The start to this year is unlike any other year we’ve seen. Well, perhaps except for COVID, which was once in a lifetime type of event, but you get my point. First, the market was taken aback by the development in Venezuela last weekend, where Maduro was captured. Now, we have the social unrest developing in Iran. The most important indicator for me is the betting market on Khamenei exiting before the end of 2026.

Source: Polymarket

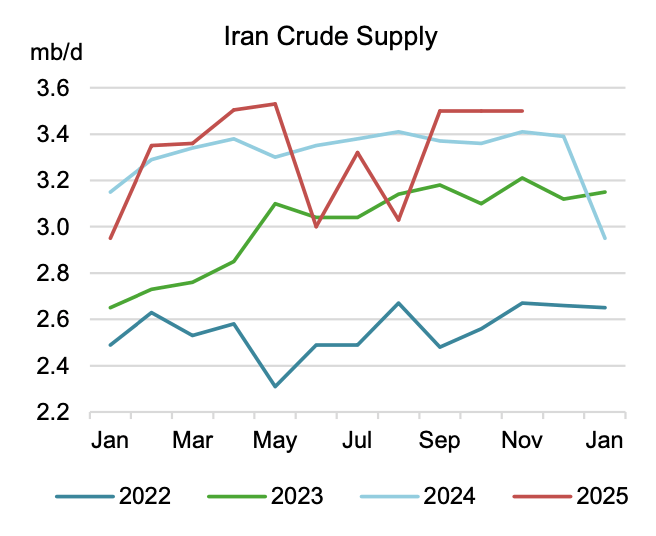

There’s major importance in this when we look at the global oil market. Iran is a big player with crude exports averaging ~2.2 million b/d (including shadow fleets) and producing ~3.5 million b/d of crude oil.

Source: IEA

All-in, Iran produces ~5 million boe/d total liquids, which is extremely meaningful for the market. Any prolonged disruptions to the existing regime imply that supply security will be at risk, and the geopolitical premium in the oil market will spike.

Let’s look at what needs to happen for readers to take this signal (Iran) seriously, but first, let’s look at the oil market implications.

Market Implications

For the last 10-years, if you faded every geopolitical event, you would be rich.

Iran sanctions (2018 to 2019).

Every Libya supply outage.

Abqaiq outage (Saudi 2019).

Russia/Ukraine (2022).

Israel/Iran (2024, and again in June 2025).

Following so many letdowns, the market is going to inherently fade any geopolitical price spikes. I mean, who can blame them? It’s been happening for 10-years!

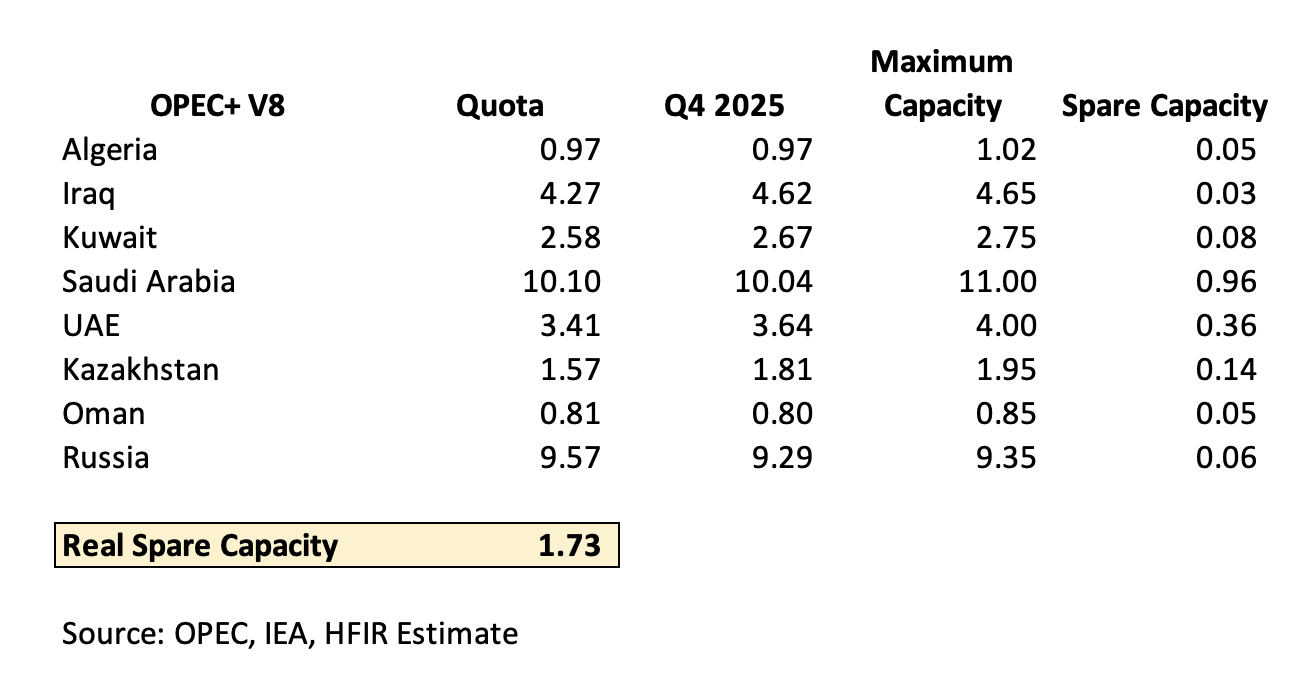

The difference this time is that “effective” spare capacity inside OPEC+ is close to peaking. Note that at the beginning of December, we wrote a piece titled, “A Watershed Moment Is Coming For The Oil Market In 2026.” In it, we laid out this chart:

And our conclusion on the finding is that the effective spare capacity inside OPEC+ is 1.73 million b/d.

With Iran producing close to ~3.5 million b/d of crude, OPEC+’s effective spare capacity will only cover half of that. Where will the other half come from if Iran’s production goes offline?