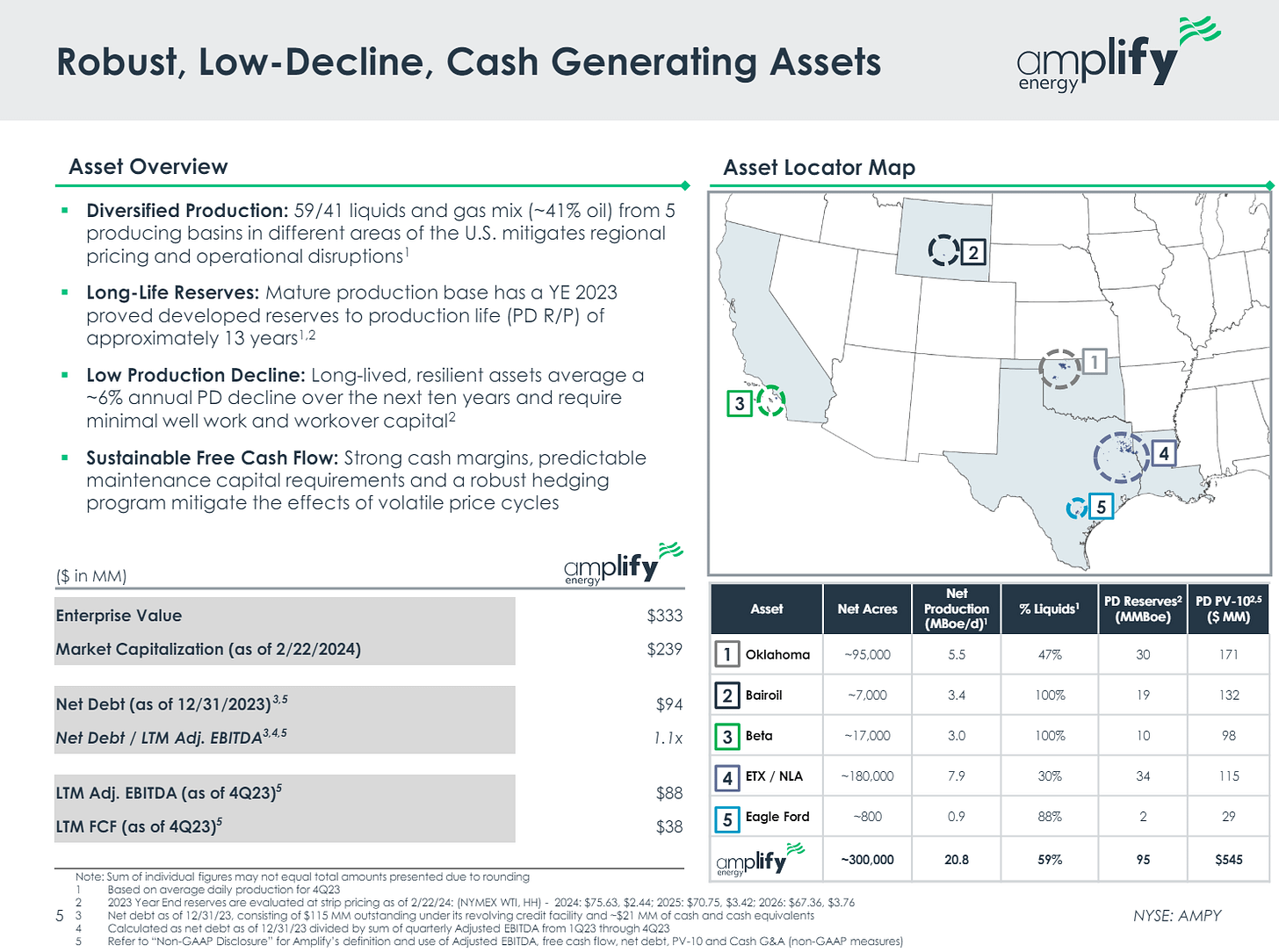

Amplify Energy (AMPY) is a U.S. E&P with an enterprise value of $370 million. It produces approximately 20,800 boe/d of oil and natural gas, 59% of which is liquids.

AMPY has an interesting collection of assets for a domestic E&P. All its production outside of California entails hydraulic fracturing. However, its wells exhibit low decline rates, averaging 6% annually.

Source: Amplify Energy Q4 2024 Earnings Conference Call Presentation, March 7, 2024.

The downside of the company’s low decline rate is that the enhanced recovery techniques required to bring it about—which include injecting water and carbon dioxide into wells—entail high operating costs.

Consider that AMPY’s $19.00 per barrel operating expense towers above that of Diamondback Energy (FANG) and Permian Resources (PR), two frackers that boast operating expenses in the mid-$5 per barrel range.

AMPY’s Dispersed Operating Footprint

A rundown of AMPY’s geographical areas of operation is important to understand its operations.

The company’s Oklahoma acreage spans 95,000 acres and represents approximately 30% of its proved reserves and 27% of production, or 5,500 boe/d.

Its Wyoming acreage, located around the town of Baroil, represents 24% of its proved reserves and 16% of its production, or 3,400 boe/d. AMPY is in the process of marketing its Wyoming acreage for sale. Management intends to use the sale proceeds to pay down debt and accelerate the timetable for returning capital to shareholders.

The company’s East Texas/North Louisiana acreage represents 30% of proved reserves and 38% of production, or 8,000 boe/d, while its Eagle Ford acreage represents 3% of proved reserves and 4% of production, or 900 boe/d.

AMPY’s Beta field represents 13% of its reserves. The field is located in federal waters 11 miles from the coast of Long Beach, California. The company’s Beta field production is currently approximately 3,000 boe/d. AMPY has a 100% working interest in the field and owns a 75.2% average net revenue interest in three blocks. It also owns and operates the infrastructure associated with its Beta production. In 2024, it is investing to expand its Beta production.

The Beta field was the site of an oil leak that has been an albatross for the company since the leak was discovered in early October 2021. The leak occurred when maritime vessels owned by the Mediterranean Shipping Company (MSC) and COSCO dragged their anchors over the pipeline that carries AMPY’s Beta crude and caused a 13-inch rupture.

AMPY shut-in the production associated with the pipeline and deployed 1,800 personnel to fix the pipeline. The situation was stabilized by mid-October. AMPY sued MSC and COSCO for damages associated with the leak.

On December 15, 2021, a federal grand jury returned a criminal indictment against AMYP’s Beta subsidiary in connection with the oil leak. The company reached court-approved agreements to resolve all criminal matters. It pled guilty to one misdemeanor count and paid a fine of $7.1 million to be paid in installments over three years. Despite the settlement, class action lawsuits were still pending against AMPY. The company ended up settling them for $50 million, which was funded by its insurance policies. The settlement with the class action plaintiffs was approved on April 24, 2023.

Overall, AMPY expects to spend a total of $190 to $210 million on fines, penalties, and remediation associated with the leak. In March 2023, it settled its MSC and COSCO lawsuits for a combined sum of $96.5 million, of which AMPY ultimately received $85 million. AMPY’s insurance policies covered another $50 million of costs.

In 2023, AMPY brought its Beta production back above the levels before the leak.

Outside of exploration and production activities, AMPY founded Magnify Energy Services in 2023 to provide services to its operated wells in Oklahoma and Texas. Management expects Magnify to reduce costs relative to alternative oilfield service providers and give AMPY greater control over its production activities.

Capex Aimed at Boosting Production

Management plans to allocate $55 million of capex to the company’s properties in the following manner in 2024.

Source: AMPY 2023 10-K.

Guidance calls for 74% of capex to go toward boosting production in the Beta field.

The company has seen a steady uptick in its oil cut over the past few quarters, which has been positive in light of low prevailing natural gas prices.

Beta production is 100% liquids, so any production increases will increase the percentage of higher-value oil in AMPY’s production mix.

Aside from the Beta pipeline leak, AMPY has been cash flow positive over the past few years and has managed to pay down a large portion of its long-term debt. However, its results have been held back by hedges the company has put in place to ensure that it can service its large debt load.

Free cash flow based on AMPY’s netback is shown in the table below.

In 2022, when the company realized $91.34 per barrel on its crude production and $6.43 per mcf on natural gas, hedges struck at lower levels held down free cash flow by more than $80 million. This sum amounts to multiple years of free cash flow at $80 per barrel WTI and $2.50 per mcf natural gas.

Hedges will remain a headwind at current oil prices. The chart below is sourced from AMPY’s fourth-quarter earnings conference call. It shows AMPY’s oil production is approximately 76% hedged in the mid-$70s per barrel range, and, more favorably, its natural gas production is 69% hedged in the mid-$3.00 per mcf range.

Source: Amplify Energy Q4 2024 Earnings Conference Call Presentation, March 7, 2024.

Fortunately for shareholders, management is committed to reducing debt. Paying down debt will eliminate the need for significant hedges, allowing shareholders to participate in the upside of higher oil prices.

In 2023, the company made good progress on the debt paydown front by reducing its net debt balance by half. By year-end, long-term debt was comprised of $115 million drawn on its revolving credit facility. The credit facility features a steep interest rate of more than 9%, so paying it down will deliver a boost to cash flow.

Moreover, AMPY’s Wyoming acreage could fetch more than $150 million in a sale. Management intends to allocate the proceeds to debt reduction. This amount would be more than enough to eliminate the remaining balance on its revolving credit facility by year-end.

Once debt is paid down and debt service obligations fall, hedges won’t be necessary. By 2026, hedges will have rolled off and AMPY’s free cash flow should be off to the races if oil prices cooperate.