Heads Up: Saudi Materially Increases Crude Exports In July

For over a month, the oil market was on high alert about President Biden's visit to Saudi Arabia. Following the meeting, Saudis confirmed their willingness to increase spare capacity from 12 million b/d to 13 million b/d by 2027 but acknowledged that after that, there was no more additional spare capacity.

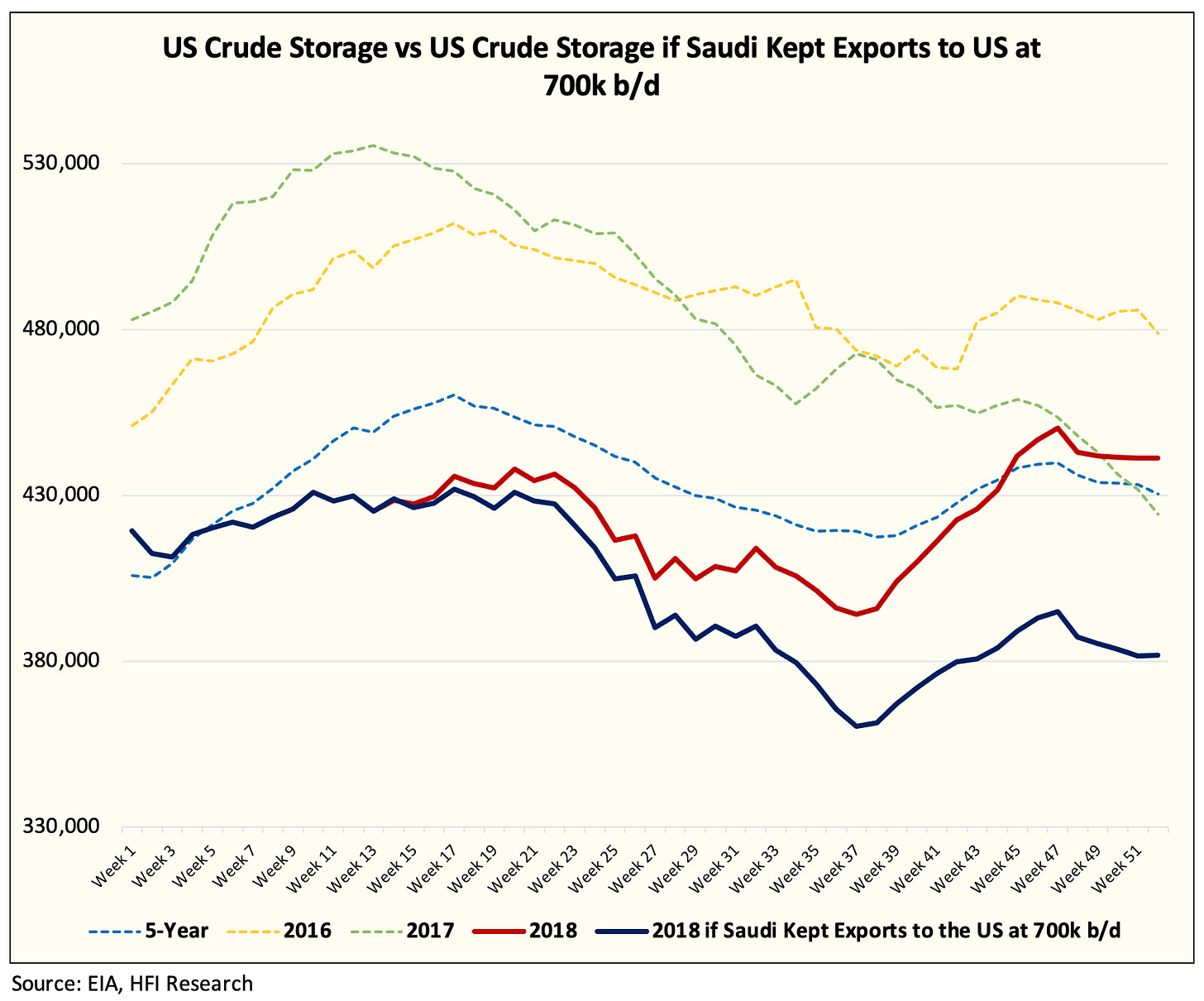

For energy investors that remember the craziness of 2018, you will remember that former President Trump started tweeting nonstop about oil in May 2018. Following his pressure on OPEC, the Saudis increased oil production at the end of June 2018. We wrote a lot of articles on this back then, but to summarize, the extra exports the Saudis sent to the US increased commercial crude storage by ~60 million bbls.

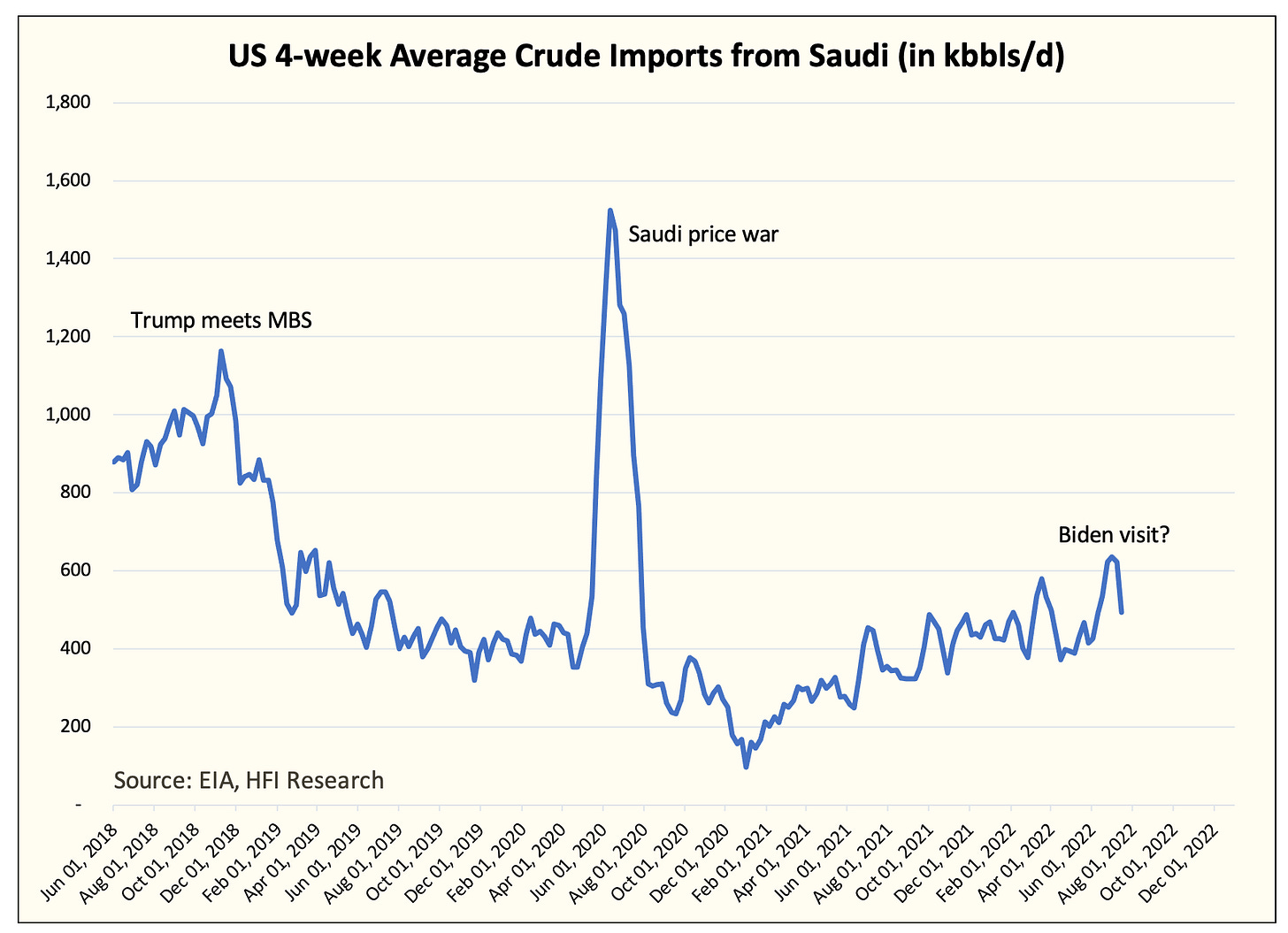

Since then, the Saudis have flipped the strategy 180. You can see this from the 4-week US crude imports from Saudi.

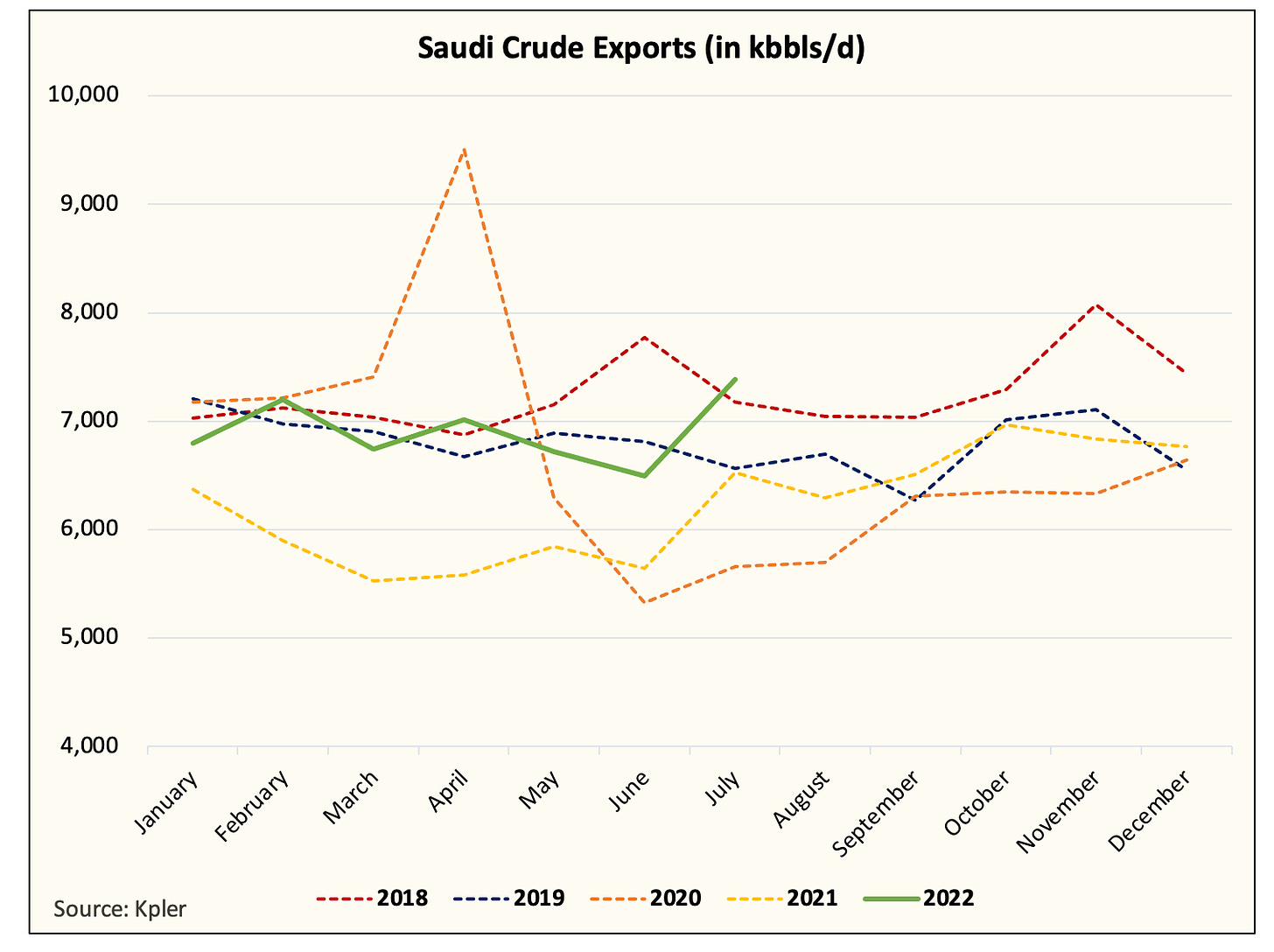

But like the paranoid energy investors we are, we have to wonder if something concrete actually came out of this Biden visit. One cause for concern is that Saudis have materially increased crude exports in July.

Actual exports so far in July are at the highest level in years. Considering that Saudis usually show lower crude exports in summer months due to domestic power burn demand needs, you do have to wonder if US politics had something to do with this.

In addition, we are tracking individual vessels heading to the US and so far this month, we are starting to see a jump versus the previous months. This means that the Saudis are indeed looking at pressuring the recent surge in oil price.