(Idea) Diamondback And Endeavor

The big news in the oil patch this week was Diamondback Energy’s (FANG) acquisition of privately-held Endeavor Energy Resources. The combination will create the largest pure-play Permian E&P after Exxon Mobil (XOM) completes its acquisition of Pioneer Natural Resources (PXD), which currently holds that title.

Diamondback paid up for the deal. It beat out ConocoPhillips (COP) in the bidding process and will take on debt to fund the acquisition. However, the combined entity will become the premier independent Permian E&P, holding 838,000 acres in the basin, nearly as much as COP.

We like the deal. While Endeavor didn’t come on the cheap, it’s hard to make the case that Diamondback overpaid assuming WTI of $80 per barrel and above. The combined entity has an improved cash flow profile relative to standalone Diamondback, and its free cash flow generation can improve over time due to synergies and reduced interest costs.

Perhaps most importantly, when the rest of the Permian basin has depleted its top-tier inventory and is forced to drill lower-quality acreage, Diamondback will possess years of high-quality acreage. And if oil prices increase to reflect a higher cost of marginal production, Diamondback’s free cash flow will surge, and its shareholders will benefit from management’s outstanding capital allocation.

The Deal's Details

Diamondback agreed to pay $26 billion for Endeavor. Consideration will consist of 117.3 million Diamondback shares and $8 billion of cash funded mostly through debt.

At the deal’s completion, Diamondback shareholders will own 60.5% of the combined entity, and legacy Endeavor shareholders will own the remaining 39.5%. Endeavor shareholders have agreed to vote their shares as recommended by Diamondback’s board of directors as long as they own more than 20% of outstanding shares.

Diamondback will increase its base dividend by 7%, from $3.36 per share on an annual basis to $3.60 after the deal closes, which is expected in the fourth quarter of this year.

Endeavor has the largest remaining inventory of top-tier drilling locations of any private Permian operator. Raymond James’ estimate published in the spring of 2023 is shown below.

Source: HoustonOGLand, X, Dec. 11, 2023.

Endeavor was reportedly ready to sell because its 85-year-old owner, renowned wildcatter Autry Stephens, was diagnosed with prostate cancer. His treatment left him unable to run the firm as he saw fit.

Endeavor was the fifth-largest private U.S. E&P by production, behind Continental Resources, Ascent Resources, Aethon Energy, and Mewbourne Oil Company. Endeavor boosted production in the run-up to its sale. Reports put Endeavor’s 2023 production growth at 87,569. By year-end 2023, the company was producing 350,000 boe/d, representing annual growth of 33%.

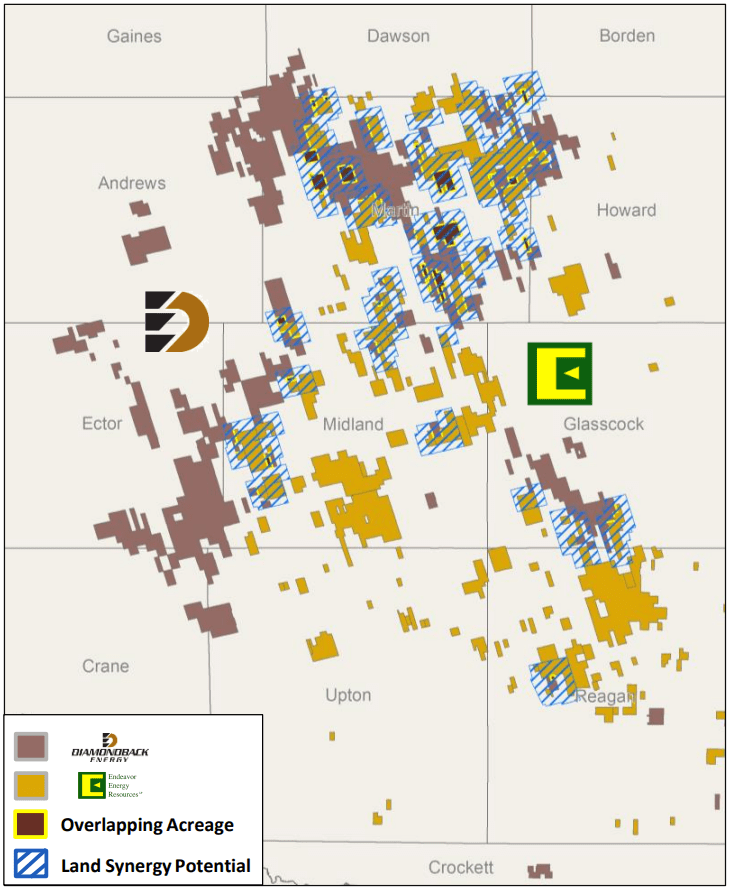

Aside from its high-quality drilling inventory in the heart of the Midland sub-basin, Endeavor’s attraction to Diamondback stems from the contiguity of its acreage, which overlaps in many regions, as shown in the map below.

Source: Diamondback Energy Endeavor Energy Resources Acquisition Slide Presentation, Feb. 12, 2024.

The combined entity will boast 6,100 pro forma top-tier drilling locations that break even at less than $40 per barrel. This drilling inventory spans 13.5 years of drilling at our estimate of the combined company’s current annual drilling rate. This estimate of top-tier drilling inventory leaves out the many thousands of drilling locations that will break even above $40 per barrel.

These lesser-quality wells could prove valuable after the Permian’s best acreage has been exhausted, which we estimate will occur over the next few years. At that point, the price to produce the global marginal barrel may increase, and low-cost producers like Diamondback will benefit through sustained higher free cash flow.

Diamondback Didn’t Get a Bargain but Didn't Overpay

Diamondback paid roughly fair value for Endeavor. Consider that at $80 per barrel WTI and $2.75 per mcf natural gas, Diamondback generates approximately $3.2 billion in free cash flow. Before the deal announcement, it had a $31.8 billion enterprise value, representing a 10% free cash flow yield.

The Endeavor acquisition came at a slightly lower free cash flow yield. At $80 per barrel WTI and $2.75 per mcf natural gas, standalone Diamondback generates approximately $18.50 per boe of free cash flow. Applying the same figure to Endeavor’s 350,000 boe/d of production results in $2.3 billion of free cash flow. Diamondback’s $26 billion acquisition price therefore represents a 9% free cash flow yield, just shy of Diamondback’s own 10% free cash flow yield before the announcement.

Our estimates assume the combined entity will be operated in maintenance mode, as Diamondback had been operating before the deal. We assume organic production will remain more or less flat. Diamondback management expects $550 million of cost, capital, and land synergies, which would make the purchase price more attractive from a free cash flow perspective if they are realized.

The deal’s attractiveness is largely a matter of perspective. The U.S. equity market certainly liked it. Diamondback’s stock surged 10% after the deal was announced.

Over the long term, its success will depend on the course of commodity prices. If WTI can average greater than $80 per barrel, it is likely to be a win for Diamondback shareholders.

But the acquisition appears expensive when compared with Canadian E&P stocks. Many high-quality Canadian names achieve returns on capital on par with Diamondback at $80 per barrel WTI, yet their shares trade at far lower multiples than both Diamondback and the Endeavor deal metrics.