By: Jon Costello

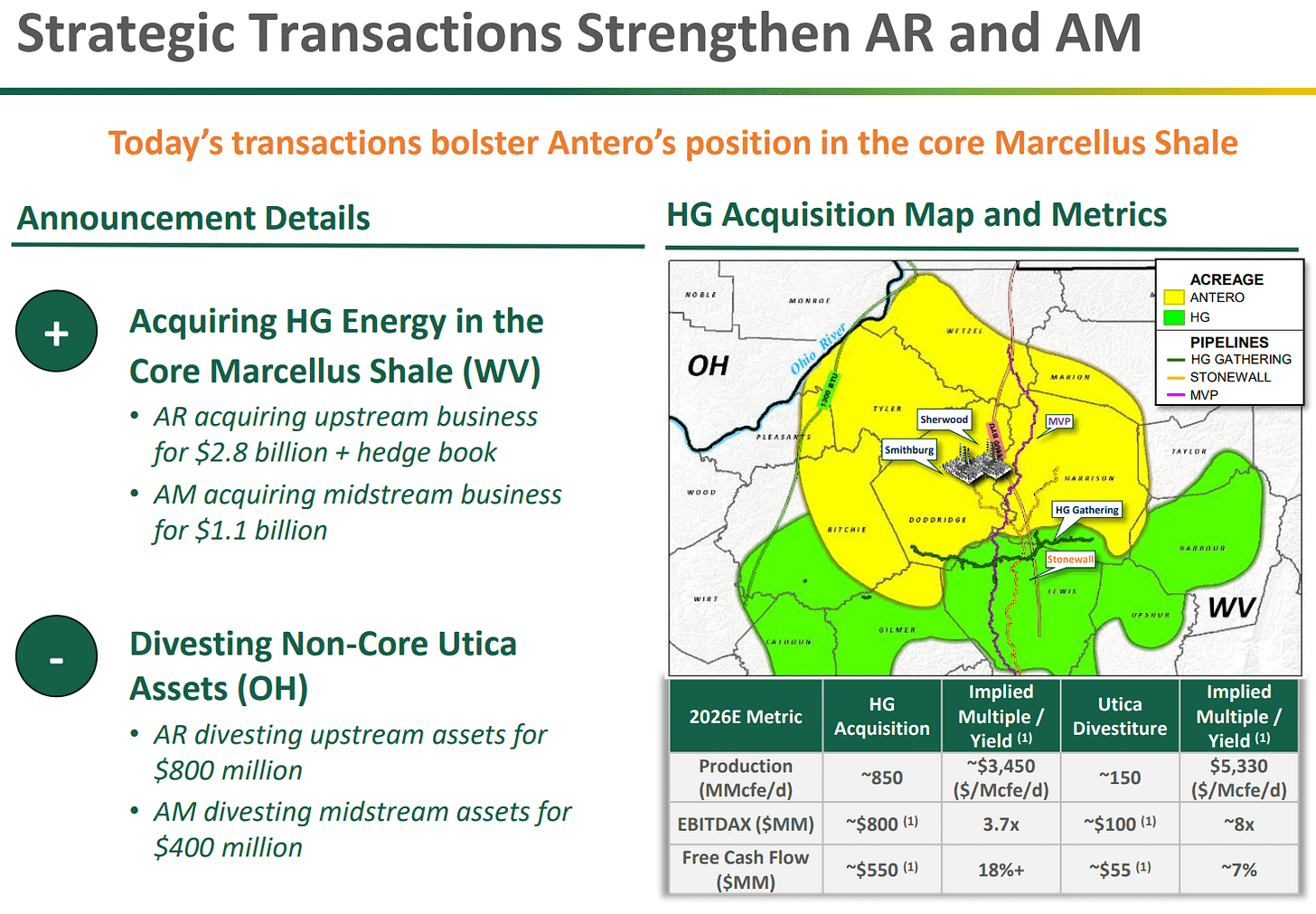

This morning, Antero Resources (AR) announced that it would acquire HG Energy, a privately held E&P with operations contiguous to AR’s core in West Virginia. AR is paying $2.8 billion for the assets, while divesting its non-core Ohio Utica assets for $800 million. In a related deal, AR’s midstream operator, Antero Midstream (AM), will simultaneously acquire HG’s midstream system for $1.1 billion and sell its Utica midstream footprint for $400 million.

The deal stands to increase AR’s production from 3.5 Bcfe/d to 4.2 Bcfe/d. The acquired assets are contiguous with legacy AR. After the Utica divestiture, the company will emerge with the entirety of its production located in the core of the Marcellus in West Virginia.

Source: Antero Resources, Strategic Transaction Slide Presentation, December 2025.

This deal essentially represents Antero selling a smaller, higher-multiple, non-core asset and reinvesting the capital into a larger, lower-multiple, core asset. In the process, it will keep its investment-grade balance sheet intact by financing the deal with a three-year term loan, free cash flow, and proceeds from the sale of the Utica asset.

AR will emerge from the deal with a materially greater liquids weighting. The acquired assets produce 75% liquids, so AR’s liquids weighting will increase from 38% before the deal to 46% after the deal. We’re bullish liquids over the long term, so we view this as a net positive, as it reduces risk to shareholders if the natural gas bull market underwhelms relative to today’s rosy expectations.

While leverage will tick higher, the deal is likely to be accretive on an NAV and operating cash flow basis at natural gas prices above $3.00. We remain constructive on natural gas prices over the coming years, so we like this deal. AR will emerge with lower cash costs and operations concentrated in the core of the Marcellus, one of the world’s lowest-cost natural gas basins.