Devon Energy (DVN) is one of the largest pure-play domestic E&Ps, with an enterprise value of $39.8 billion. It expects to produce 650,000 boe/d in 2024, split 48.5% crude oil, 25.0% NGLs, and 26.5% natural gas.

The company’s operations are spread over most major shale oil basins, including the Bakken, Powder River Basin, Anadarko Basin, Permian Basin, and Eagle Ford. Its Permian operations are concentrated in the Delaware sub-basin.

DVN’s regions of operation are shown below.

Source: DVN 2023 10-K.

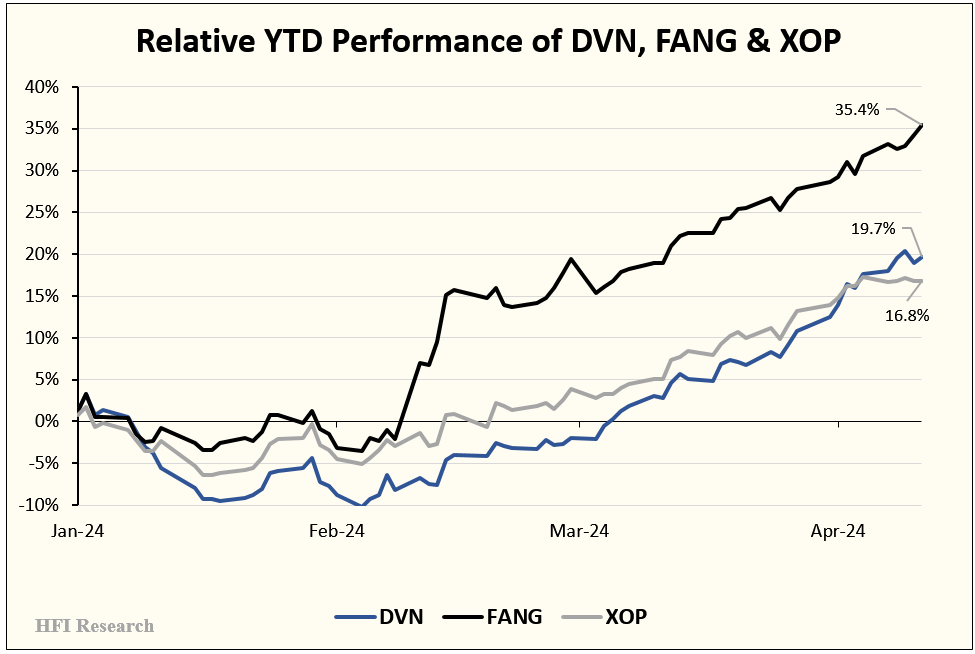

As a large-cap E&P, DVN has been a primary recipient of capital flows into the energy sector, which picked up considerably in recent months. Year-to-date, DVN shares have outperformed the S&P Oil & Gas Exploration & Production ETF (XOP), gaining 20.6% versus the XOP’s 15.9% gain.

Despite DVN’s size, its acreage is of lower quality than that of the major Permian pure-plays such as Diamondback Energy (FANG) and Permian Resources (PR). DVN’s relatively higher operating costs result from its far-flung operations, lower price realizations, and lower returns on capital than its Permian-focused peers. Its inferior acreage quality has caused its shares to materially underperform Diamondback’s, arguably the highest-quality U.S. pure-play oil-weighted E&P. Year-to-date, DVN’s 19.7% return lags behind Diamondback’s 35.4% gain.

As shown in the following chart, DVN has outperformed the XOP by 4.7% and underperformed FANG by 15.4% year-to-date.

The torrid rally experienced by DVN and other U.S. E&Ps has significantly reduced their appeal relative to their large Canadian peers, which continue to trade at a discount to U.S. E&Ps. Moreover, the rally has caused U.S. E&P shares to be fairly valued at WTI in the mid-$80s per barrel range and natural gas in the low-$2 per mcf range. As such, we recommend investors avoid large U.S. E&Ps in favor of Canadian large caps like Cenovus Energy (CVE) and Suncor Energy (SU), both of which may be ripe for a catch-up trade with large U.S. E&P stocks.

A Strong Operating Model

While DVN’s acreage is inferior to Permian-focused names, its acreage features repeatability and attractive returns on capital employed relative to the entire U.S. E&P cohort.

DVN’s diversification across shale basins relative to Diamondback and other more focused operators brings some advantages. For one, its Bakken acreage produces a higher content of higher-value crude oil. It also realizes significantly higher natural gas prices than Permian operators, many of which are exposed to the negative pricing currently prevailing in parts of the basin. As the Permian becomes gassier, E&Ps focused in the basin could see their oil weighting decline, which would reduce their capital efficiency and return on capital employed. That outcome would be a tremendous headwind for Permian-based E&Ps. DVN’s diversified footprint mitigates these risks relative to Permian-focused operators.

Like its large-cap E&P peers, DVN is practicing restraint when it comes to production. Management has publicly embraced a “value over volume” approach. DVN’s production isn’t likely to grow from current levels without a major acquisition. Management is guiding to 650,000 boe/d of production for full-year 2024 after the company produced 662,000 boe/d in the fourth quarter of 2023.

Management plans to increase capital efficiency in the near term by increasing the capex allocated to the Permian. In 2024, Permian basin capex will represent 63.5% of the company's total upstream capex. The 2024 capex breakdown by basin is shown below.

Source: DVN Q4 2023 Earnings Presentation, Feb. 24, 2024.

Higher capital efficiency would increase free cash flow per dollar of capex as long as DVN’s Permian production economics remain intact.

Shareholder-Friendly Capital Allocation

DVN is clearly committed to distributing free cash flow to shareholders. The company’s base dividend is set at $0.22 per share, representing a 1.6% yield on its current $54.50 stock price. The dividend is covered by free cash flow 5.5-times, more than enough for comfort.

The company repurchased $979 million of stock in 2024, following its repurchases in 2022 that totaled $718 million and its repurchases in 2021 of $598 million. Altogether, these repurchases reduced its share count by 6%.

Dividends paid to DVN shareholders could be enormous amid sustained high oil prices. In 2022, when WTI averaged $94.33 per barrel and natural gas averaged $6.64 per mcf, DNV paid out fixed and variable dividends totaling $5.17 per share.

The massive increase in dividends in recent years relative to previous years that occurred as free cash flow grew is shown below.

DVN shareholders should expect continued large variable dividends if oil prices remain elevated above $80 per barrel.

Debt isn’t a problem. The company’s debt level, at 0.7-times EBITDAX approximates management’s target. Meanwhile, debt maturities are manageable, with the next significant debt maturity in 2029. In 2024, management plans to allocate 30% of free cash flow after dividends to debt paydown. The remaining 70% will be allocated to variable dividends and share repurchases.

DVN hasn’t been active on the acquisition front despite recent rumors that it would acquire Enerplus (ERF:CA). Presumably, it failed to submit the winning bid, as Enerplus announced a merger with Chord Energy (CHRD) in February. DVN’s most recent deals were a series of bolt-on acquisitions in the Eagle Ford and Bakken in 2022.

Among other deals, DVN entered into an agreement with Delfin Midstream to supply natural gas for an LNG liquefaction facility that has yet to receive a final investment decision.