I Will Attempt To Decipher This Oil Market But It's Like Pulling Your Hair Out

As the title of this article may suggest, pulling your hair out might be easier than deciphering this oil market. Quite frankly, depending on which camp you are in (bear vs bull), you can look at this market and say, "This is as easy as it gets," or look at it puzzled and confused.

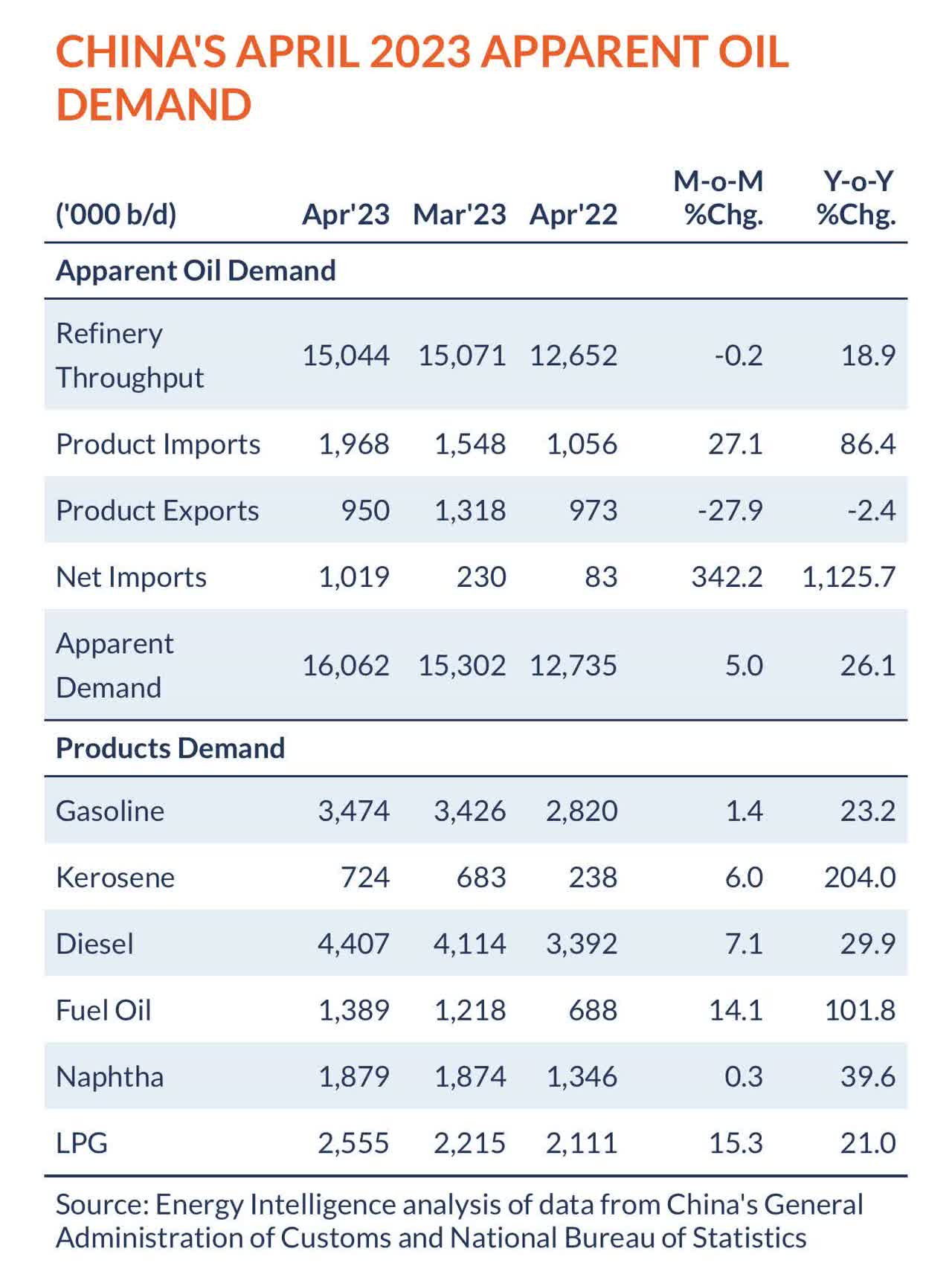

I will illustrate the first and most obvious example: China's oil demand.

Over the weekend, I retweeted Energy Intel's report on China's apparent oil demand for April, and it gained a lot of traction.

Source: Energy Intel

The gist of it is that China's "apparent" oil demand is at an all-time high of ~16 million b/d. The IEA had pegged China's oil demand at ~16 million b/d for March, and OPEC's oil market report pegged it somewhere around there as well.

Fast forwarding to today, Energy Aspects pegged China's apparent oil demand at ~16.6 million b/d.

But the more the demand surprises to the upside, the more confused I get. Why? Well, for starters, why are China's onshore crude inventories surging?