Greetings from Tokyo! I apologize for the timing of some of these updates as the time of this writing is already the end of day in New York, but I wanted to collect my thoughts better and deliver you a summary of everything I'm seeing (including the EIA oil storage report).

Concerns...

But before I begin, I want to point out some glaring issues I see in the oil market today.

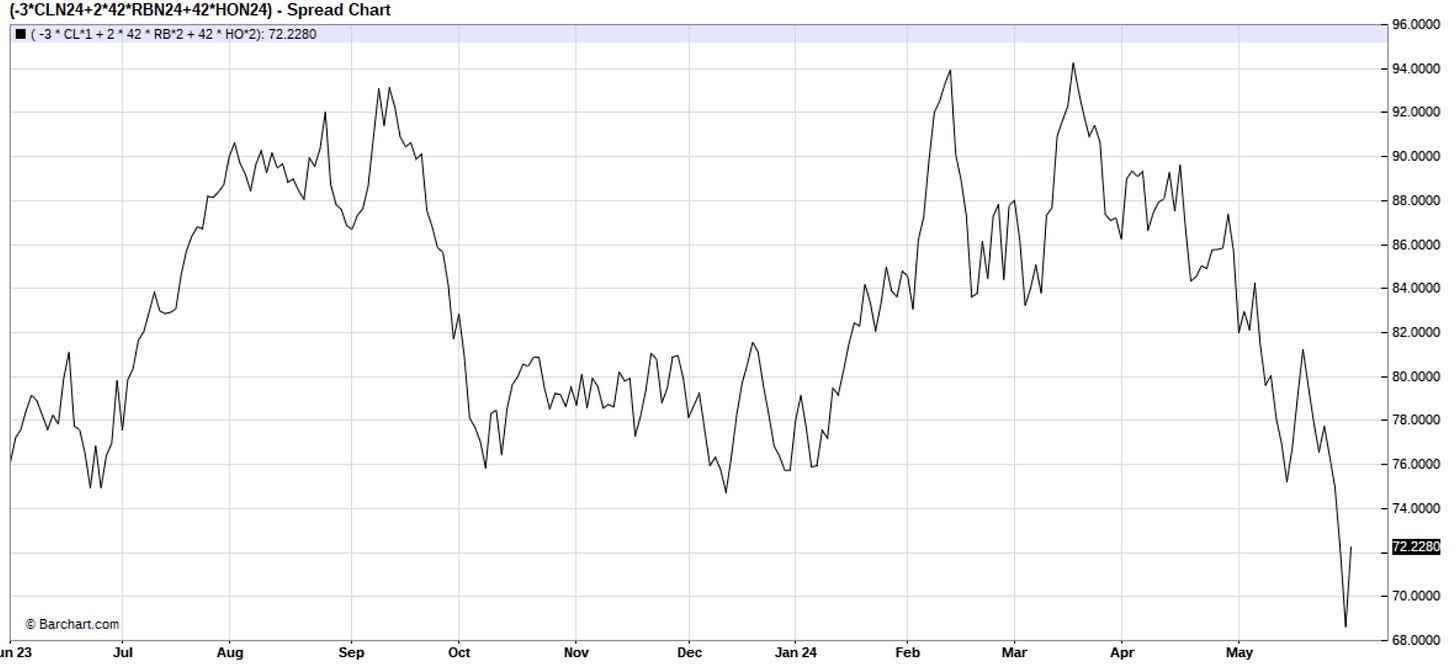

One of our key leading indicators this year (for where oil prices are going) is to watch global refining margins. In this case, the vanilla 3-2-1 crack has dropped materially into the end of May as refinery throughput surprises to the upside.

Color me surprised as well, but not only did EIA surprise to the upside this week (crude draw of 4.2 million bbls versus our expectation of a build), but US refinery throughput surpassed ~17 million b/d for the first time since COVID.

Looking at US refinery utilization, we are at a 5-year high for this time of the year. The higher-than-expected utilization comes after the dismal underperformance in US refinery throughput in Q1 2024 (due to colder-than-normal weather). We think much of the compensation from that had to do with the prolonged maintenance we saw in Q1.

As a result, part of the underperformance in refining margins has to do with the stellar outperformance we are seeing from refineries. This, however, doesn't change the fact that product storage saw a material build this week with other oil contributing to the total build of 13.2 million bbls.

We think this build is an anomaly and with what we are seeing for US crude storage going forward, oil inventories should draw, which should provide a nice tailwind for oil prices.

Next week's estimate

US crude storage outlook