Here we go again. Geopolitical tensions are back in play, which has prompted a lot of tourists to think that World War 3 is on the horizon. And while some argue that there's nothing the US can do this time to stop Israel from attacking Iran, history suggests otherwise.

Instead of speculating on whether an attack will or will not happen, we need to focus on the things we know:

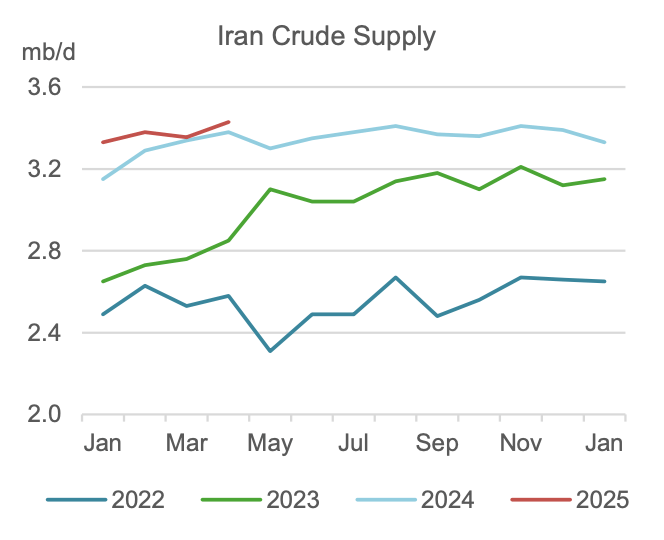

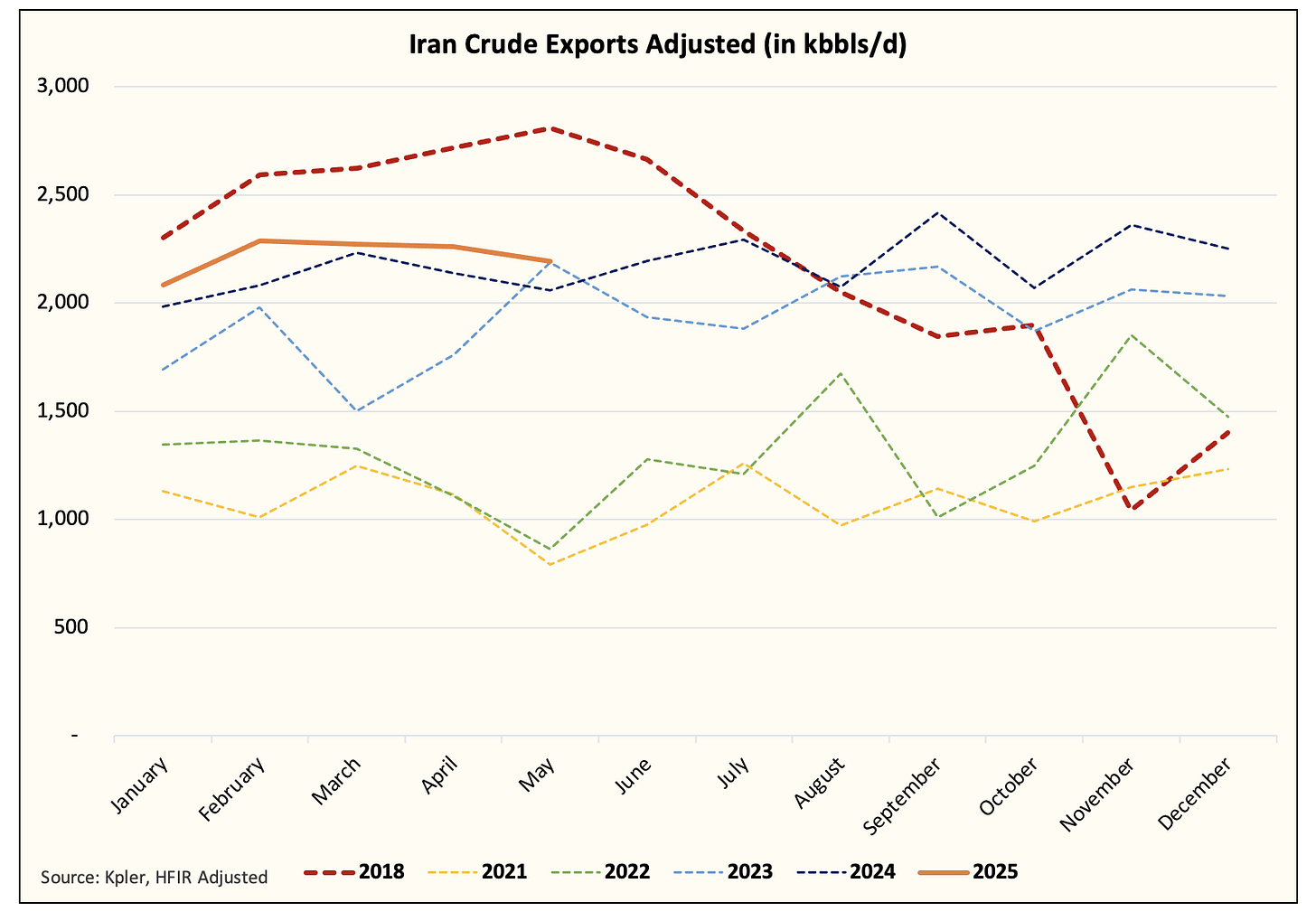

Iranian crude oil production is near a multi-year high.

Iranian crude exports (adjusted for Malaysia) average around ~2.2 million b/d.

Whether the US and Iran agree to a nuclear deal or not will have no impact on the global oil market fundamentals. Iran has been producing near maximum capacity and selling oil near maximum capacity. This means that any geopolitical conflicts that increase the probability of supply disruptions are asymmetrically skewed to the downside (i.e., supply loss).

The third point is the most important to understand when analyzing the oil market. Given that Iran is already doing everything it can to sell oil to the market, any increase in conflict increases the probability of supply disruptions, which increases the price of oil.

It doesn't matter if it actually results in a supply loss or not; it's just the remote possibility of a significant supply loss that will keep oil prices elevated... for now.

The Contradiction

But as geopolitical conflicts fuel oil prices higher, another variable comes into play: Trump's hatred for high oil prices.

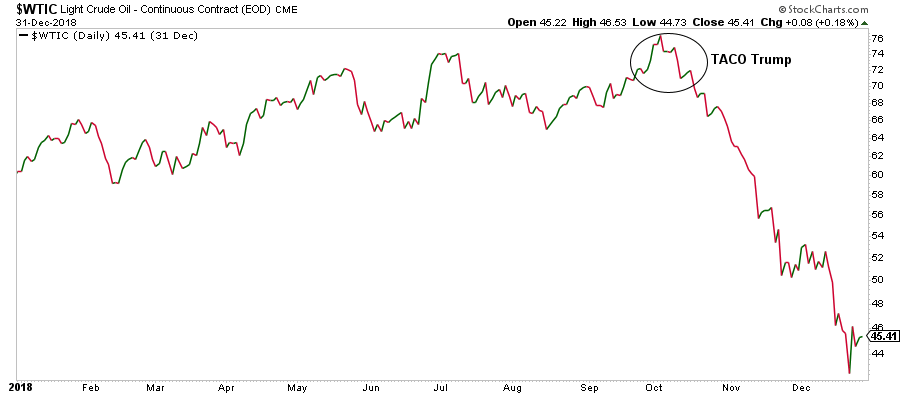

Many of the energy specialists may recall the 2018 to 2019 debacle. Trump gave waivers just days before the Iranian sanctions were supposed to be enforced. He looked at Brent surpassing $80/bbl and decided he would issue waivers to prevent prices from climbing higher, which subsequently resulted in prices crashing straight down after.

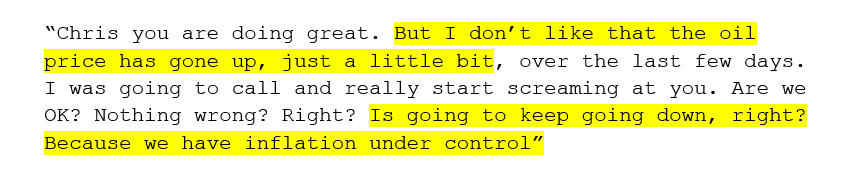

Just today, Trump made a notable comment to Energy Secretary Chris Wright about higher oil prices. Here's what he said:

Source: Javier Blas

These remarks came after Chris Wright publicly stated that he did not think US crude oil production would head lower in 2026.

The fact is that all of this is just a giant contradiction.