(Guest Post) Anas Alhajji's Oil Market Outlook For 2023 - 2024

Note: We thought Dr. Alhajji's oil market outlook for 2023 - 2024 was very insightful. If you have not checked out his Substack yet, please do so here.

-----

Companies have been reacting to higher oil prices and the prospect of prices remaining elevated over a sustained period by increasing investments and oil production. As a result, OPEC, and the Paris-based International Energy Agency (IEA) have revised up their estimates of non-OPEC output.

Below is a summary of the views of OPEC, the IEA, and the US Energy Information Administration (EIA), as published in their recent monthly oil reports. We would like to remind our readers that it is customary to estimate oil demand based on behavioral variables and non-OPEC production and OPEC NGLs based on new and expansion projects (OPEC NGLs are not included in the OPEC/OPEC+ quota). The difference between the estimated demand on the one hand and the estimated non-OPEC production and OPEC NGLs on the other is the “call on OPEC” and change in inventories. For example, if the difference is 1 million barrels per day (mb/d) and OPEC keeps production unchanged, then inventories in this case must decline by 1 mb/d. Historically, such a difference has been covered by an increase in production and a decline in inventories.

We would also like to remind our readers that these are only estimates, and they could be wrong. That’s why it’s important to monitor inventories all the time since mistakes will show up in unexpected level changes.

Global Oil Demand

Global oil demand will hit a record high in 2023 and will climb to a new high in 2024, according to forecasts by OPEC, the IEA, and the EIA. We agree with this outlook.

Estimates for growth in global oil demand were slightly revised by the three groups in August from the previous month. In general, demand growth in the first half was revised up while demand growth in the second half was lowered. Although the EIA adjusted its demand growth estimates as we previously expected, we still believe that OPEC and the IEA are overestimating demand growth, while the EIA is still underestimating it. We believe that the IEA’s estimates of oil demand growth in Europe in 2024 are too pessimistic, and we also question the reasoning for the decline.

Another point to emphasize is that demand is one thing, while consumption is another. For example, higher demand in the first half of 2023— which led to a major build in Chinese crude inventories— was accompanied by lower consumption. In such cases, demand is usually higher than consumption.

As oil prices remain high in the second half of 2023, China’s crude imports are expected to decline as Chinese companies withdraw oil from inventories. In this case, consumption would be higher than demand.

For all the reasons stated above, the figures published by the IEA and OPEC for the second half of 2023 are inflated.

Figure (1) below compares the quarterly forecasts of global oil demand by the three organizations (OPEC, IEA, and EIA). While the predictions of OPEC and the IEA for the fourth quarter of 2023 are virtually the same, the EIA’s forecast is significantly lower.

The forecasts for 2024 are widely divergent, specifically OPEC’s and the EIA’s estimates for the fourth quarter.

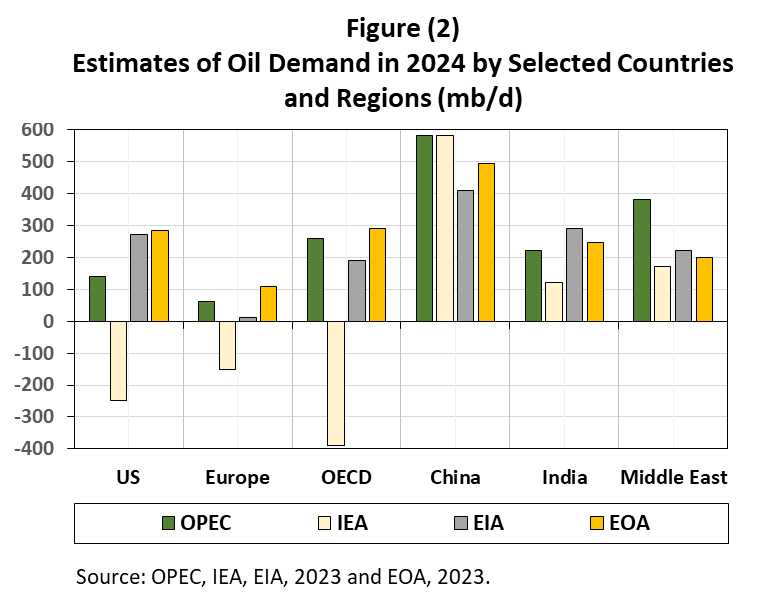

Figure (2) below indicates the origins of oil demand according to OPEC, the IEA, and the EIA, and our view as the EOA. Figure (1) above shows lines trending up, but the details tell a different story. While all three organizations agree that demand will grow in China, India, and the Middle East, they differ on growth in oil demand in the US, Europe, and the OECD. The IEA expects a decline, but in our opinion, the agency’s view is not really a forecast but wishful thinking! Our estimate of oil demand growth in the US, Europe, and the OECD is higher than others. Absent a recession, we expect strong economic growth and a low impact from the penetration of electric vehicles.

Meanwhile, regarding our estimate of oil demand growth in China, it is lower than that of OPEC and the IEA, but our forecast is higher for India. As for the Middle East, we expect moderate growth as governments remain conservative in their spending.

Non-OPEC Production

Dealing with non-OPEC production prior to 2016 was easier. Estimates of non-OPEC production now include the production of non-OPEC members who are members of OPEC+, and for this reason, the announced output cuts are counted in the forecasts. This has become problematic since projections take the announcements at face value and do not count cheating, for example.

Estimates of non-OPEC production have been revised up in the OPEC and IEA August reports, indicating that rising prices are encouraging investments and higher production. The EIA is the most bullish simply because it is bullish on US shale production as shown in Figure (3) below. All three organizations agree on the sources of the increases: The US, Canada, Norway, Brazil, Guyana, and Kazakhstan. Russia’s announced output reductions are counted as cuts and the projections assume that Russia will fully comply. But if Russia cheats, non-OPEC production would end up higher.

“Call on OPEC” and Inventory Changes

As mentioned above, the difference between the estimated non-OPEC production and OPEC NGLs is the “call on OPEC” and inventory changes (see Figure 4 below). OPEC is the most bullish, while the EIA is the least bullish. The differences among various forecasts are strikingly large.

The problem is that the current OPEC production is significantly lower than all projections. According to OPEC, the current “call on OPEC” is higher than actual production by 2.1 mb/d. Therefore, inventories MUST decline by more than 180 million barrels (MB) in the third quarter, but that’s not happening. Clearly, the “call on OPEC” is overestimated mostly because demand growth is inflated.

Since OPEC has decided to extend its cuts until the end of 2024, this indicates that either the group has to revise down its demand forecasts and reduce the “call on OPEC”, or it has to raise production. And we may see OPEC embracing both measures simultaneously.