Here's My Game Plan

The problem with timing the market is that you are bound to be wrong-footed, and when you are, you question your very own existence. This just happened to me as my cautious approach flipped bullish stance was blindsided by the recent drop in both oil and energy stocks.

Just two weeks ago, I was still writing about how the oil market may know something that we don't. Then just 3-days later, I pivoted as I saw bullish signals reappear in the market. Those very same bullish signals such as copper prices outperforming are starting to disappear.

That's what makes markets so challenging to navigate. And this is especially true during turbulent times like these. There's nowhere to hide, there's no asset class that's safe from the sell-off today, and it's risk-off everywhere.

It's been extremely challenging to read the markets as of late. For those of us that use market price action as a guide to seeing what the market is trying to say, I have found it extremely difficult. It is senseless and directionless in the narrative it is portraying. It's as if the market price action is just saying, a recession is coming, inflation is rampant, and the Fed will be unsuccessful in fending off inflation. The problem with this narrative is that it's contradictory. A recession normally lowers economic growth, which would lower commodity demand. This would, in turn, reduce inflation, which means the Fed would be successful in fending off inflation. This would, in theory, lead growth stocks to outperform relative to cyclical stocks. This is not happening.

Now if we take the Fed will be unsuccessful approach and inflation remains rampant, then investors should be buying energy and commodity producers to hedge for the longer-than-expected inflation. Recession risk would, in this case, be a more mild and prolonged one thus impacting demand, but not to the extent of the GFC (think 2008, 2009). Investors are clearly not doing that.

Another plausible narrative is that the strength in the Dollar could cause emerging market contagion and resurface worries about an impending debt crisis, which would then really dampen demand. And because inflation is rampant, investors can't even buy bonds, so they are forced to dump everything and hold cash.

As you can read through the logic chain, this is a very challenging time, and so for investors, the only way to really think your way through this is by reverting to fundamentals.

Since our entire portfolio is in energy, we have to ask ourselves a few basic questions:

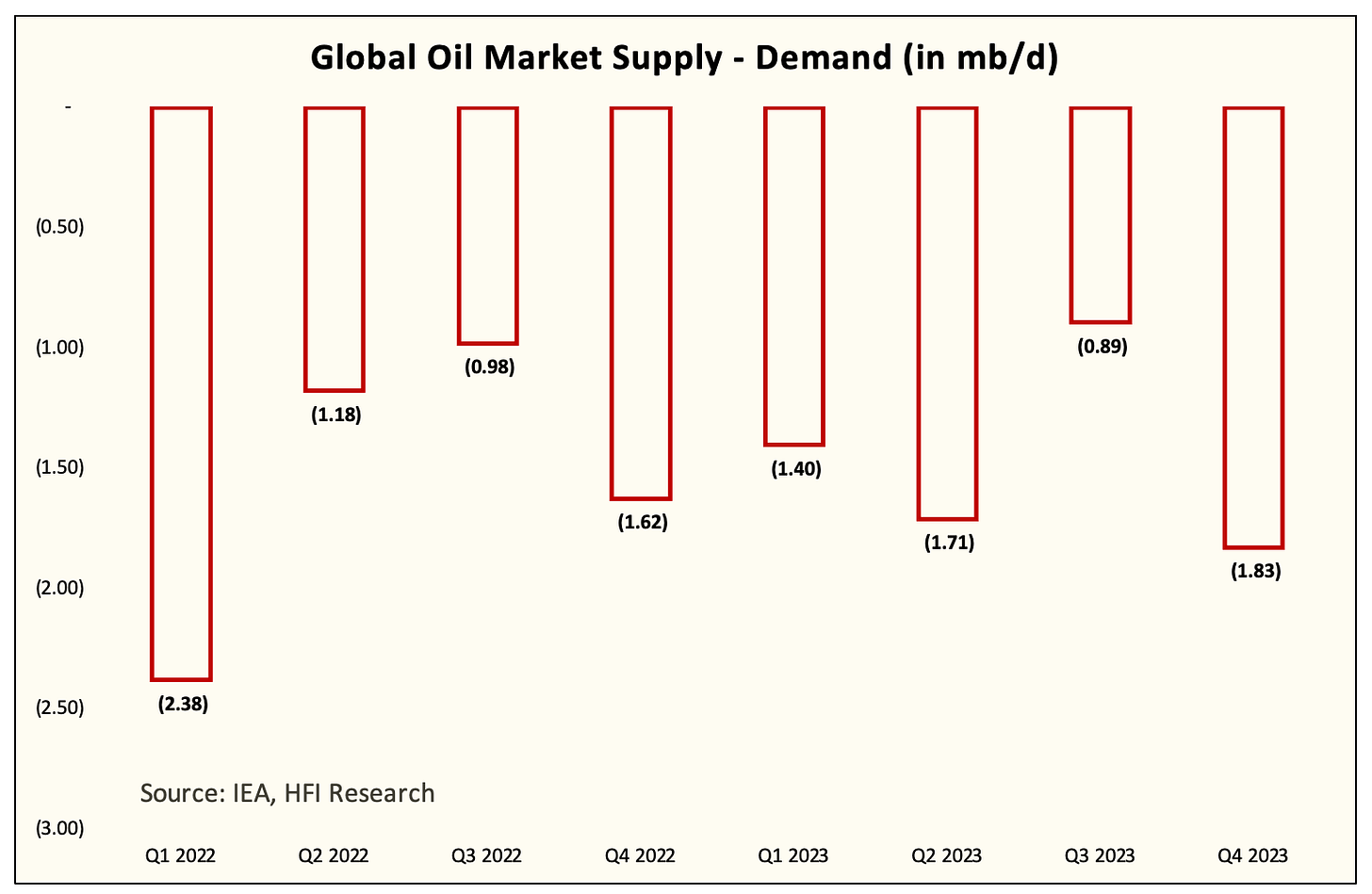

What does supply & demand look like even if demand disappoints to the downside?

Answer: We can withstand a recession half the size of the one we saw in 08/09. Anything greater than that will push the oil market into a surplus.

What do the fundamentals of our energy holdings look like in the event oil drops to $65 to $70?

Answer: All of the names we own will continue to generate a positive free cash flow yield. The average yield will drop to ~12%, but given many of the names are either debt free or getting close to it, there's no balance sheet concern similar to that of 2020.

In the event that oil demand surprises to the downside, will OPEC+ reduce supplies?

Answer: Yes, but if that's the case, the market will view it as a sign of weakness that global demand is really falling, which would still pressure prices. While on a fundamental basis, an OPEC+ cut is supportive, it won't be helpful to perception.

The 3 questions result in the same conclusion: fundamentally, the companies we own and the oil market we are currently in will be fine.

But when it comes to portfolio management, what you perceive fundamentals to have really no relevance. Portfolio management, at the end of the day, is how you perceive yourself both emotionally and psychologically.