Message from Wilson: CLMT is Jon's highest conviction idea, and I can see why. I encourage readers to read through Jon's previous write-ups on CLMT.

As Jon clearly explains in this article, the rationale behind the long thesis in CLMT makes a lot of sense. The political narrative and the backdrop make this a special situation idea. The key is first to understand the situation, then the hard part is to figure out the timing.

I will take care of the timing part, so I will let the deep dive segment to Jon. And for your part, you just have to read and get familiar with the idea.

By: Jon Costello

The outcome for Calumet (CLMT) investors will depend to a great extent on politics. The political angle is the following.

Trump’s tariffs are hurting the domestic agriculture industry. I have spoken with some of the top agriculture executives in the country and can confirm that their industry is concerned.

The tariffs will impact some crops more than others, with soybeans arguably being hit the hardest. After the U.S. imposed sanctions on China on April 2, China increased its import tariff on U.S. soybeans to 44%. China is the largest export market for U.S. soybeans, importing an estimated 105 million tons in 2024. Following the tariffs on U.S. soybeans, China has turned to Brazil to fulfill its soybean needs.

Trump’s approach to trade is hurting U.S. agriculture. His administration is therefore more likely to promote policies that support domestic consumption.

The fastest and simplest way for the administration to support domestic agriculture is to mandate that refiners blend the various oils produced by these crops into the petroleum fuel supply. Leaving aside the question of how sensible or practical such a policy may be, such blending has been the law of the land since the Renewable Fuel Standards were signed into law in 2005, and it is the route most likely to be taken by the administration to support domestic agriculture interests.

Biofuels are clearly part of the renewables “in group” favored by the administration, which can be distinguished from the “out group” consisting of wind and solar. The administration’s policies have consistently favored the former while diminishing the prospects of the latter.

Trump has consistently reiterated his support for farmers. Reports like the following from Reuters in March have been common during the first months of Trump’s presidency.

Source: Reuters, “US farmers face higher costs, fewer markets from tariffs, farm groups warn,” March 4, 2025.

Besides the adverse impact of trade policy, I have not seen a measure proposed or enacted by the administration that wasn’t supportive of U.S. farming interests. I expect the support to continue.

Providing Direct Support for Farmers

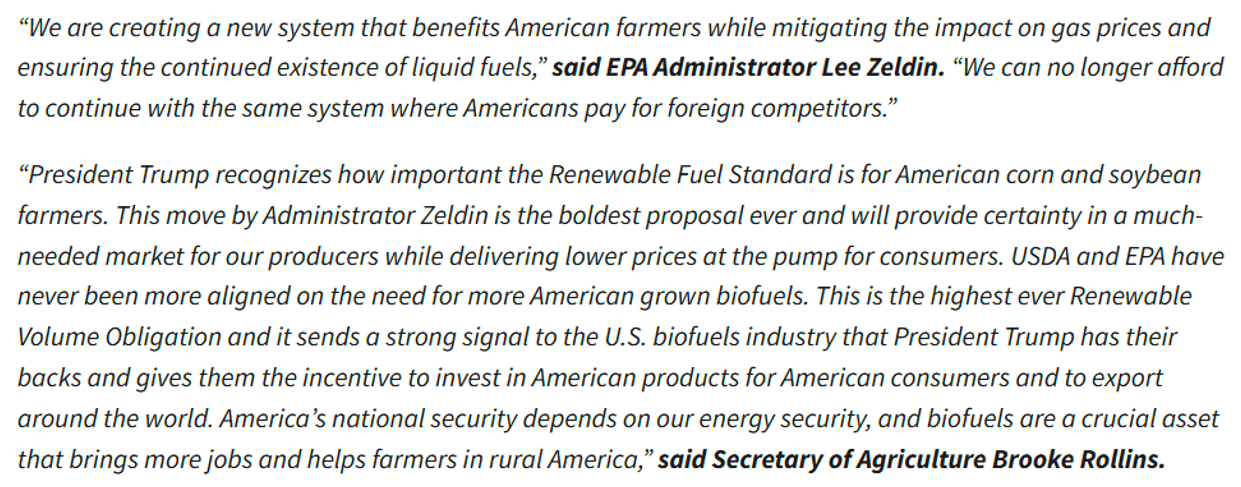

The Trump administration’s support for biofuels is reflected in the Renewable Volume Obligation (RVO) set by its EPA. The RVO determines the amount of biofuels that must be blended into the U.S. petroleum fuel supply.

The administration and its Republican allies in the House and Senate have strongly endorsed a substantial RVO to promote domestic agriculture. Earlier this year, 28 members of the House of Representatives and 16 Senators, led by Charles Grassley and Amy Klobuchar, expressed their support for a high Renewable Volume Obligation.

On June 13, the administration released its proposal for renewable fuel standards for 2026 and 2027. The proposal sets a biomass-based diesel RVO for 2026 at 5.6 billion gallons.

In the EPA’s press release accompanying the RVO proposal, EPA Administrator Lee Zeldin and Secretary of Agriculture Brooke Rollins were quoted as saying the following. Notice their explicit support for agriculture.

Source: “EPA Proposes New Renewable Fuel Standards to Strengthen U.S. Energy Security, Support Rural America, and Expand Production of Domestic Fuels,” June 13, 2025.

The 5.6-billion-gallon RVO aligns with consensus estimates of total U.S. renewable diesel production capacity. As a result, it will help restore normal margins for biomass-based diesel producers, which include biodiesel producers and renewable diesel companies such as CLMT. Historically, the typical margin for renewable diesel producers has been around $2.00 per gallon.

Upon receiving the EPA proposal on June 13, politicians commended the agency for rules that “would strengthen American energy security and support American farmers.”

Why A High RVO Matters to Agriculture

To understand how biofuel policy affects domestic agriculture interests, consider the soybean market.

According to the USDA, the U.S. is on track to produce approximately 4.5 billion bushels of soybeans this year. Approximately 2.4 billion of these bushels, representing 53% of the annual crop, are crushed to produce 3.7 billion gallons of soybean oil. Approximately 1.7 billion gallons of soybean oil will be consumed as biomass-based diesel feedstock. Biomass-based diesel includes biodiesel, renewable diesel, and sustainable aviation fuel (SAF).

On a volumetric basis, the administration’s biofuel policies influence nearly one quarter of U.S. soybean demand.

Or consider the issue from an acreage perspective. Of the 315 million acres of U.S. crop land estimated by the USDA in 2024, farmers planted 86 million acres of soybeans. Soybeans made up 27% of the crop planting area in the U.S. Biomass-based diesel policies directly affect about 6.5% of all U.S. farmland, or more than 20 million acres.

The administration can exert significant influence over this market with the stroke of a pen.

Consider further that soybeans are only one of many agricultural products used as feedstock for biomass-based diesel. In 2024, soybeans represented 35% of biomass-based diesel feedstock.

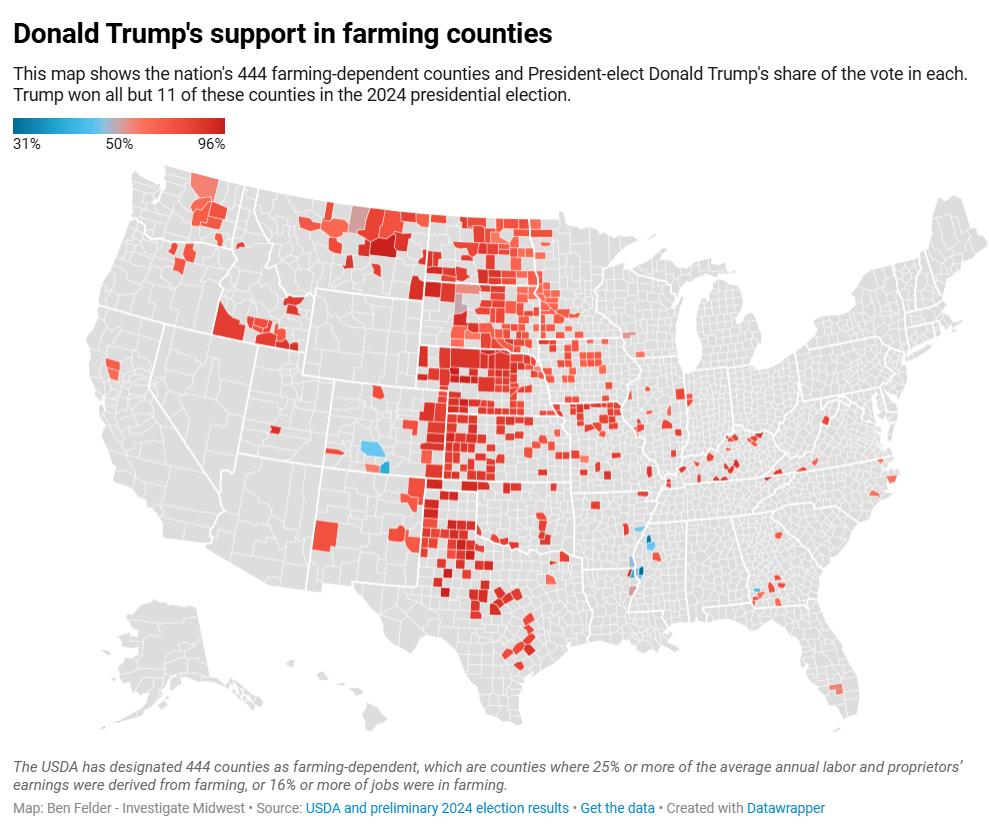

The administration is heavily incentivized to support the agriculture community due to its staunch support of Trump. The map below illustrates the extent to which farming communities voted for Trump in the 2024 presidential election.

Source: Investigate Midwest, “Trump support grew in America’s top farming countries despite first-term trade war,” Nov. 14, 2024.

Given the economic impact of supportive policies on a loyal segment of Trump’s voter base, it’s a no-brainer for his administration to support farmers.

Low Biofuel Margins Have Hurt CLMT

For the past eighteen months, biomass-based diesel producers like CLMT have suffered from historically low biofuel margins. The low margin environment that started in early 2024 has led to a dramatic reduction in biomass-based diesel production.

Some factors lowering margins are undeniable; others are less clear. One of the most obvious is the increasing biomass-based diesel production capacity in recent years. Another is the extremely low RVO that the Biden administration set for the industry in 2023-2025. The Biden administration set its RVO at just over half of the domestic biomass-based diesel industry’s capacity. Finally, regulatory uncertainty has led obligated refiners to delay blending activities until they gain policy clarity.

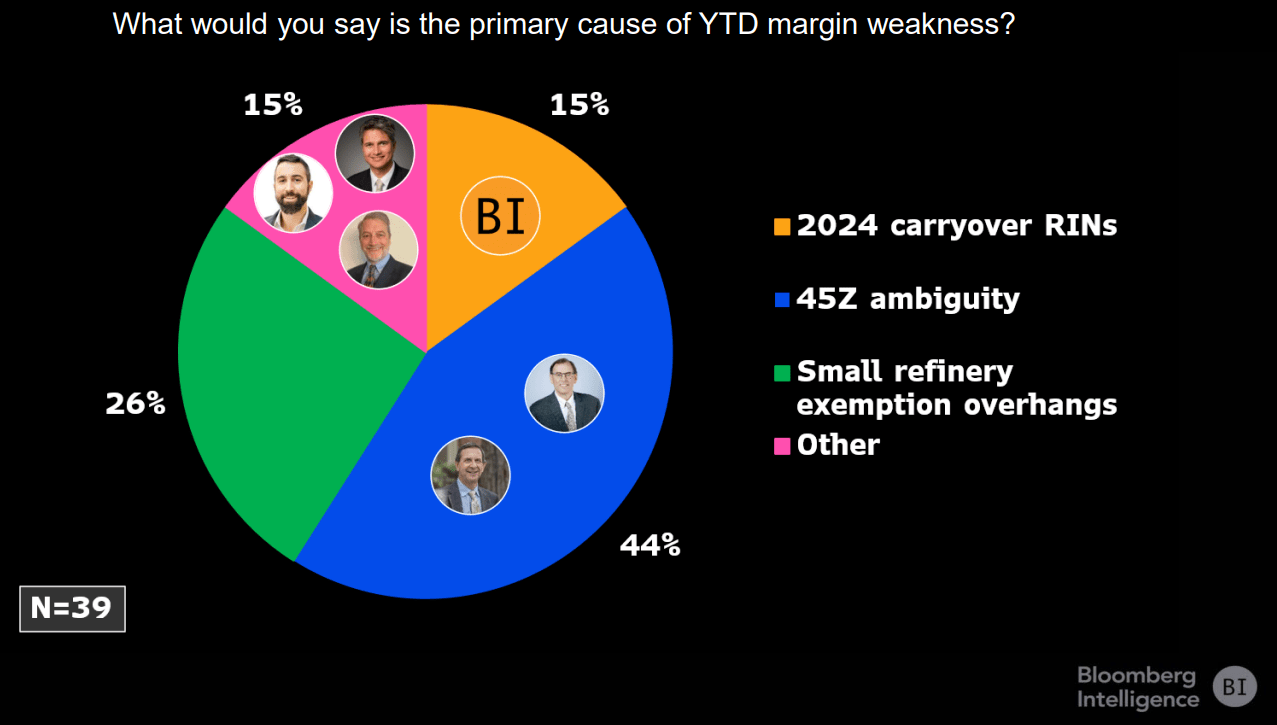

Other important factors have contributed to low margins that are subject to debate. Even biofuel experts remain conflicted, which underscores the complexity of this sector. A recent Bloomberg poll of leading biofuel experts and other respondents asked about their views on the cause of margin weakness. Results are shown below.

Source: Brett Gibbs, Bloomberg poll, “Biofuel Analysts Go on Record,” July 15, 2025.

Fortunately, all the factors highlighted in the poll will be resolved over the coming months. As they are, biofuel margins and CLMT’s prospects are likely to improve considerably.

The question currently hanging over the market is the extent to which they are resolved favorably.

2024 RIN Bank to be Less of an Issue

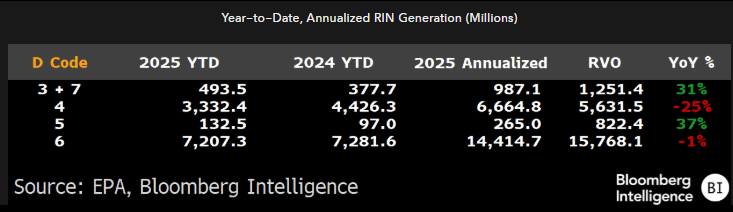

With regard to the “2024 carryover RINs” mentioned in the chart above, Bloomberg provides the following table displaying the most recently released EPA data on biofuel production. It shows that for the biomass-based diesel producers—collectively referred to as D4, the second line down on the table—recent blending volumes on an annual basis are tracking 25% below the current RVO on an annualized basis. This represents a massive amount of biomass-based diesel underproduction relative to the 2025 RVO.

Source: Brett Gibbs, Bloomberg, X, July 16, 2025.

Instead of blending biofuels into petroleum, obligated refiners can submit RINs to comply with their respective RVOs. These refiners can retain up to 20% of their RINs generated in one year to use for compliance in the next. The quantity of 2024 RINs that still exist due to excess 2024 RINs generated relative to the 2024 RVO is known as the RIN bank.

The large number of carried-over RINs was creating an overhang on 2025 biofuel margins. Obligated refiners had until June 30 to submit their carried-over 2024 RINs.

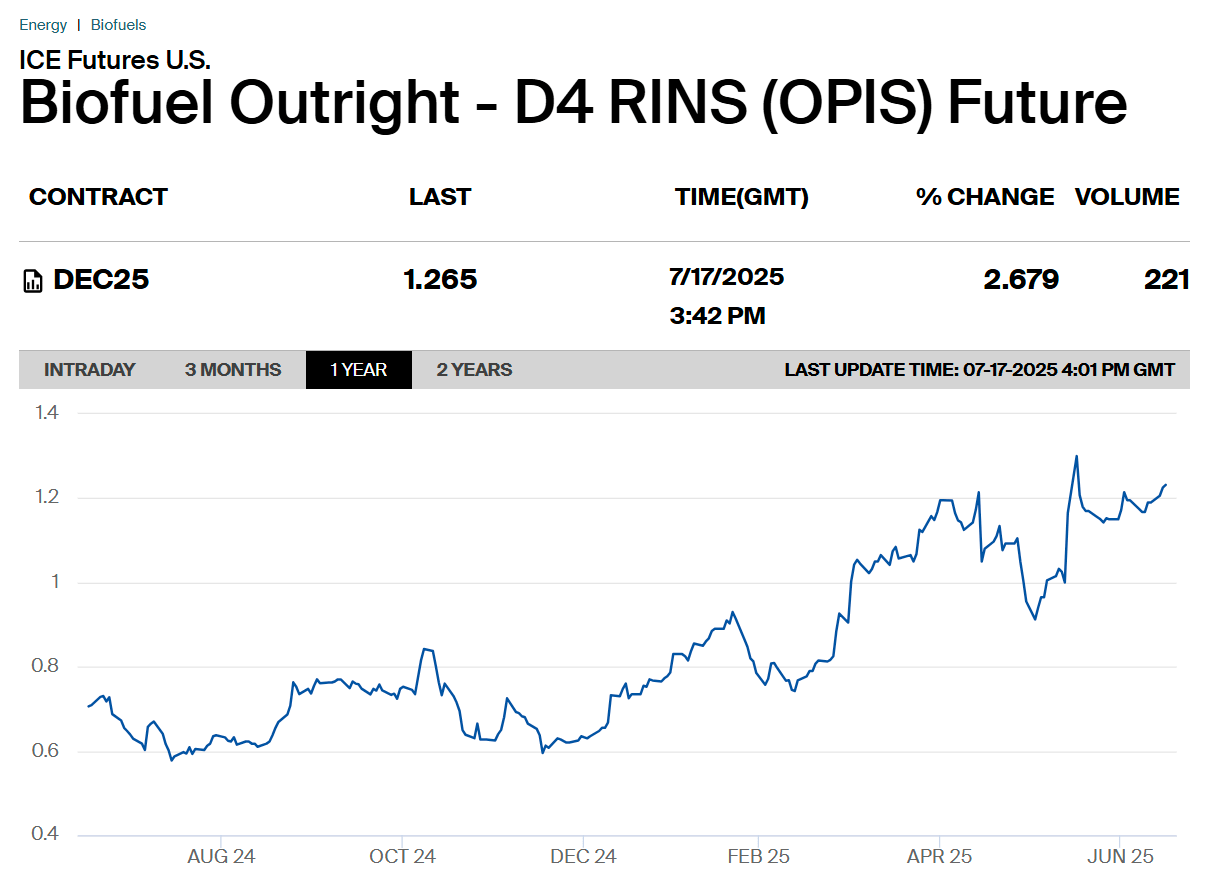

Fortunately, June 30 is behind us. Interestingly, RIN prices have trended higher since then, as shown by the red arrow below.

Source: Intercontinental Exchange, July 17, 2025. Red arrow added by author.

The 2024 D4 RIN bank is not likely to be a significant factor in depressing biofuel margins going forward.

The Pesky SRE Issue

Next up is the issue of “45Z ambiguity” as stated in the Bloomberg poll referenced above. The 45Z tax credit for biofuel producers was mostly addressed in the Big Beautiful Bill. The bill clarified the RIN equivalence values for various biofuel feedstocks, removed an indirect land-use charge that penalized higher carbon intensity feedstocks, and excluded imported feedstocks from qualifying for the 45Z credit.

As for “the small refinery exemptions” (SREs) in the Bloomberg poll, this is where politics enters the picture.

SREs are an important feature of the renewable fuel standards. If a refinery is small—with 75,000 barrels per day of throughput capacity or less—and compliance with the standards would create disproportionate economic hardship, the refinery could win an exemption from the RVO requirements. Refineries that qualify for SREs also tend to be independent, lacking a deep-pocketed parent.

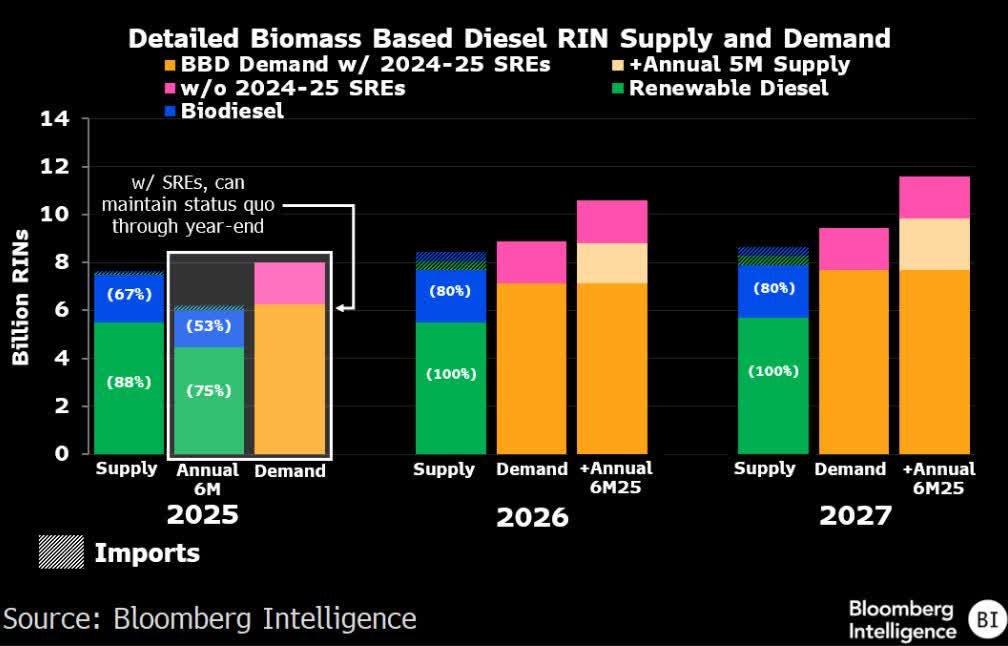

If the administration grants SREs on a scale reflected in the 2024-2025 SRE petitions, it would severely reduce the ultimate number of gallons required to be blended by refiners. Essentially, it would significantly reduce the effective RVO. The chart below illustrates the impact of SREs on the final annual demand figure for U.S. biomass-based diesel.

Source: Sabrina Gutierrez, Bloomberg, X, July 17, 2024.

Given the current RVO, a large SRE would risk reducing the obligation to levels below the total production capacity of U.S. biomass-based diesel producers.

The SRE issue represents a binary proposition: either the Trump administration implements a policy that hurts farmers, or it supports them. A favorable policy would be a welcome change for the agriculture community from the Biden administration, which hurt the farmers with its absurdly low 2023-2025 RVOs.

The prospects for CLMT shares therefore hinge on the extent to which SREs support 2026-2027 biofuel margins. I have a high conviction that the Trump administration will support the farmers.

The Trump administration’s EPA has already demonstrated its commitment to the agriculture sector through its recent RVO proposal. In order to follow through, the EPA will have to devise a creative way to prevent a large issuance of SREs from materially reducing the total number of biofuel gallons that have to be blended.

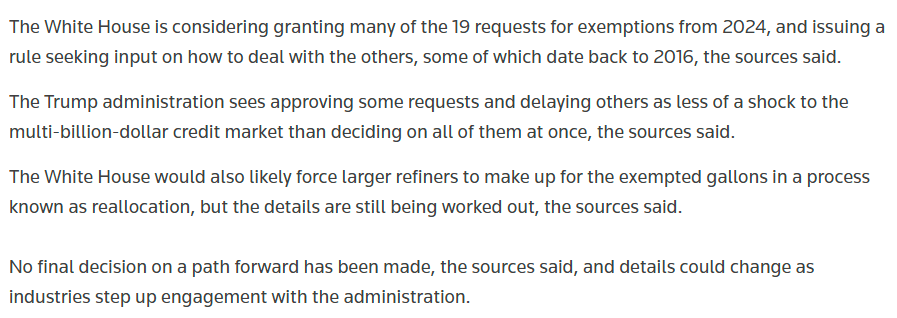

It’s beyond the scope of this article to consider means of achieving this. Suffice it to say that the EPA possesses various paths to achieve this objective. Reallocation of volumes associated with SREs to larger refineries is one such path, as discussed in a recent Reuters article.

Source: Reuters, “White House considers plan to clear record backlog of small refinery biofuel waivers,” May 30, 2025.

An investor's position on this issue depends more on their view of politics than on biofuel economics. I think the political fallout from not supporting the farmers would be too damaging to the administration for it to ignore the SREs in a way that favors the agriculture sector.

If SREs are resolved in a manner that supports the agriculture interests, biomass-based diesel margins are likely to surge in short order, as biofuel demand will suddenly increase as large-scale blending activity resumes.