Please read, "(WCTW) It's Time To Get Extremely Bullish Natural Gas (Long-Term)."

We are bullish on natural gas in the long term. The central driver of our bull thesis is that natural gas power burn demand (in the US) will not decline in the coming 5-years. The AI revolution is real and datacenter buildout will require an immense amount of electricity demand. While no one is certain of just how much demand will be required, our base case assumption is for no demand decrease from now to 2029.

In addition, structural demand increases from the LNG buildout and Mexico gas exports will result in a large mismatch in domestic supply & demand. Due to insufficient natural gas working storage buildout over the last decade, volatility in the US will create chaotic price swings if there are any prolonged deficits (think winter heating demand, freeze-offs, and lag in production increase).

As a result, readers contemplating a bullish position in natural gas need to think very carefully about what and how to profit from the potential price jump. In this article, we will go over 10 large-cap natural gas E&Ps, and what names are the most favorable.

It's also important to note that just because we are bullish on natural gas does not imply that we underwrite our investment thesis using our price projections. We need to account for the fact that there's the possibility of being very wrong, and we want a name that has 1) high quality, 2) torqued upside, and 3) a good management team.

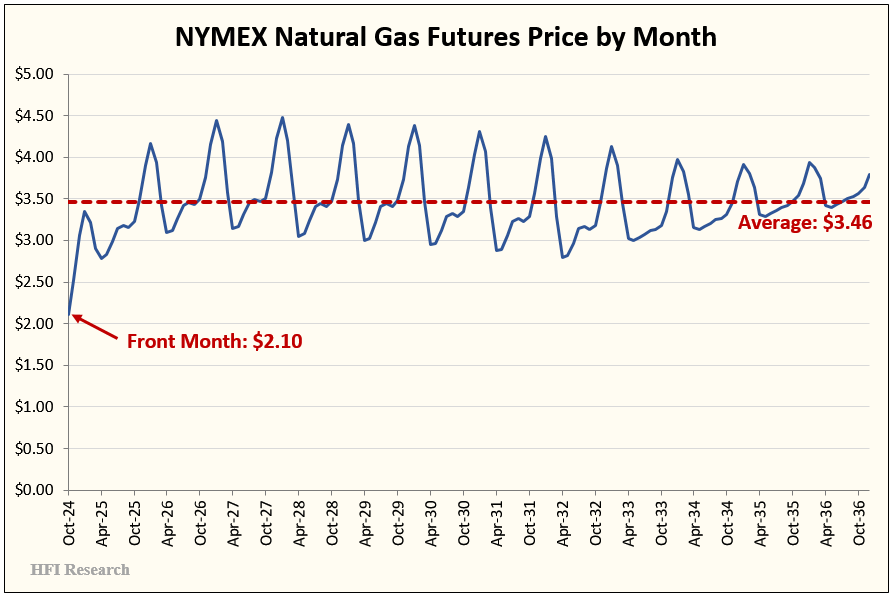

To arrive at conservative valuations vis-à-vis our bullish thesis, we assumed prices would follow the course of the current futures curve, pictured below.

The curve’s fluctuations around a $3.46 average provide a good barometer for which investments are overvalued or undervalued. In the event that our thesis doesn’t pan out, investors can rest assured that our analyses remain valid even at lower natural gas prices. And if our thesis does work out, then the upside will be reassessed when the time comes.

Executive Summary

Timing

The natural gas market will not show any meaningful price appreciation in the near term. As a result, you do not need to rush to buy any of the energy names you read below. It's also important to note that many of the names trade close to the futures curve implied valuation. Names that are large, offer quality, and torqued upside are by and large not without their issues. Names that are of very high quality (Tourmaline) often trade at a premium valuation.

From a timing perspective, the LNG ramp-up won't happen until H2 2025, which means the structural demand increases we mentioned in the WCTW won't impact the physical gas market. In the meantime, the natural gas market has near-term issues to contend with such as 1) bloated inventory, 2) uncertainty over heating demand this winter, and 3) associated gas production increasing into year-end.

We would not be buyers of natural gas futures today as the steep contango we see in the market imply too much upside given the backdrop we just mentioned. As a result, you will receive real-time guidance from us as to when to contemplate long positions in natural gas.

The below gives you a rough guide as to what names you want to own.