So far, the E&Ps we’ve profiled to date for capital appreciation and income have been confined to oilsands operators. These include Cenovus Energy (Cenovus Energy Inc. (CVE) Stock Price Today, Quote & News), Suncor Energy (Suncor Energy Inc. (SU) Stock Price Today, Quote & News), MEG Energy (OTCPK:MEGEF), and Canadian Natural Resources (Canadian Natural Resources Limited (CNQ) Stock Price Today, Quote & News). We prefer oilsands operators over shale or conventional operators due to their low operating risks, leverage to higher oil prices, long reserve lives, and their stocks’ significant discounts to intrinsic value.

Cardinal Energy (OTCPK:CRLFF) (CJ.TO) is our first E&P recommendation outside the oil sands. Cardinal’s stock may be a desirable holding in its own right but also as a way to diversify an energy equity portfolio by operating model.

Cardinal produces primarily medium and light grades of crude oil from conventional reservoirs in Alberta and Saskatchewan, Canada. The company’s asset base is diversified by region with each region contributing to total production in a balanced manner, as shown in the graphic below.

Source: Cardinal Energy Website.

Cardinal aims to acquire mature, low-decline crude oil properties that generate significant free cash flow to fund growth and pay a dividend. Despite paying out most of its cash flow as a dividend, the company has an impressive track record of prudently growing production. Its liquids production by year is shown below.

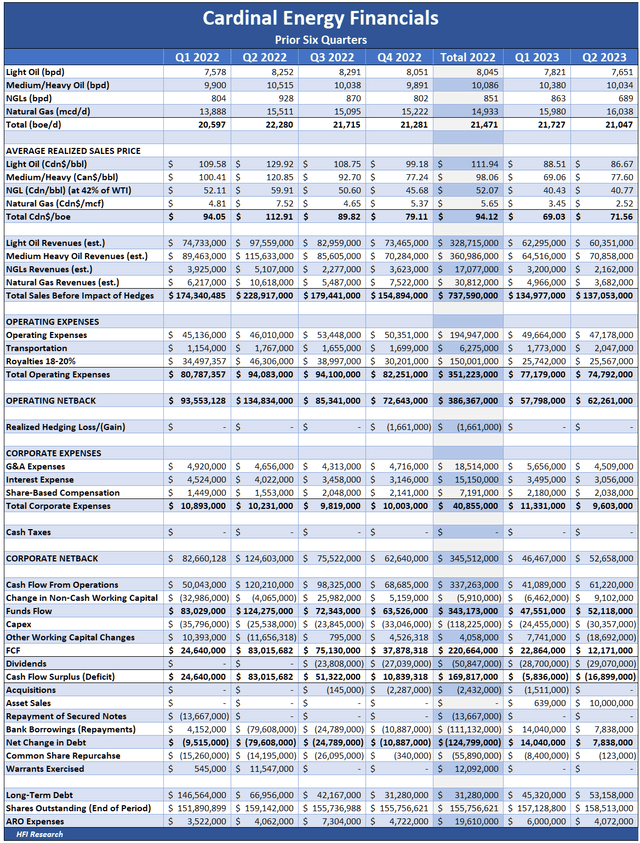

In the first half of 2023, wildfires reduced Cardinal's production by 700 boe/d. Production is currently running at approximately 22,000 barrels per day (bpd), roughly the production rate achieved in 2018. Production has been stable over recent quarters, as shown in the following chart.

Source: Cardinal Energy May 2023 Investor Presentation.

Management plans to sustain production of 22,000 boe/d in the second half of the year.

Due to Cardinal’s peer-leading 10% decline rate, its 88% liquids cut, and the lack of capex being allocated to significant production growth, its capex requirements are relatively light for a conventional oil producer. The following table details the $115 million of capex Cardinal plans to spend in 2023.

Source: Cardinal Energy May 2023 Investor Presentation.

At the rate of 21,750 bpd, the company has 11.0 years of reserves of oil and NGLs, with the latter accounting for only 3.7% of total liquids reserves. Cardinal’s reserve report estimates its net present value to be $18.54 per share, more than double the current stock price.

Management is actively engaged in replacing reserves through acquisitions and developing existing acreage. Since 2019, its net proved plus probable reserves have grown by 4.9%. Over that period, Cardinal spent $23.8 million acquiring new assets while also generating $21.4 million of proceeds from asset sales.

At the moment, the best example of Cardinal’s efforts to find and develop new reserves is its Clearwater position in northern Alberta. The Clearwater recently emerged as one of the hottest plays in Canada, and Cardinal has 12,000 acres in the play. It’s in the process of delineating the acreage. Highly economic production is likely to boost Cardinal’s production rate, cash flow, and stock price.

Cardinal’s Attractive Economics

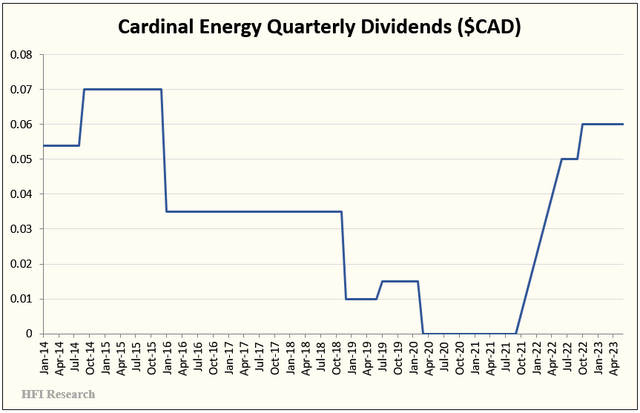

Since 2022, Cardinal has paid a $0.06 monthly dividend. The company has varied its dividend in response to changes in the oil price environment, as shown in its long-term dividend record.

Cardinal offers its shareholders production stability and low financial risk to equity. It also offers leverage to higher oil prices, as shown in the following table.

We estimate Cardinal’s dividend is covered by free cash flow down to US$68 per barrel WTI.

However, the company has the flexibility to sustain its dividend even if WTI falls below US$68 per barrel. Out of the $115 million of capex it budgeted for 2023, only $64 million is dedicated to drilling, completions, and well reactivation activities, with the remainder to be spent primarily on maintenance, facilities construction, and equipment. The relatively low amount of capex required to keep production flat means that Cardinal can defer non-drilling capex while maintaining drilling and completion capex, thereby keeping production flat. Doing so would boost free cash flow and lower the oil price at which its dividend is covered by free cash flow. We suspect management would maintain the existing dividend for up to six months as long as prices remained above $65 per barrel.

If we assume WTI averages US$82.50 per barrel, we estimate the company will generate $161.3 million of free cash flow—or $1.02 per share—annually. After dividends, it will have $47.2 million left over to spend as management sees fit.

In recent quarters, management has allocated free cash flow most aggressively to debt reduction. Throughout 2022, it allocated the outsized free cash flow generated from high oil prices to pay down $124.8 million of Cardinal’s long-term debt, including the full balance of its secured notes. By year-end 2022, long-term debt stood at $31.2 million versus a stock market capitalization of $1.19 billion.

In the first two quarters of 2023, Cardinal’s long-term debt balance climbed from $31.2 million to $53.2 million as declining oil and gas prices caused free cash flow to drop below the level sufficient to cover quarterly dividends.

With WTI back above US$80 per barrel, Cardinal is generating a healthy cash flow surplus. Debt is no longer needed to fund operations and dividends, so we believe management will once again prioritize debt reduction until long-term debt is brought below $40 million.

But share repurchases have also been a priority in recent quarters. Cardinal repurchased 3.7 million shares at an average price of $7.05 over the past year. On June 28, the company renewed its share repurchase program, which will allow management to purchase up to 12.3 million shares. We believe share repurchases will be the next use of surplus cash flow after debt is substantially paid down.

Risks to Cardinal’s Stock Price and Dividend

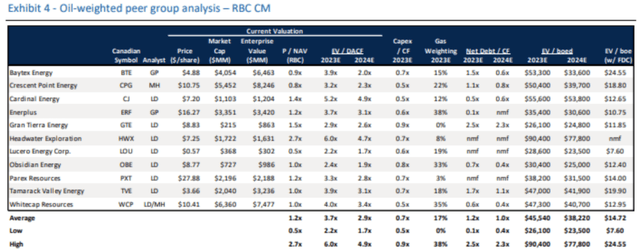

The main knock against Cardinal Energy’s stock doesn’t have to do with its business fundamentals, but its stock’s trading multiple. Due to the company’s attractive economic characteristics, conservative balance sheet, outstanding long-term track record, and large dividend yield, Cardinal stock trades at a steep multiple compared to its peers.

Source: RBC Capital Markets, July 30, 2023.

The table above shows Cardinal stock trading at 5.2-times estimated EV/DACF versus its peer average of 3.7-times. However, we would argue that nearly all the peers shown in the chart are inferior to Cardinal, and in oil and gas, it’s almost always worth paying up for quality for a long-term holding period.

Risks for Cardinal shareholders are surprisingly few; they’re certainly far fewer than almost any other conventional and shale E&P we cover. As with all E&Ps, the primary risk stems from a sustained bout of low oil prices that force the company to cut its dividend. Prices sustained below US$65 for more than six months would likely result in a dividend cut. Recall that it continued to do so in the first half of this year even though free cash flow didn’t cover the dividend.

With so few risks in the picture, Cardinal’s results could surprise to the upside. Areas we’d look for improvement include increasing margins from a greater proportion of light oil in the production mix. The company is also trying to reduce expenses by lowering its dependence on the power grid. We also hope it continues to strategically dispose of its decommissioning liabilities.

Valuation

If we use US$85 per barrel WTI as our long-term base case, Cardinal shares would trade at $10.67 to generate a 10% dividend yield. They would trade at $8.89 to generate a 12% dividend yield.

Meanwhile, a discounted cash flow scenario using the $153.6 million of free cash flow the company generates at US$80 per barrel WTI values the shares at $9.69, representing 36% upside from the current price of $7.15 per share.

Given our near-term and longer-term outlook for WTI to be sustained above US$80 per barrel, we believe $10 per share is an appropriate price target for Cardinal’s stock. This implies 40% upside from the current share price.

Conclusion

Cardinal Energy is one of the best income alternatives among E&P stocks for playing higher oil prices. The company offers stability, but also the prospect of upside if its efforts to delineate its Clearwater acreage are successful. It offers other benefits as well, such as large tax pools that management expects will eliminate taxes until 2026.

Cardinal’s large margin of safety, ample dividend yield, dividend growth potential, capital appreciation potential, and conservative management make it an outstanding addition to any income portfolio. We rate the shares as a Buy and believe they should be bought before their price discounts the bullish oil market we see playing out over the coming months.

Analyst's Disclosure: I/we have a beneficial long position in the shares of MEG.TO, CVE.TO, SU either through stock ownership, options, or other derivatives.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Looking to buy CJ.TO in the next 72 hours.