"There are no bad assets... just bad prices." - GMO

New Stratus Energy, which I am reluctant to keep writing about, continues to offer us meaningful news that forces us to have to explain.

In our last update on March 12, titled, "Drama In Ecuador - Our Last Update On New Stratus Energy," I wrote that the Sacha deal remains on the table despite President Noboa's "fake" deadline on March 11 at 9 PM.

But markets hate uncertainty and the fake deadline imposed caused shares to crater down to C$0.34. At the time, I wrote:

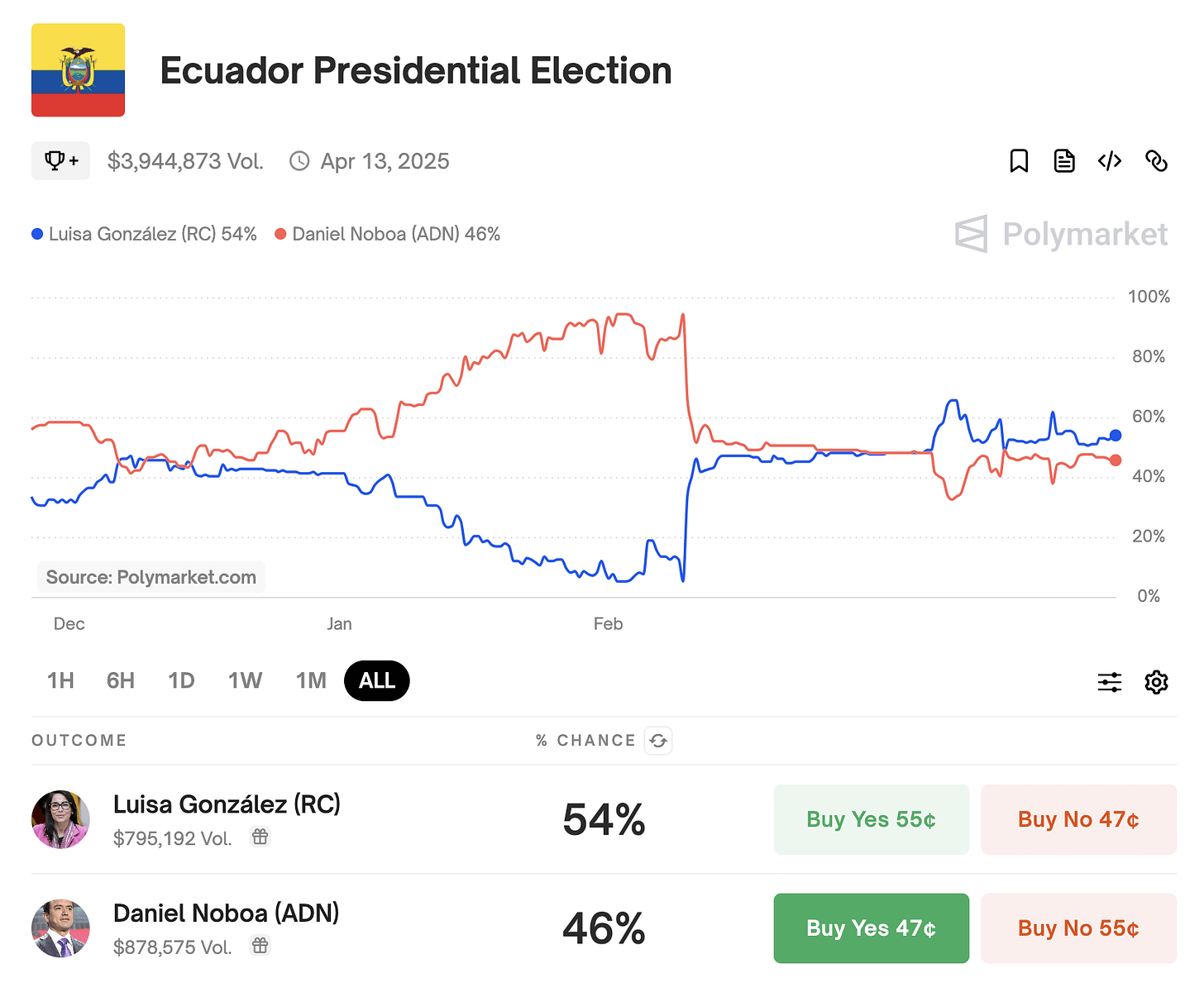

The end result is that New Stratus and Sinopec are in limbo until the April 13th Ecuador Presidential Election.

What do I mean by that?

The government will continue to state that they will not "sign" the deal and look for alternatives, all the while, the deal remains on the table because the official closing date is April 16th.

The opposition will push the Noboa administration hard on the fact that the deal is not "canceled", but there will be ways to maneuver around this by saying things like, "They are looking for other options."

The bad news is that because of this increased uncertainty in the market, NSE will have an extremely difficult time in raising the financing of $120 million. We know that following the deal announcement, NSE had lined up ~$70 million in equity financing at C$0.50, but with this uncertainty, that base deal is in question.

With today's press release, we know that NSE had to reprice the base deal and increase the share amount to raise the full $120 million.

It also issued 33.3854 million shares at C$0.30 for a total of C$10 million.

It's important to note that the $120 million or 572 million shares expected to be issued to close the Sacha deal will only occur if President Noboa wins. If Noboa doesn't win, the 572 million share issuance will not take place.

The 33.3854 million shares issued are regardless of the outcome of the election.

Assuming that Noboa does win and the deal is closed, this is the capital structure of NSE.

Asymmetry

This is where the quote from GMO comes in handy. The situation at NSE is so unique that it is truly a special situation.

Not only does the market still believe that there's no Sacha deal in place (the government officially denying any involvement with Sacha), but the company just press-released that it raised the financing to close the deal.

But since the market hates uncertainty and no one knows right now who will win the election, the stock is pricing in no upside.

Unlike normal market conditions where market participants get to at least price in some probability of an outcome, at C$0.26, there's no upside priced in, which is what makes this situation particularly interesting.

For market participants, the uncertainty of what happens if Noboa doesn't win is what's keeping market participants from engaging with NSE, but the reality on the grounds offer a much simpler view.

Petroecuador, the government-owned oil company, has a history of operational deficiencies. Sacha oilfield, the once crown jewel of Ecuador, will need 3rd party investment and operations if it is to reverse the decline in production trend. Ecuador is also heavily dependent on China for financing, so bilateral relationships are important to maintain regardless which candidates win.

Even in the scenario that Gonzalez wins, the Sacha deal will be alive in some form or another. Whether it's through a service contract or the current production sharing agreement (PSA), the government will need to delegate the oilfield to Sinopec/NSE.

This is why I think this situation is asymmetric.

At C$0.50, you can argue that the market was pricing in higher odds of Noboa winning and the deal closing, but at C$0.26, I don't think anything is priced in, especially given the context we laid out before about the potential payout in lawsuit + Mexico oil assets.

The other downside risk scenario to this is that there's the pending litigation between NSE and Ecuador on the previous blocks 16 & 67. NSE sued for $260 million, but it's doubtful that it will recover that amount. The estimated settlement (after the lawyer fee) is around $20 million (cost recovery).

If the Sacha deal falls through, the cost associated with this transaction is $10 million ($5 million after lawyer fees).

Net-net, lawsuit payout would be around $25 million or C$36 million.

Here's a summary table of the situation (updated to reflect the new shares outstanding and share price):

Net of lawsuit payout, NSE trades at 0.73x (updated).

It won't have the same torqued upside from having the Sacha deal, but the downside is also limited.