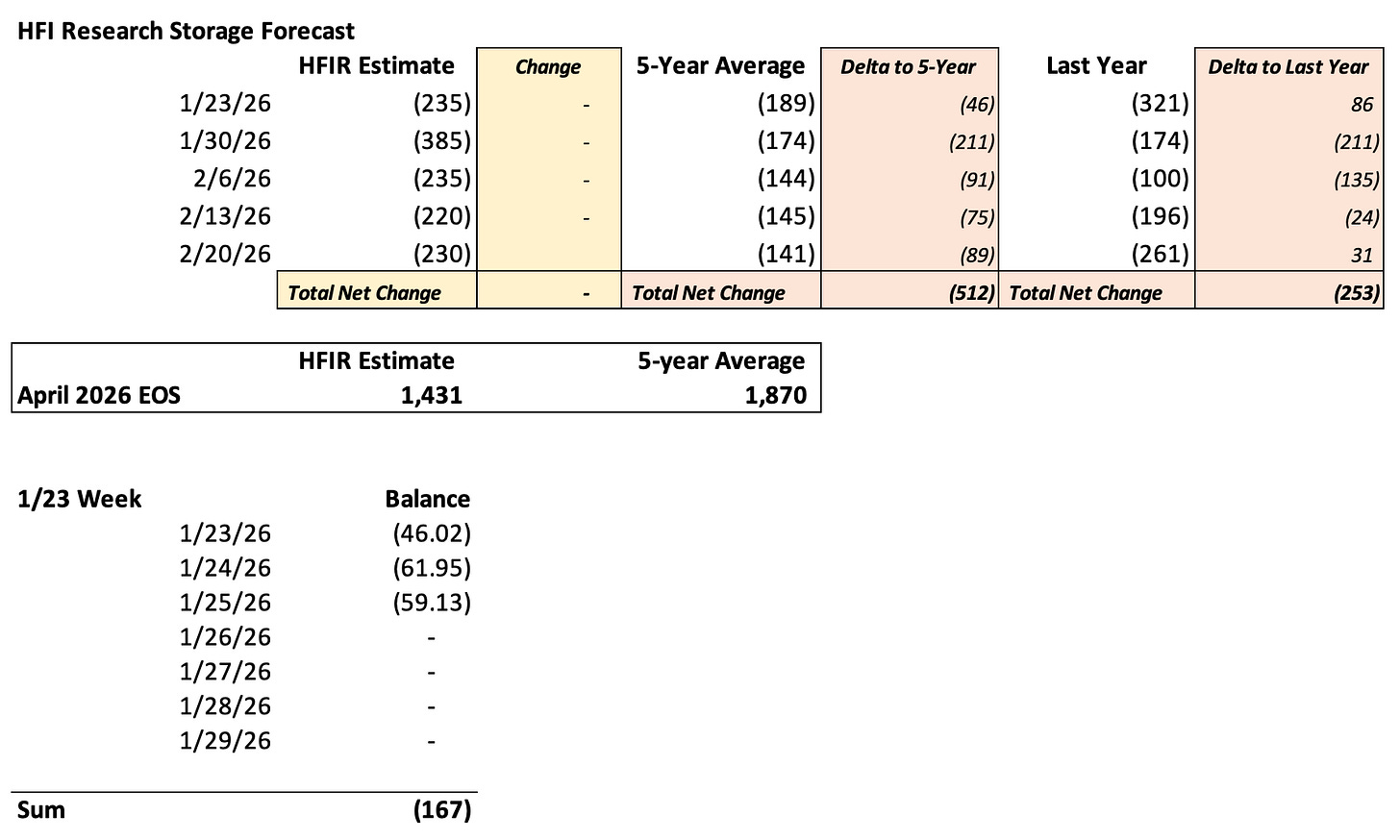

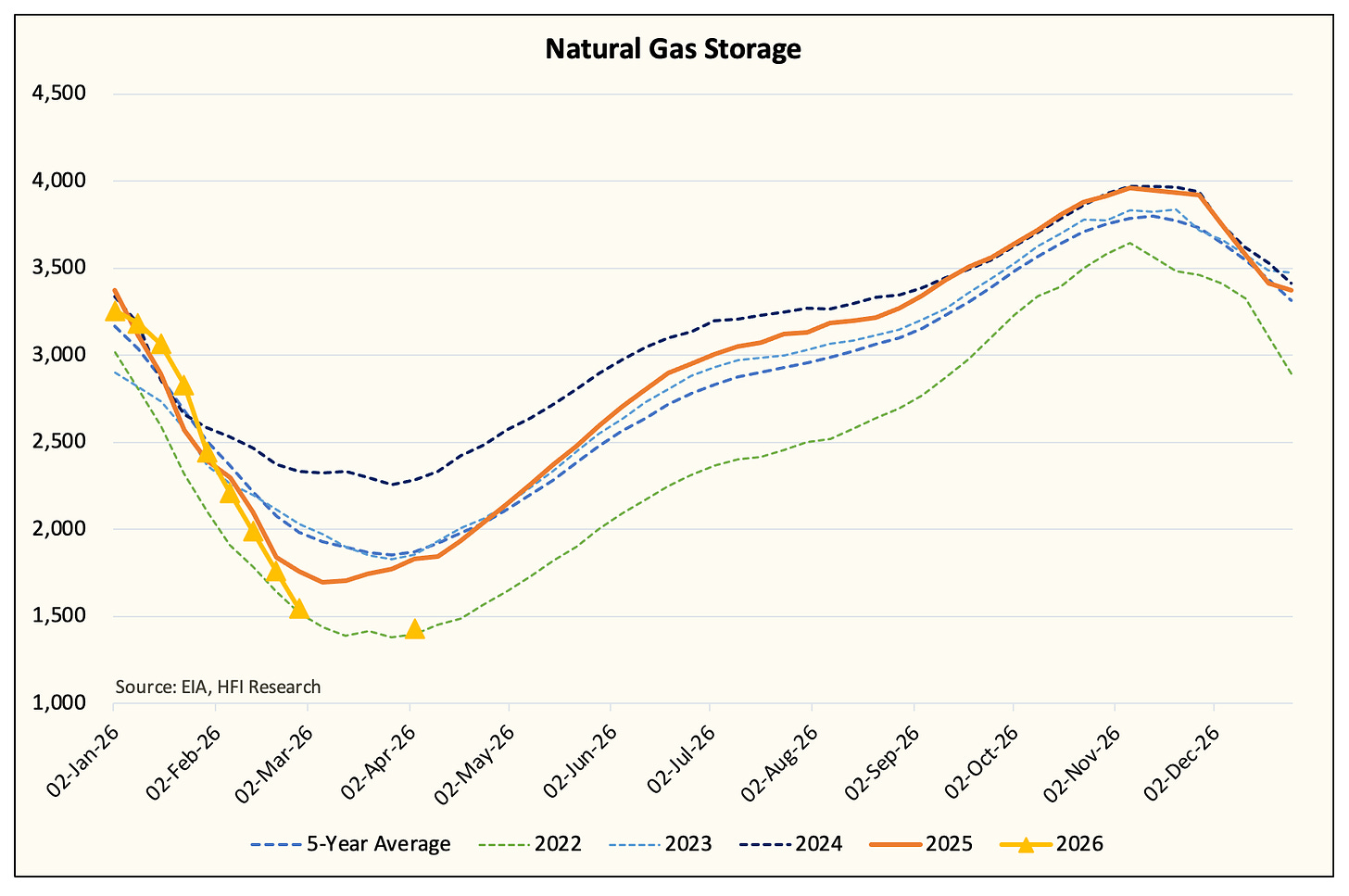

Our storage withdrawal estimate puts the Jan 30 week at a record-breaking 385 Bcf.

Our EOS forecast shows 1.431 Tcf.

With these fundamental developments, where does that put the fair value?