(Guest Post) Oil In 2026: Narrative Vs Reality - Why The Oil Market Is So Confused By Dr. Anas Alhajji

Editor’s Note: The consensus has been overly bearish on the oil market in 2025 and Dr. Anas Alhajji correctly pointed out that the surplus was exaggerated. He was kind enough to share with us his report and the issue he’s seeing in the oil market today. Please consider supporting Dr. Alhajji’s service!

By: Dr. Anas Alhajji

Related Links:

Oil Inventories Flash Red: Crude, Gasoline, Distillates – All Critically Low

Brazil Shatters Crude Export Records in October: A Short Note

Oil Market Update: Debunking the Bearish Narrative

US Crude Oil Production Reached a Record High in August, But What About Shale? A Short Note.

One of the major problems now is that 2025 is nearing its end, yet forecasts for demand and market balances differ widely. Thus, 2026 forecasts not only have their own variances but also inherit the discrepancies from 2025, creating greater confusion among market participants and investors. Historically, large forecast differences at the start of the year converged by year-end. That is not happening now. As previously stated, we will never know actual global demand; we can only use various tools to assess which forecast is more credible. Regardless, the IEA has an 18-year record of underestimating oil demand, according to the IEA itself, President Trump will remain the main source of volatility in the oil market with China and OPEC+ remaining the main driver of market fundamentals.

2025 Estimates

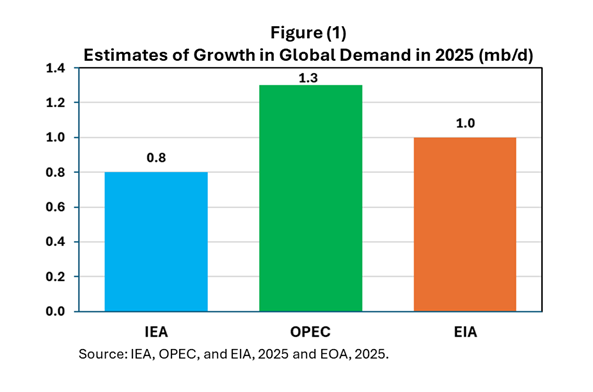

After several upward revisions, the IEA now forecasts global oil demand growth of 800 kb/d in 2025, while OPEC estimates it at 1.3 mb/d—a whopping 500 kb/d difference as shown in Figure 1. The US EIA expects 1 mb/d growth. We at EOA have revised ours down by 80 kb/d to 1.1 mb/d, partly due to weaker-than-expected jet fuel demand earlier this year. Forecasts should be converging by year-end, but they are not. Using multiple variables, one thing is clear: the IEA is significantly off, and we expect further upward revisions. Remember, revisions for 2022, 2023, and 2024 totaling 350 mb only came in May 2025.

Logically, supply forecasts should converge more easily than demand by year-end, as production and shipments are simpler to track. Yet that is not occurring now.

The IEA sees global supply rising 3.1 mb/d in 2025 to 106.3 mb/d, with 1.8 mb/d from non-OPEC+. OPEC estimates non-OPEC+ growth at just 1 mb/d. The EIA forecasts total supply growth of 2.8 mb/d (300 kb/d below IEA) and supply of non-OPEC+ at 2 mb/d. The gaps are huge: IEA’s non-OPEC+ figure is 200 kb/d below EIA’s number and 800 kb/d above OPEC as shown in Figure 2. (Note: in all cases, OPEC+ NGLs are included in non-OPEC+ supply numbers above, as OPEC+ quotas exclude them.)

From demand and non-OPEC+ supply, we derive the call on OPEC+. The IEA implies OPEC+ must cut 1 mb/d in 2025 from last year’s average. The EIA sees a similar ~900 kb/d cut. OPEC, however, calculates a required increase of 300 kb/d. So far, the market supports OPEC’s view, at least directionally: the group has added far more than 300 kb/d (almost triple the amount), yet demand absorbed it without prices crashing to the $30–40s as some analysts have predicted. Figure 3 compares the various estimates for the change in demand for OPEC+ crude.

What about 2026?

The IEA forecasts global oil demand growth to be only 800 kb/d, EIA 1.1 mb/d, and OPEC 1.4 mb/das shown in Figure 4. Large early-year differences are normal, but these may persist like 2025’s. Our estimate is 1.17 mb/d, potentially higher if the US reaches a comprehensive trade deal with China.

The IEA sees global supply rising 2.5 mb/d in 2026 (600 kb/d less than 2025 but still very high). The EIA expects only 1.4 mb/d.

Non-OPEC+ growth forecasts: IEA 1.4 mb/d, OPEC 800 kb/d, EIA 1.2 mb/d as shown in Figure 5. The resulting call on OPEC+ varies sharply: IEA requires a 600 kb/d cut, OPEC a 600 kb/d increase, EIA a modest 100 kb/d cut as shown in Figure 6. The 2026 problem is exacerbated by the unresolved 2025 discrepancies layered on top.

The Surplus

The IEA predicts a historic 2026 surplus exceeding 4 mb/d. Many major investment banks and analysts foresee large surpluses and lower prices. Here are some examples:

World oil market faces even larger 2026 surplus, IEA says

Goldman Sachs sees oil prices falling through 2026 on supply surge

Morgan Stanley First to Revise Oil Price Forecast After OPEC+ Update

Barclays Cuts 2026 Brent Forecast on OPEC+ Supply Increase Expectations

On the other side, we see OPEC, OPEC members, and oil majors dismissing the idea of a large surplus:

Saudi Aramco CEO Dismisses Oil Surplus Concerns for Next Year

TotalEnergies CEO Downplays Oil Market Oversupply Fears

OPEC Rejects Claims It Forecasted a Global Oil Supply Surplus for 2026

UAE dismisses oil oversupply warnings amid OPEC+ production pause

Meanwhile, some bearish analysts warned that if Russian or Venezuelan supplies are curbed, we will end up with a tight market is 2026 and oil prices will rise:

Russia

U.S. sanctions on Russia could push Brent above $85, Barclays warns

Rystad Energy: Sanctions could cause disruptions to Russian crude production and exports

How the new US sanctions on Russian oil will impact energy markets

Oil prices climb 2% to 4-month high with sanctions expected to disrupt Russian supplies

Russia faces higher costs on sea-borne oil exports due to new US sanctions

Venezuela

Why US Military Deployment Has Venezuela Worried About Its Oil

US Venezuela Oil Conflict: Causes, Consequences, and Global Impact 2025

Explainer | US warships are circling Venezuela – what does this mean for the oil trade?

Venezuela Oil Flows in Focus as US Military Presence Builds

Moving up: the US invasion of Venezuela will lead to higher oil prices

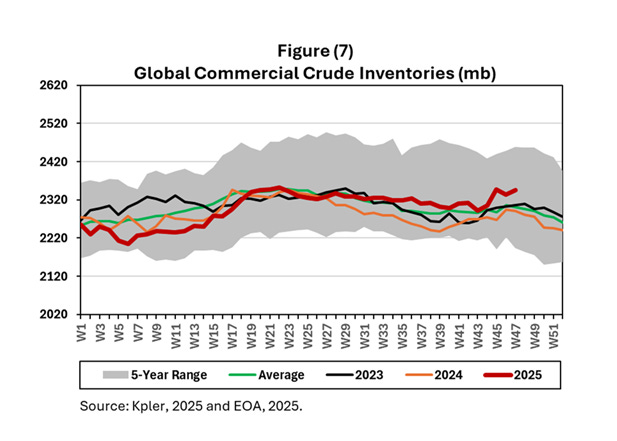

At the same time, global commercial oil inventories are rising as shown in Figure 7. Oil on water is high as shown in Figure 8, and floating storage is increasing as shown in Figure 9. Meanwhile global oil demand and production are at record high and refining maintenance at its peak. In addition, the amount of oil and the number of oil tankers sanctioned are also at record high. Add top the mix that no one can predict what would President Trump do or say tomorrow.

Bottom line: To the casual observer, the oil market looks like a perfect storm wrapped in thick fog — a setup that makes misinformation spread effortlessly, especially through agenda-driven media outlets

Our View

The large surplus and oil on water stories are exaggerated as we detailed in previous Notes. US crude, gasoline, and distillate inventories are low by historic standards as we explained in our last report. The news that Indian oil companies, especially Reliance, halting imports of Russian crude are also exaggerated and in some cases fake. Most of the increase in oil on water and floating storage is medium sour at a time when most of the refineries in the Middle East and India that take medium sour crude are going through maintenance. Chinese oil on water and floating storage is decreasing. However, most of the “unknown” where most of the increase is, could be going to China.

The impact of sanctions on Russia is also exaggerated. The impact of US attack on Venezuela will have a serious impact, mostly because of crude quality, not the quantity.

We will end up with seasonal build in inventories. For now, we expect the group of 8 in OPEC+ to extend the pause of unwinding the 1.6 mb/d of voluntary cut form April to July unless there are strong evidence of stronger than expected growth in global oil demand.

Related Links:

Oil Inventories Flash Red: Crude, Gasoline, Distillates – All Critically Low

Brazil Shatters Crude Export Records in October: A Short Note

Oil Market Update: Debunking the Bearish Narrative

US Crude Oil Production Reached a Record High in August, But What About Shale? A Short Note.

Bottom Line, the surplus and oil on water is exaggerated. The IEA surplus estimates are ridiculously high: There is not even enough storage capacity for the predicted surplus of 1.5 billion barrels! IEA estimates of global oil demand growth is very low. US oil inventories are critically low. The US is locking up more oil in the SPR than what crude oil producers have produced since the beginning of the year, and we expect the Trump admisntration to continue filling the SPR. OPEC+ crude supplies are expected to decline as refiners return form maintenance.

We do not include political events in our models. But here are some issues that will influence the markets in 2026:

Russia

If the war ends, Overall oil prices will decline, even if Russian oil production and exports do not increase. But Russian discounts will start shrinking, making oil mor expensive for India and China. End of war does not mean ending the sanctions. It might, officially, lead to conditional easing of these sanctions. However, the end of the war will erode the strict implementation of the sanctions. We expect to see countries publicly violating the sanctions knowing that the Trump admisntration will turn the blind eye. The end result is another change in the global trade in oil and LNG. However, we will NOT return to pre-Ukraine invasion. Russian crude and LNG will continue to flow to Asia as the US oil and LNG share is enriched in Europe. It remains to be seen if LNG shipments will return to the Red Sea.

If the war doesn’t end, the main scenario will be how President Trump sees it: Who is not accepting the peace deal, Putin or Zelinsky? If he blames Putin, we expect the US Congress, Senate, and the White House to act in Unson to put additional pressure on Russia with the largest package of sanctions ever, which includes secondary sanctions, leading to another shock to the global oil and LNG markets. The results will depend on the enforcement. One fact will make us believe that the impact will be limited: Trump does not want to see high oil prices.

The price difference between these two scenarios could add up to about $10/b. In the second scenario, China will enjoy very low prices for Russian oil that has not been seen since 2020!

Venezuela

The biggest risks for the Maduro leadership in Venezuela is the end of the war in Ukraine! The End of the war will not only give the Trump administration more leverage to pressure Maduro, it will also embolden the Trump administration for not fearing higher oil prices if Venezuelan oil exports are halted! However, one would argue that the diplomatic success of the Trump admisntration in ending the war in Ukraine will also enable the admisntration to diplomatically sole the problems with the Maduro government.

Regardless, in case we lose all the Venezuelan crude exports, the impact on overall prices is limited if it comes after the end of war in Ukraine. Regardless, the impact in terms of crude quality and price differentials will be higher than the impact in term of quantity. In this case, we expect China to import more form Canada and the US to import more form Iraq. We will have a detailed note on this matter soon.

The idea that the US will attack Venezuela to control its oil resources is so naive and simplistic. We have heard the same thing about Iran, Afghanistan, Iraq, Syria, Yemen, Sudan. If the US is after Venezuelan oil, it can triple its imports form Venezuela within two weeks with a a signature form Trump lifting the sanctions, which will also lead to Venezuela increasing its production gradually. The Maduro government, working with Chevron for years, have no problems working with other US oil companies. The bottom line here is that this dispute is not about US thirst for Venezuelan oil.

China

When looking at 2026, there are two main issues:

1- The impact of China’s strategy of reducing dependence on seaborne energy imports, especially oil and LNG. As discussed in the past, this strategy meant increasing domestic production of all energy sources, building massive inventories, and increasing gas imports via pipeline form Russia and land imports of coal from Mongolia. It also means increased electrification of the transport sector. China succeeded on all front, but there are limits to such growth. The question is, what will happen to seaborne imports in cases of strong economic growth (especially after a comprehensive trade deal with the US), drought, or unexpected growth in power demand because of AI and data centers? This is the bullish side of the equation. We will discuss all those issues in details in a future Note.

2- The role of Chinese oil inventories: for about a decade, China built oil inventories when oil prices are low and released oil form inventories as prices increased above certain threshold, about $70/b for Brent. China built massive oil inventories form cheap Iranian and Russian oil that are larger than US inventories by about 400 mb. While most of the increase in inventories are strategic (commercial inventories are mostly owned by government owned oil majors), companies can release large amount of oil in case of increasing prices. That means if the market turned in 2026 and prices starts going up, China will cap these prices by releasing oil form its inventories. As Chinese refineries use cheap oil form inventories instead of importing oil, global oil demand for traded oil would be less than other wise. This is the bearish side of the equation.

Conclusions

To the casual observer, the oil market in 2026 is shrouded in storms and dense fog. Forecasts and views are so divergent that market confusion is justified. Our view, excluding political events, is neither bearish nor bullish. Bearish stories about oversupply and oil on water are exaggerated as we explained in previous Notes. More crude is locked in US Strategic Petroleum Reserves than producers are adding. Once the refinancing maintenance season is over, oil on water and floating storage will decline significantly.

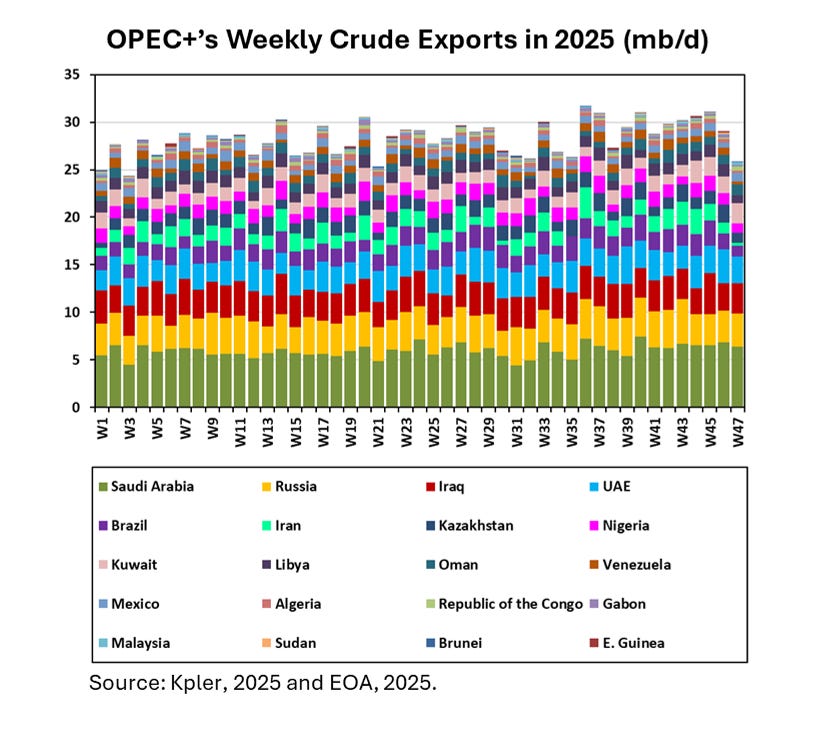

We expect the OPEC+ group of 8 to extend the pause on unwinding voluntary cuts until July, unless global oil demand growth significantly exceeds expectations. Prices should remain range-bound, with occasional spikes driven by fake news and distorted narratives influencing short-term trading. It’s worth noting that, aside from the fact that OPEC+ is approaching its peak supply (see the OPEC+ crude exports chart at the top of this page), many OPEC+ members are already producing at or very close to their maximum capacity.

An end to the Ukraine war would lower oil prices even if Russia cannot raise output, though the impact would be limited. However, it would free the Trump administration to focus on Venezuela and Iran. If the war persists, the outcome hinges on whom the Trump administration blames for failed negotiations.

In short, absent major political or economic shocks, Brent prices are expected to remain range-bound in the $60s in 2026, with occasional deviations. President Trump will remain the main source of volatility in the oil market with China and OPEC+ remaining the main driver of market fundamentals.