For The Oil Market, The Inflection Point Is Here

It's here. It's make-or-break time for the oil bulls. And I'm not saying that to be dramatic, but it's time for the rubber to meet the road.

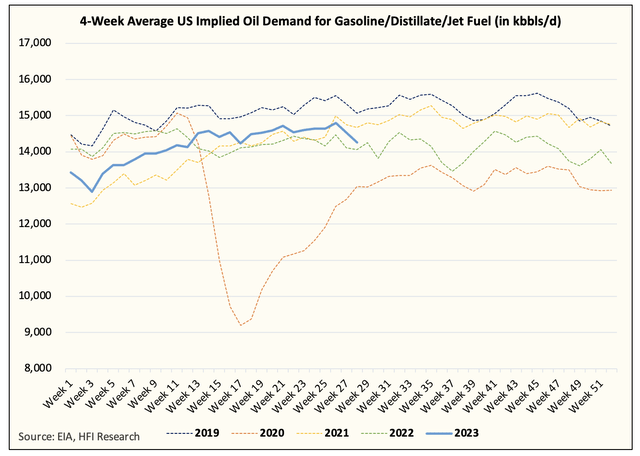

With the funky holiday data behind us, US weekly implied oil demand popped, but there are still signs of weakness we are seeing. While implied gasoline demand in the US is well above 2022 levels, we will need to see continued strength for this inflection point to be real.

We believe that US gasoline demand should continue to improve. If so, then we should continue to see gasoline lead the way for the oil complex. This has also been reflected in the very low gasoline storage we are seeing.

And while implied total US oil demand is better than last year, we are still seeing pockets of weakness in areas like distillate.

Total US implied oil demand

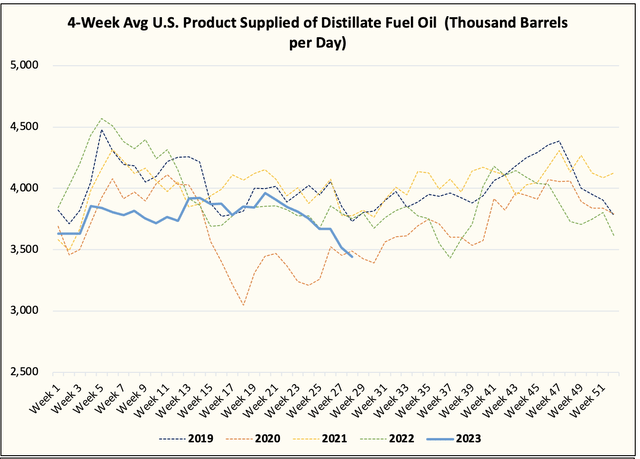

Distillate

As we wrote in our write-up last week, distillate is an economically sensitive fuel, so persistent weakness in this figure implies that we are already in a recession on the manufacturing front. Consumers, on the other hand, appear to be doing better with better gasoline and jet fuel figures.

The end result, however, is that the big 3 implied oil demand is barely just above 2022. You can thank weak distillate demand for that.

So this is what needs to happen for us to be right about this being the inflection point.

We need to see higher implied gasoline demand over the next few reports. Gasoline is currently leading the oil complex and should continue to do so. This should be reflected in the crack spreads.

Total liquids in the US need to start drawing meaningfully. On average, we should see draws averaging over 6 million bbls over the next few weeks.

Crude inventories should continue to draw. Our preliminary estimate shows next week's draw is around 4 to 5 million bbls.

We need to see signs of distillate demand bottoming. If not, then you can confirm that the recession is already here.

From an oil market perspective, the voluntary cuts from Saudi and Russia are starting to meaningfully drain oil-on-water, which will translate to lower onshore crude inventories. This combined with skewed oil speculator positioning will put upward pressure on oil prices. But the market will only buy the bullishness if global oil inventories trend lower. So this is why we need to be right about the most visible inventory data (US market) in order for oil to keep trending higher.

If we are right, then we see WTI reaching $80 in the next few weeks.

It's time for the rubber to meet the road.

One thing I don't think I realized is the magnitude of the impact of the EIA product import/export methodology change on product supplied. Tom L with a good graph here: https://twitter.com/TomLoughrey_LFE/status/1679510999865475076

While 2022 comps may work, before that gets fuzzy. If anything it looks like it would be a sign of even stronger demand than those years. Perhaps at least partially supported by lower inventories despite "weaker demand". Diesel demand number seems like a wait and see... despite the underwhelming numbers the past two weeks NY Harbor ULSD Cracks are looking strong and rallied today. Thanks again for the great charts.