The prospects of geopolitical risks escalating have prompted some to believe that oil could spike to as high as $100/bbl. But we've been in the business long enough to remember Abaqiq, which physically took supplies off for a short while only to see both energy stocks and oil sold off materially after.

Geopolitical risk is like the carrot to the donkey for oil bulls.

It's ever-present but always far away. My advice to anyone trying to find a true edge in oil trading/investing is to ignore geopolitics. While it's never your job to completely disregard it, my advice is to heavily discount it unless something actually happens.

So as geopolitics dangles the prospects of higher oil prices for many, real oil watchers should know that the fundamentals have recently worsened. In our Monday WCTW, "Follow the Process." We pointed out that Asian topping margins have gone negative and crack spreads are following suit. Refining margins will be the leading indicator for crude this year, and with refining margins peaking and still trying to find the bottom, crude won't get the tailwind it needs.

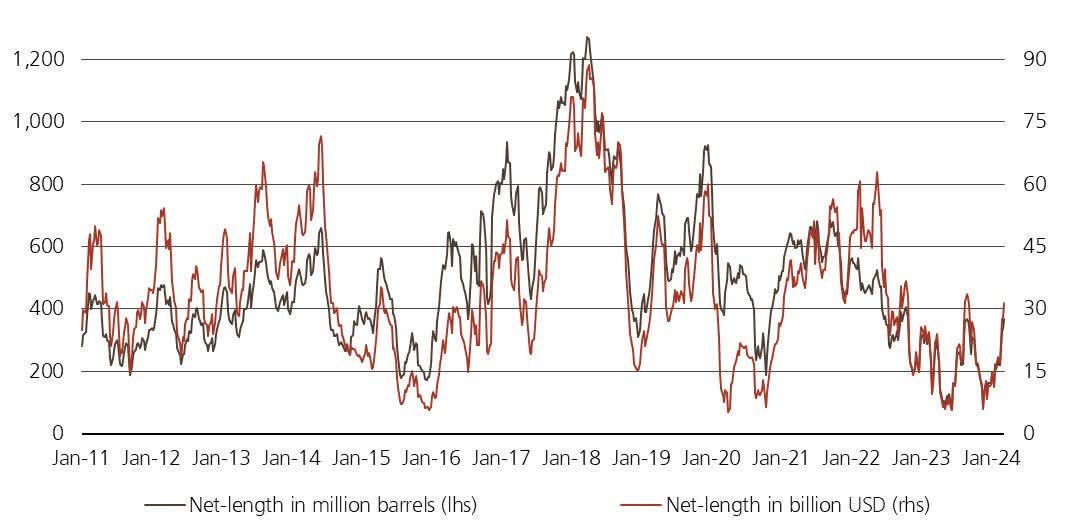

To make matters worse, we think oil speculator positioning is likely to show another sizable increase in this Friday's CFTC report. Net long positioning is already back to October 2023 levels, a level which saw oil prices hit the $60s just a few months later.

Source: CFTC, Giovanni Staunovo

One key difference to keep in mind is that while we don't expect a dramatic reversal in positioning, it does present itself as a headwind.

On the fundamental side of things, US crude storage saw a sizable build last week with another large build expected for next week's report. Looking at the current trajectory for US crude storage, April will be a weak month.