HFI Research Note:

This is an excellent article by Dr. Anas Alhajji. If you are not a follower of Dr. Alhajji, I highly recommend you to do so.

-----

Note: in this article, we use “liquids demand” and “oil demand” interchangeably, although liquids include biofuels. When talking about crude, we will mention “crude.”

Yes, the increase in electric vehicle sales is replacing some gasoline demand but manufacturing them is creating a boom in oil demand!

A night view of the Liaoyang Petrochemical Company factory in Liaoning province. Source: China Dialogue, 2020

In the same manner that analysts and various agencies do not agree on growth in global oil production, which we discussed last week, they do not agree on growth in global oil demand in 2023. Yes, 2023!

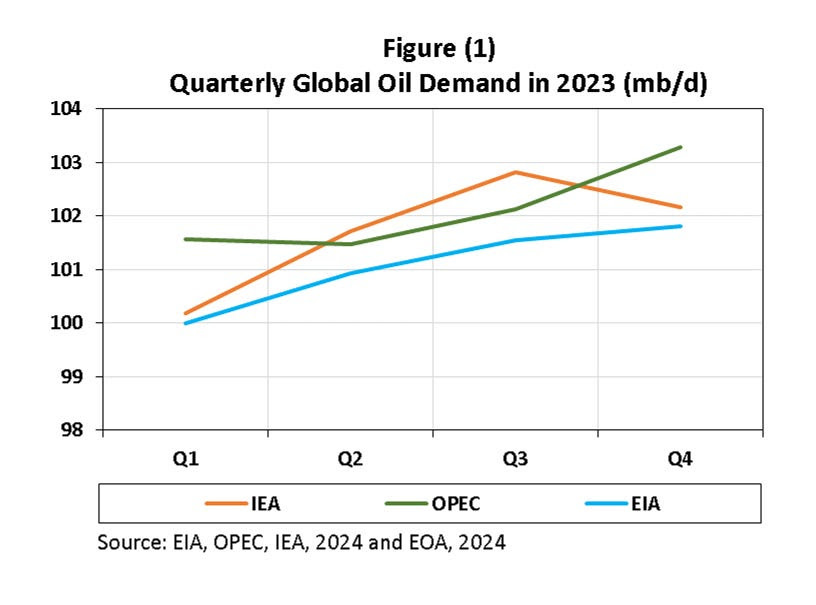

According to the US EIA, global liquids demand grew by 1.92 mb/d in 2023, which is almost double its earlier forecast. The IEA has it at 2.25 mb/d, which is lower than its earlier forecast of 2.4 mb/d. OPEC has the highest number: 2.45 mb/d, but still slightly lower than its earlier forecast of 2.5 mb/d. This data, which is shown in Table (1) below, is telling us that the differences in estimates are large: the average yearly difference between OPEC and the EIA is 540 kb/d, but looking at the fourth quarter, the average is huge: 1.5 mb/d as shown in Figure (1) below. The Figure shows estimates of quarterly global oil demand by the IEA, OPEC, and the EIA. It also shows the main problem: What really happened in the fourth quarter of 2023? According to the IEA, demand declined. According to OPEC, it increased drastically. Our readers know that our forecast failed in the fourth quarter because demand was lower than expected. Hence, the OPEC estimate cannot be correct. Demand overestimation is also confirmed today by Aramco’s CEO who said he expect global oil demand to grow by 1.5 mb/d in 2024 while OPEC had it at 2.2 mb/d.

The question is: with all these differences, what makes any of these numbers correct or closer to reality? Looking at oil trade, the increase in 2023 was only about 1 mb/d. Given that OPEC production declined but exports remained relatively flat, it is clear that demand cannot be as high as OPEC’s estimate.

The data is also telling us that earlier forecasts overestimated demand. The EIA’s forecast in December 2022 of growth in global oil demand in 2023 was wrong and we criticized their forecast in a previous report as unreliable.

Regardless of the exact numbers, global oil demand was strong in 2023 but lower than earlier expectations, especially in the fourth quarter. That growth came in two parts, one related to the continuation of recovery from Covid-19 and the growth that is expected in normal circumstances where economies are expanding. As our readers know, China, in a sudden move, lifted all COVID-19 restrictions at the beginning of 2023. Most of the recovery in demand was in jet fuel as airline travel recovered strongly. According to the IEA, global demand for jet fuel and Kerosene increased by 17.4% in 2023, but barley recovered to pre Covid-19 levels. Demand for jet fuel and kerosene in China increased by a whopping 62% in 2023. It increased by 12.3% in India.

The main lesson here is that during a recovery, most of the growth in oil demand will not be in the essential use, but in the luxury use, such as travel. However, the large decline in 2021 and 2022 was related to lockdowns and the large and quick recovery that happened immediately as restrictions were lifted. That is not the case when we have recessions and recovery from recessions or periods of low economic growth. Recovery takes time. These facts have implications for oil demand in 2024 and 2025.

Figure (1) shows estimates on quarterly basis.

In Detail

Table (2) below shows liquids demand by country and region according to the IEA. We are more interested in the trends and the magnitudes than the exact numbers. The first observation is that not everyone experienced growth in demand. The world was divided into two halves. Demand declined in Africa as well as the whole region between Europe and Russia. This decline has nothing to do with renewable energy (solar and wind) nor with electric vehicles. It is directly related to economic activities. Several countries in Europe and Africa suffered from recessions or low economic growth.

Wind and solar are used to generate electricity. Oil is rarely used to generate electricity in Europe. Therefore, no one can say the large increase in solar and wind capacity or generation reduced oil demand.

The EU GDP growth plummeted from 3.6% in 2022 to only 0.6% in 2023. Reports indicate that two million battery electric vehicles were sold in Europe in 2023. Even if we assume none of the vehicles in the previous years were replaced, and that all of them were bought on January 1, 2023, these new vehicles would account for only 60,000 b/d of oil for the whole of Europe! Therefore, the decline in oil demand cannot be attributed to electric vehicles and clearly was caused by lower economic activities.

China experienced large growth in electric vehicles: about 9.5 million units, yet its oil demand grew dramatically: more than 12%. It is worth noting that the 9.5 million EVs replaced about 270 kb/d of oil assuming they did not replace any electric or gas vehicles and all of them were 4-wheelers.

Demand by Product

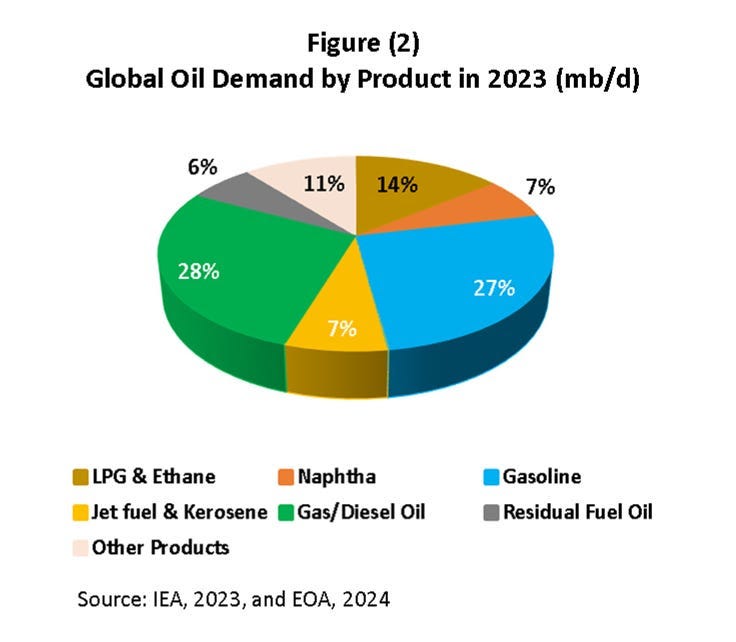

The transportation sector remains the primary user of oil as shown in the gasoline, diesel and jet fuel shares in Figure (2) below. Despite climate change policies, global demand for gasoline increased by 2.7%. We focused on this point last May when we posted an article on the surprise rise in gasoline consumption in EU countries despite the rise in sales of electric vehicles. Diesel and gas oil demand rose by 0.5%. We attribute this low growth to decline in economic growth in Europe. The biggest increase came from the airline sector as jet fuel demand increased by 17.4%. Most of the increase came from China and India. This increase was a recovery from the lockdowns of COVID-19.

One blind spot climate change extremists ignore is petrochemicals. The energy transition requires massive amounts of materials that are produced in the petrochemical sector. This is reflected by the increase in demand for Naphtha, LPG, and Ethane. Naphtha demand increased by 4.8% in 2023 while demand for LPG and Ethane increased by 3.3%.

Oil Demand in the US

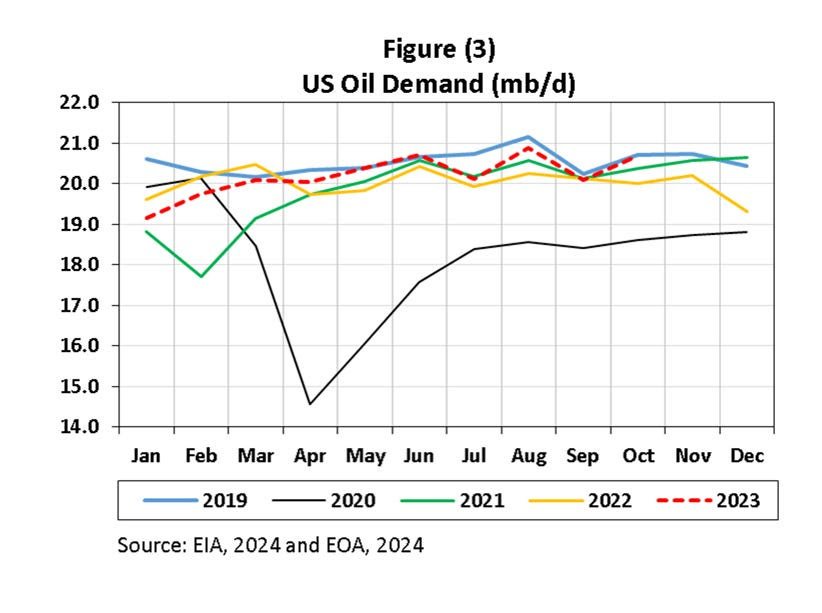

US oil demand increased in the first ten months of 2023 by about 130 kb/d over the average first ten months of 2022. Yet, demand remains below 2019 levels as shown in Figure (3) below. If demand grew faster in the last two months of the year, the average would be significantly higher.

Regardless, we believe that a growth of 130 kb/d remains within the margin of error given the amount of blending taking place where some NGLs and light crudes are counted twice. In other words, the possibility of the EIA exaggerating demand estimates are high. We are saying this even though our forecast of US liquid demand matches the EIA numbers. In other words, it is in our interest for the EIA numbers to be correct, yet we raise doubts about them.

Here’s the most important question. Why is petroleum demand (especially gasoline) lagging? More electric vehicles does not explain it because the numbers remain small. This is not a new issue; it is almost a ten-year issue. Researchers have provided several explanations. Three of them stand out today:

More people working from home

An expansion of social media/communication technologies

A change of culture where fewer young people are driving cars.

Some researchers also cited the difficulties in getting driver licenses in some states, tougher drug laws, and the number of people incarcerated.

Oil Demand in China

All forecasts agree on the large increase in demand in China, but they disagree on the amount of growth. The IEA, as shown in table (2) above, estimates the growth in 2023 to be 1.78 mb/d, while the OPEC estimate is 1.20 mb/d. The EIA had it at 0.84 mb/d. But again, the EIA was out of the picture from the beginning as we stated above. Regardless of the exact growth, China’s oil demand increased. Figure (4) below shows China’s liquids demand according to the IEA. This growth was mostly a recovery after the COVID-19 lockdowns. The data is clear since the growth in jet fuel demand was huge by historical standards as shown in Figure (5) below.

Growth in gasoline and diesel demand was also large, but it was mainly a recovery. Therefore, when we talk about 2024, all this recovery that we have seen in 2023 will not be there. Chinese oil companies have been taking about a peak in Chinese gasoline demand for a couple of years now and some have started talking about a peak in oil demand. Here are a couple of examples:

China's gasoline demand peak nears as EV boom hastens transition

China oil demand seen peaking by 2030 -CNPC research

A peak in gasoline demand followed by a decline is significant. Gasoline represents 23% of total Chinese oil demand as shown in Figure (6) below. But here is the other side of the coin. The increase in demand for jet fuel, gasoline, and diesel was a recovery from the lockdowns. But the demand for naphtha and LPG wasn’t! Figure (7) below shows the continuous increase in demand for Naphtha, especially in 2023. The expectation is that this high growth will continue! Why? The answer is in title of an article form the IEA: China’s petrochemical surge is driving global oil demand growth.

So, here is the irony: forcing electric vehicles will reduce gasoline consumption, but they need more products form the petrochemical industry which needs naphtha and LPG and feed stock! Any future decline in gasoline demand is limited, but the increase in demand for Naphtha and LPG will be large as shown in Figure (7). Note that figure (6) shows that the share of Naphtha and LPG is higher than the share of gasoline. Even if gasoline demand reaches a peak, it will be hard to see China’s oil demand reaching a peak.

Conclusions

Our forecast for Q4 2023 did not materialize because of lower demand than expected. We lean toward the IEA estimates. OPEC estimates of growth in global oil demand for 2023 was too high and remain high for 2024.

The year 2023 was the year of “records.” That includes record global oil demand and record oil demand in China. However, the growth of oil demand told the story of two different worlds: A world of growth and world of recession. Most of the global oil demand was in China, India, and Latin America. African, Europe, Russia, and others experienced negative growth.

The story of oil growth in the US needs more investigation. The penetration of electric vehicles does not explain the lack of growth in gasoline demand in the US.

As for China, the large growth in 2023 was mostly a recovery that will not be repeated in the following years. However, the growth in LPG and naphtha demand was real and expected to continue. Even if gasoline demand peaks as more electric vehicles travel on Chinese roads, oil demand is expected to continue to grow for years to come. EOA

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: Written by Dr. Anas Alhajji.