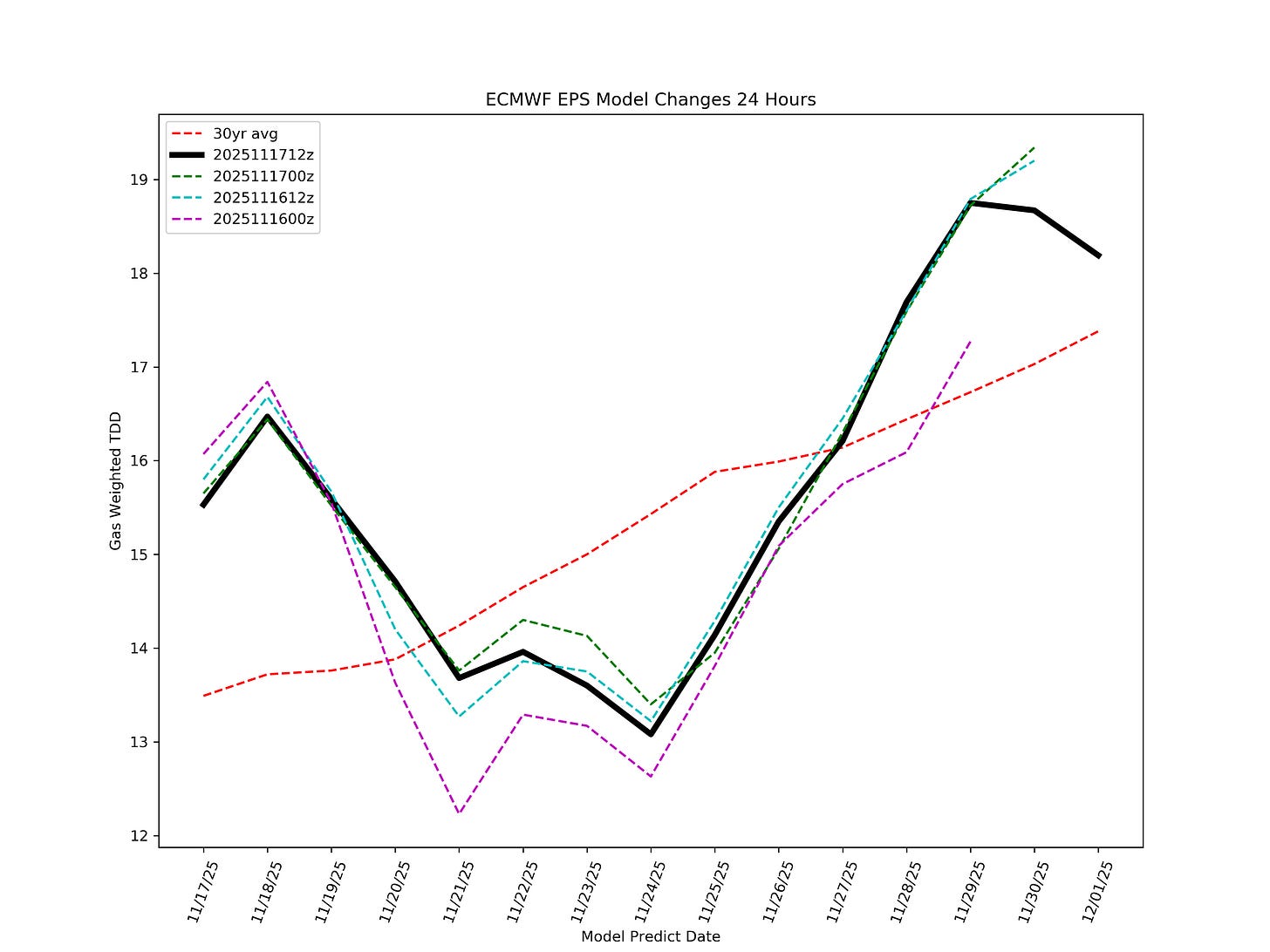

If you are wondering why natural gas prices were down 5% despite early signs of more heating demand on the horizon, you are not alone. Winter gas trading can be extremely volatile and make even the most experienced traders feel like amateurs. Part of this is due to the frequent weather model updates that occur throughout the day (2 important ones from ECMWF-EPS), and the other reason is that you have to understand the “market’s expectation.”

In today’s case, for example, a strong Alaska blocking pattern was present going into the weekend last Friday. Market participants wanted to see the big blocking pattern up North turn into material changes in heating degree days. Instead, we only saw a mild revision higher.

ECMWF-EPS TDD Chart

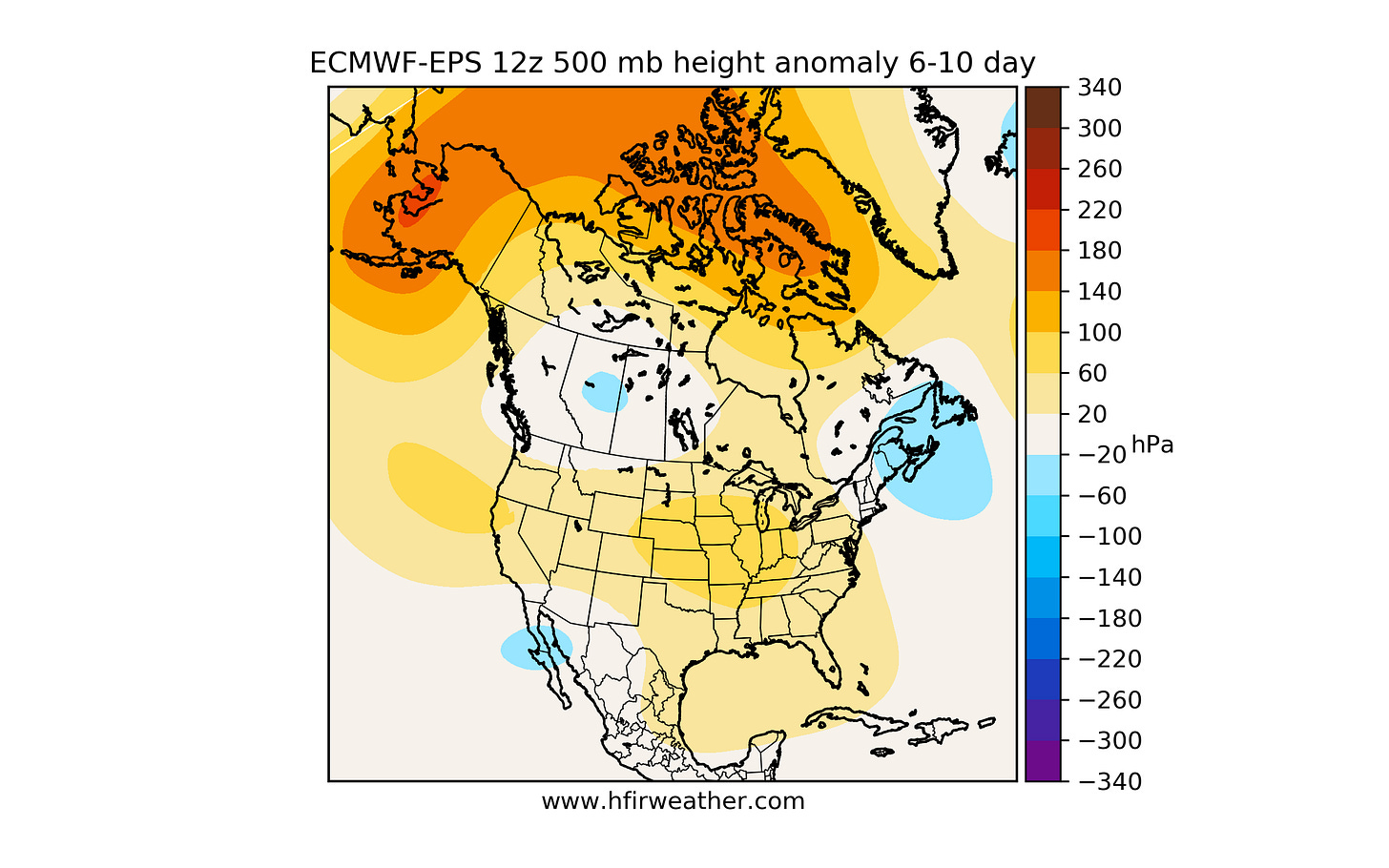

6-10 Day

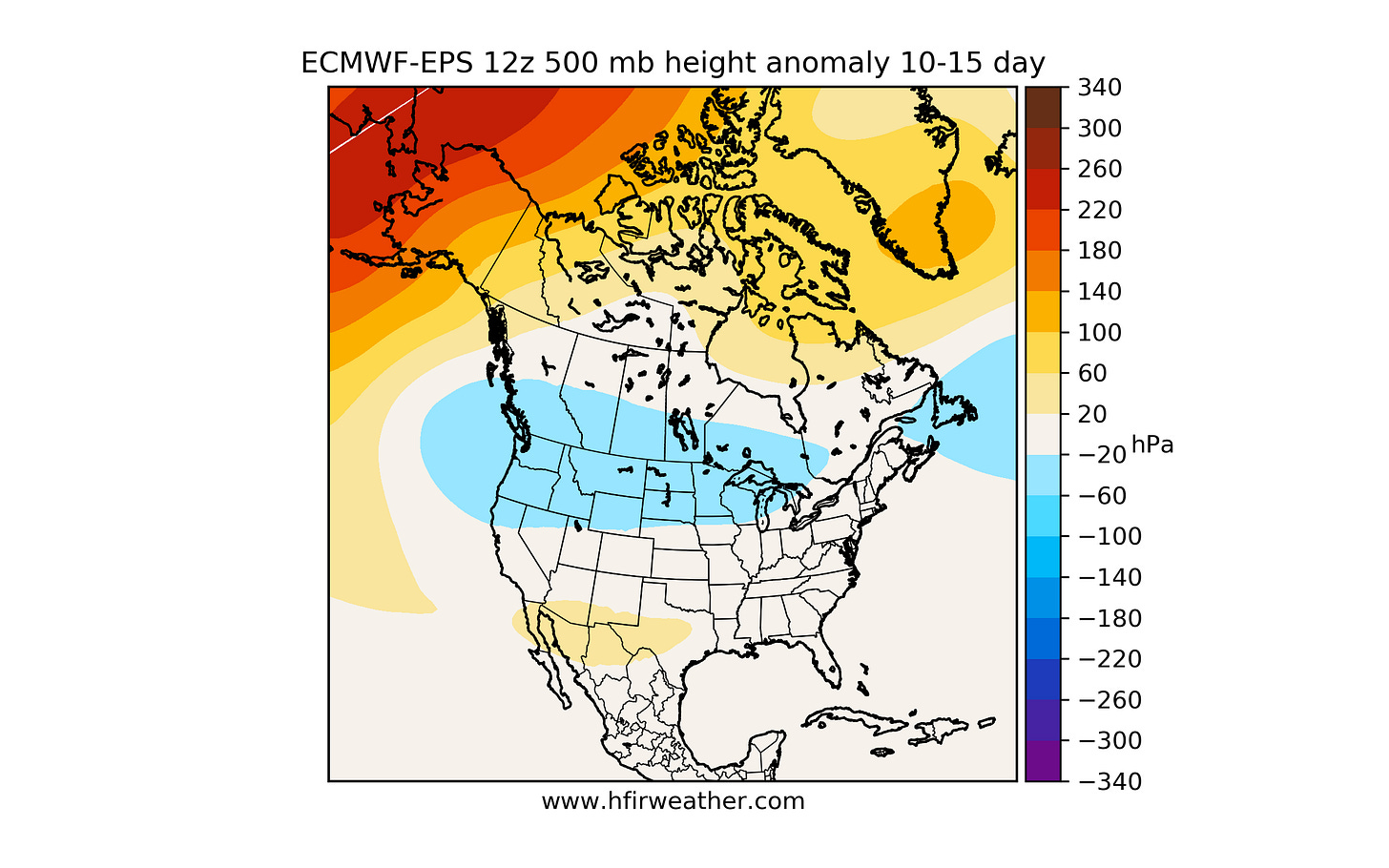

10-15 Day

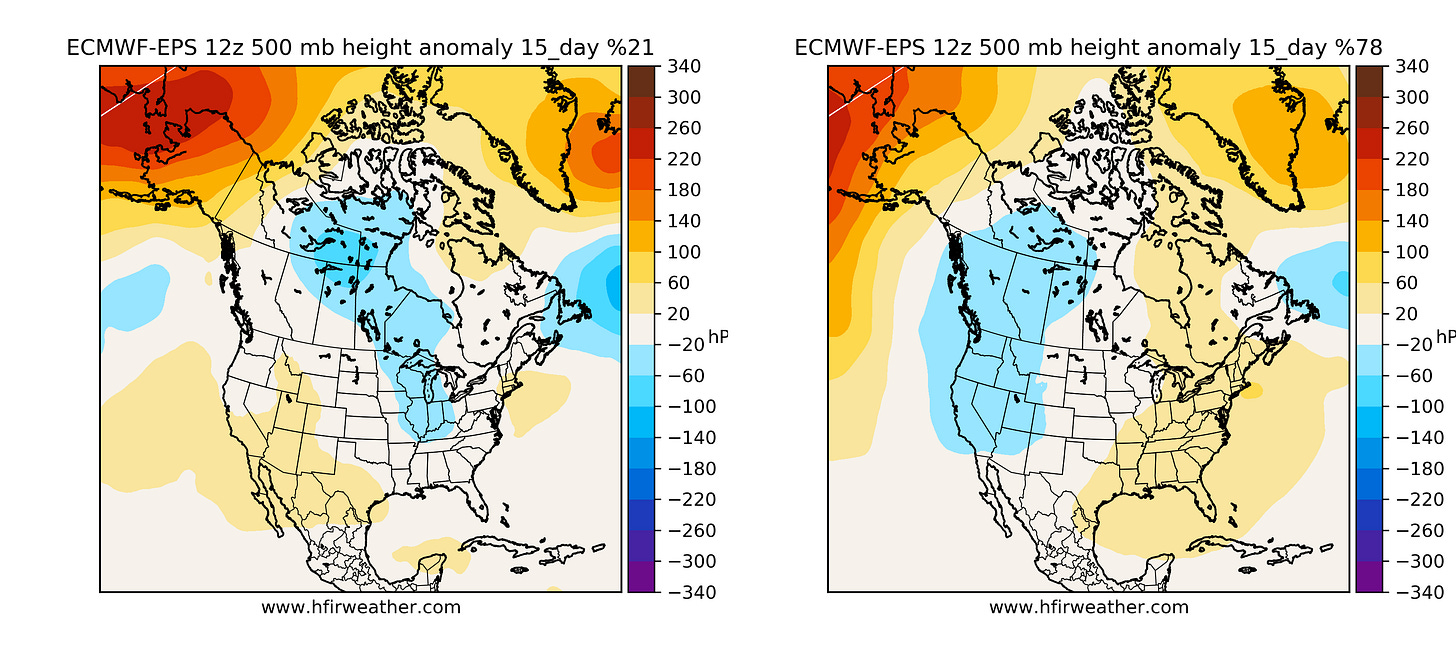

15-Day

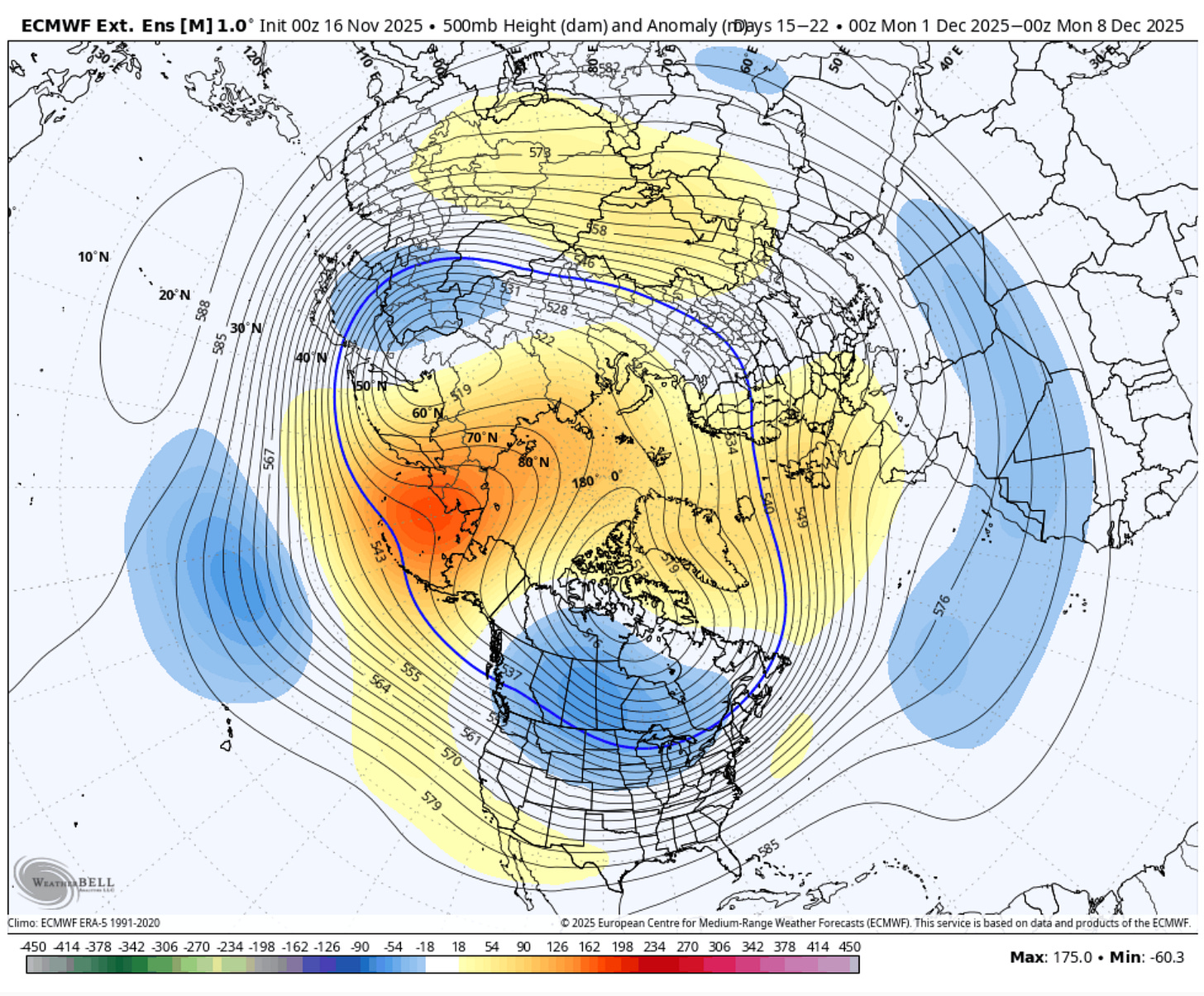

The good news so far is that the strong Alaska ridge pattern continues in the 15-day cluster. We also confirmed this via the ECMWF-EPS weekly outlook where the 15-36 is favorable:

15-22 Day

Source: WeatherBell.com

But in order for this to translate to higher natural gas prices, we would need to see it reflected in the heating demand forecast. So far, it’s just a possibility that we could see materially colder than normal weather, and sometimes, that’s not enough to jolt prices.

The Good News...

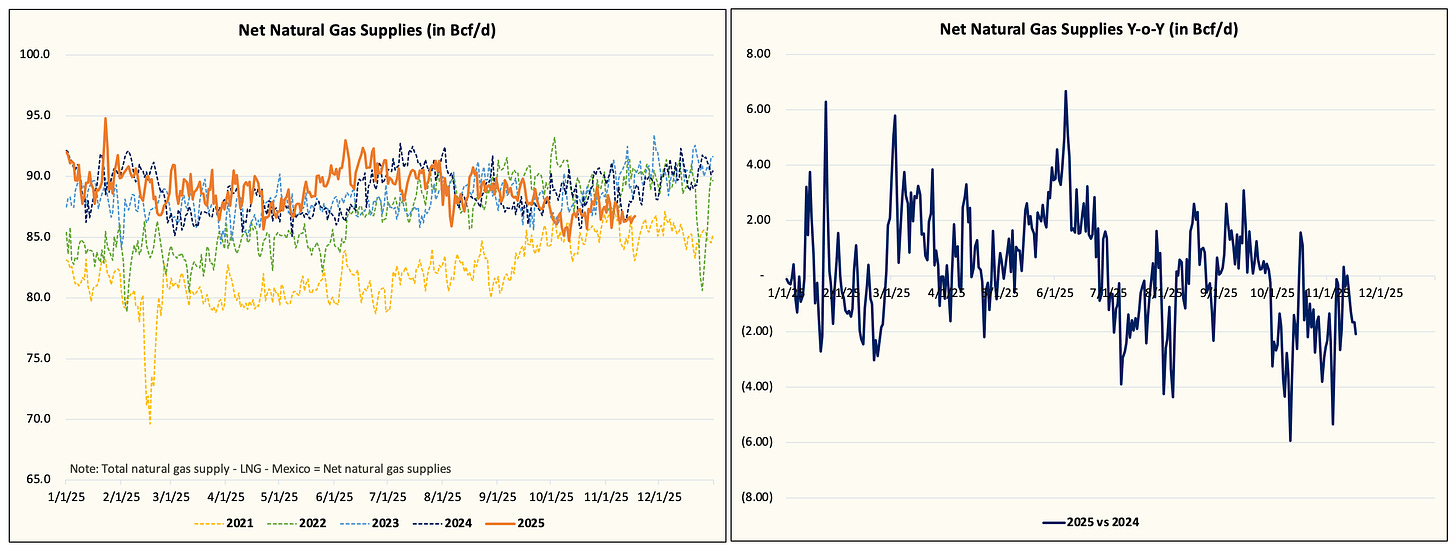

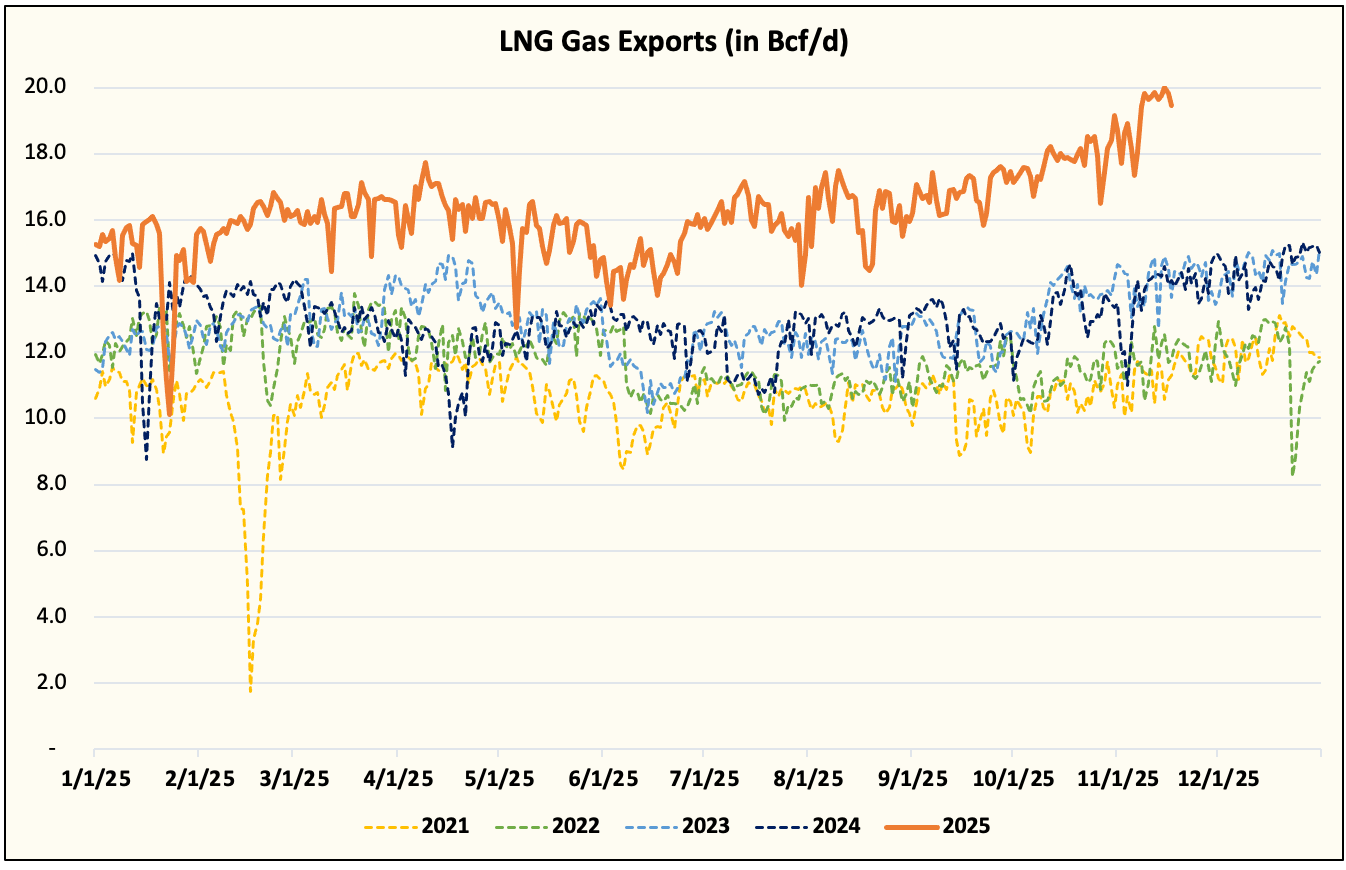

The good news here is that the natural gas market has been structurally tighter ever since LNG feedgas jumped.

Net gas supply is at one of the lowest levels in the last 5 years, thanks to the record-breaking LNG feedgas flow.