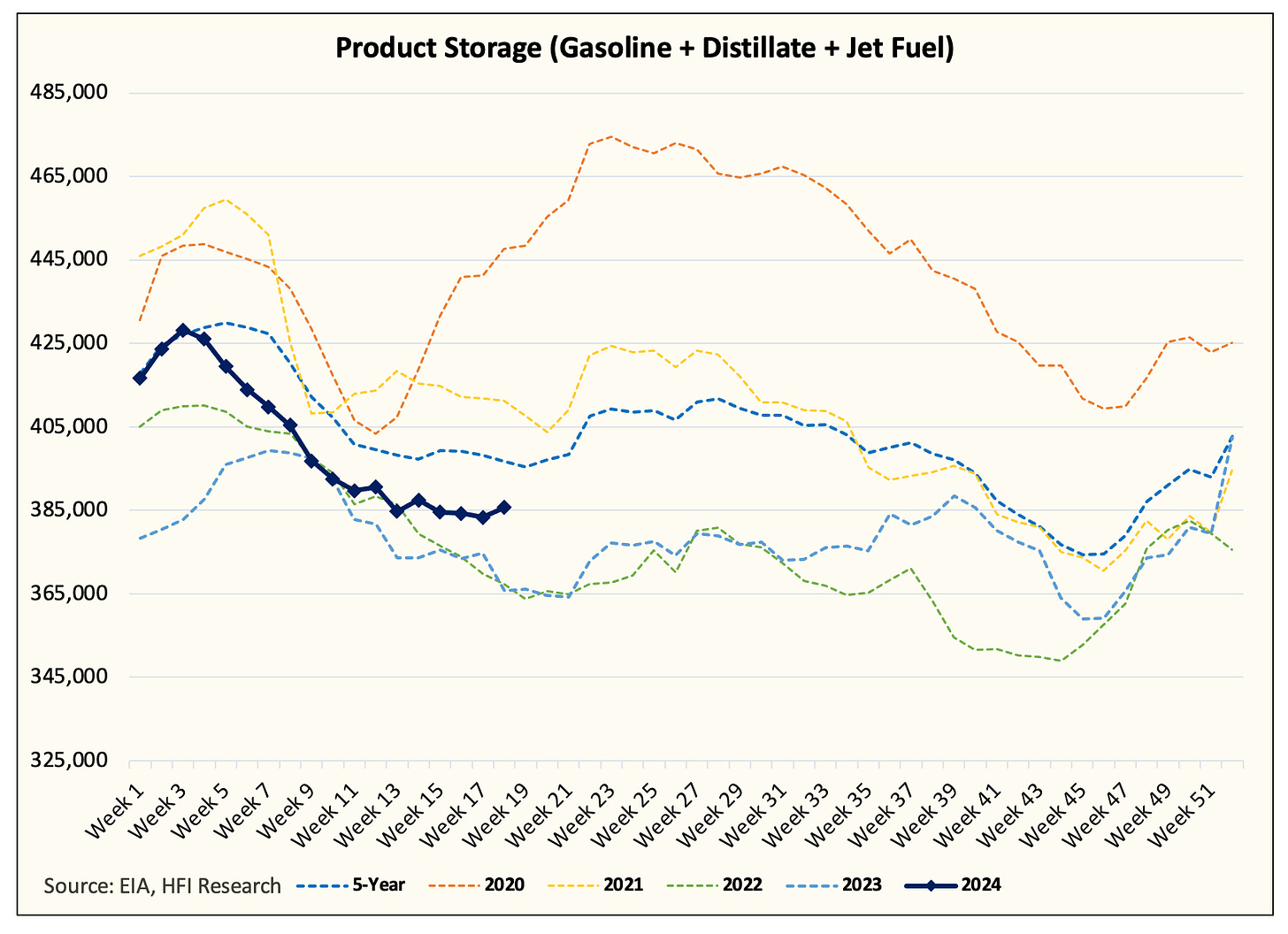

On the surface, EIA reported a constructive oil storage report today. The crude draw of 1.4 million bbls was slightly below our estimate of -1.8 million bbls. And while total liquids including SPR saw a draw of 1.2 million bbls, product storage was noticeably bearish.

As you can see from the chart above, the big 3 (gasoline, distillate, and jet fuel) are trending in the opposite direction of where 2022 and 2023 are headed.

The disparity between where product storage is relative to the previous years has been thoroughly discussed, but here's a reminder again as to why we are seeing storage levels higher.

Again, it's important to point out here that the weekly implied demand figures are by no means the solution to gauging overall demand (EIA weekly figures tend to understate real demand), but the general trend is concerning. And when you couple that with falling refining margins, I get worried.

I wish I had better news...