By: Jon Costello

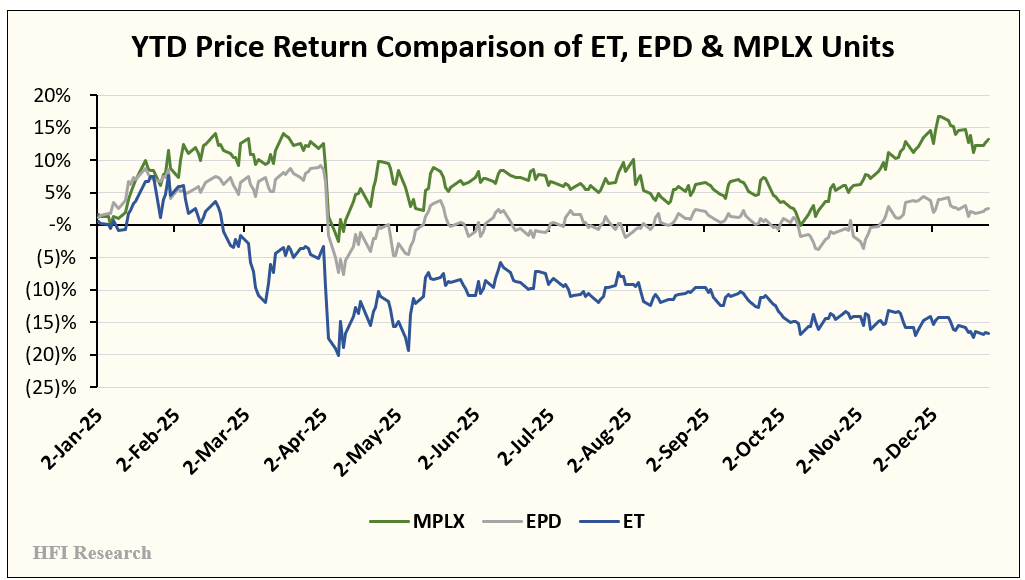

Energy Transfer (ET) units have continued to underperform peers in 2026. Both MPLX (MPLX) and Enterprise Products Partners (EPD) have fared significantly better.

The company’s weak third-quarter results explain the underperformance. ET posted the most disappointing financial results among its peers, with Adjusted EBITDA expected to now fall well short of management’s guidance range.

Despite ET’s recent poor showing, I expect investor concerns about ET relative to its peers will start to diminish over the next few quarters as its growth spending spree ramps down and new projects add to EBITDA. ET’s weak results, current out-of-favor status, and better-than-appreciated prospects bode well for its shares over a three-to-five-year timeframe. Its 8.1% distribution yield makes the units particularly appealing to investors seeking income.

Weaker than Expected Third-Quarter Results

During the third quarter, ET posted strong operating performance and weak financial results. The financial performance was weak relative to ET’s recent history, though less so than those of its large-cap midstream peers.

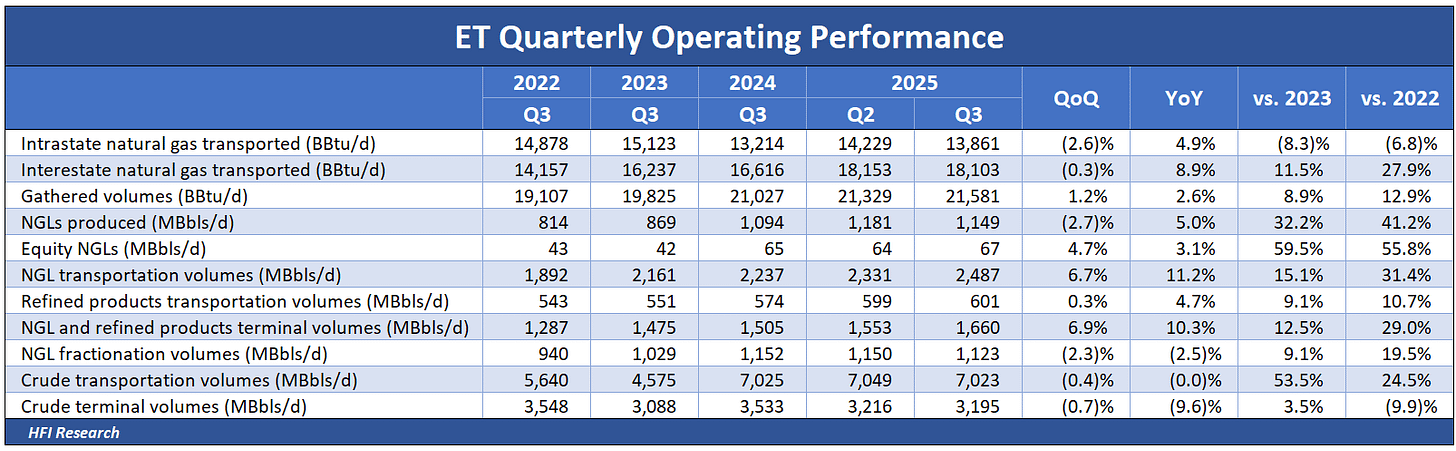

The trend underlying ET’s operating results remains intact. Volumes continue to increase across the board, with the exception of the intrastate natural gas transportation segment, as shown in the following table.

ET didn’t elaborate much on the cause of weakness in its intrastate gas volumes during the quarter, but I suspect it is tied to the company’s decision to transition customers away from optimization and toward third-party contracts. This means that they’re shifting from essentially an arbitrage business to stable transportation to a fixed fee. Volumes may be declining temporarily during the transition. In any event, I view the quarter’s results in this segment as a one-off and not a cause for concern in the long term.

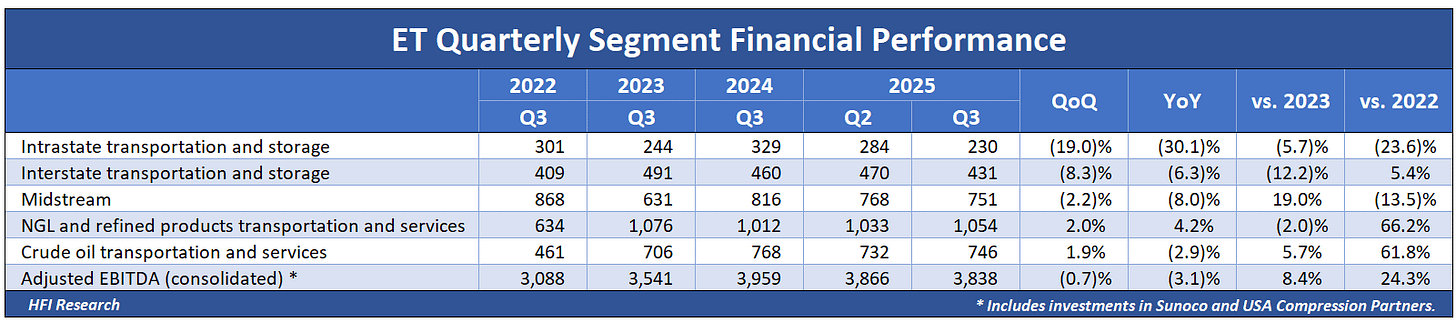

Financial results for the third quarter were disappointing, falling short of analyst and my own expectations. ET reported Adjusted EBITDA of $3.8.3 billion, missing analyst expectations of $3.97 billion by 3.5%. Results were weaker than both the previous year’s and the previous quarter’s results, as shown below.

This is clearly disappointing. I suspect the severe intrastate natural gas result was attributable to the switchover to third-party contracts.

While the weak showing doesn’t exonerate ET’s management, it’s worth noting that the company’s weak financial performance wasn’t exceptional in the midstream sector. It joined Enterprise Products Partners, Plains All American (PAA), Kinder Morgan (KMI), and Enbridge (ENB) among major midstream operators who missed analysts’ third-quarter earnings expectations. It was actually a lousy quarter for the group. Only Western Midstream Partners (WES) and South Bow (SOBO) surprised meaningfully to the upside.

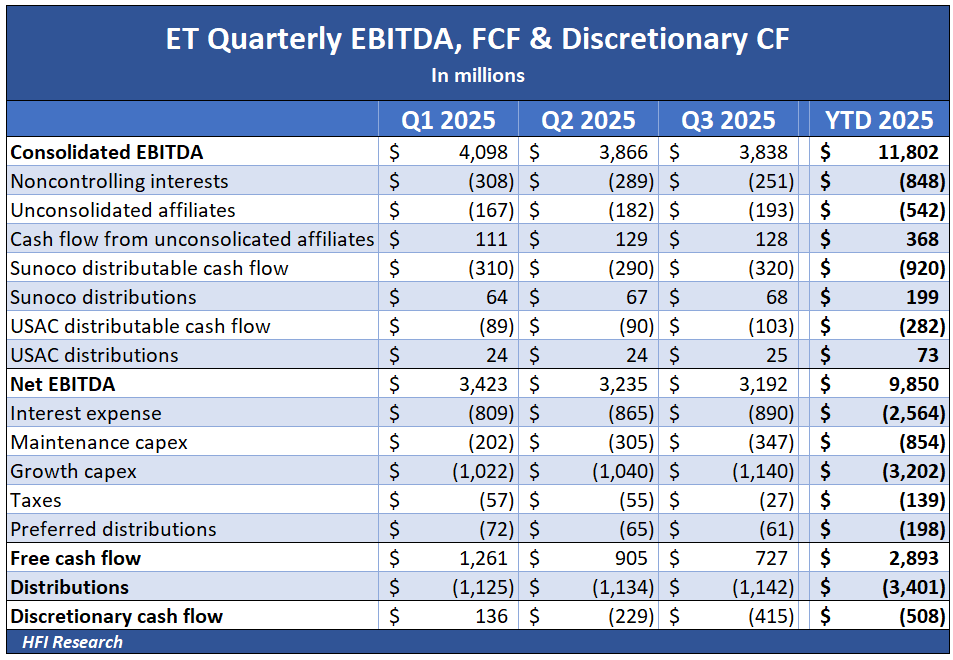

On a consolidated basis, ET outspent its free cash flow by $415 million during the quarter. The culprit was higher costs, both operating expenses and capex. Growth capex is particularly heavy this year, and is set to remain so over the coming quarters.

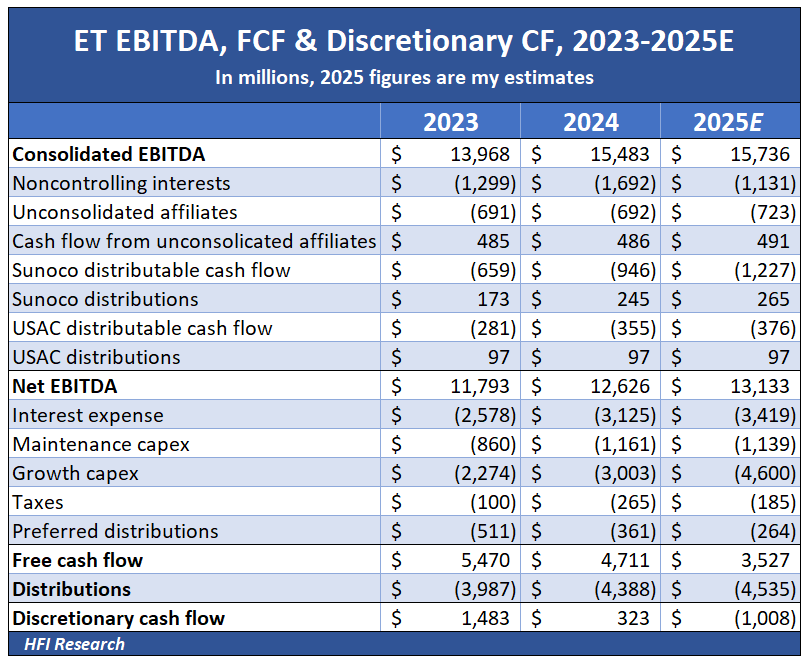

ET is currently tracking at full-year Adjusted EBITDA of $15.74 billion, approximately 4% below the lower end of management’s initial full-year guidance range of $16.1 to $16.4 billion. The table below shows how full-year 2025 performance is tracking. Growth capex is adjusted higher, to $4.6 billion, consistent with management’s guidance. ET will have to fund its $1 billion cash flow shortfall with additional long-term debt.

Operating Costs a Cause for Concern

The biggest concern with ET’s third-quarter results was a significant year-over-year increase in operating costs. The higher costs go a long way toward explaining why a strong operating performance can be matched with a weak financial performance.

Much of the cost was attributable to higher ad valorem taxes, but these aren’t necessarily one-time expenses. Ad valorem taxes are property taxes assessed on a company’s assets. When a midstream company places new assets into service, its ad valorem tax obligation increases. Typically, the increase translates into higher operating expenses, though they should be offset by the margin generated by the asset.

ET did have some one-time items that reduced third-quarter Adjusted EBITDA. The NGLs segment had one-time investigation and remediation costs of $17 million, and the Interstate natural gas segment had a one-time ad valorem tax of $43 million related to its Rover pipeline. The latter probably relates to a tax dispute over prior-period taxes that ET must have lost.

The company’s disclosures on its higher operating expenses provided little insight. And not surprisingly, there were no questions from analysts about the operating cost increase on the third-quarter earnings conference call.

At this point, we have to rely on management to be aware of the issue and take action to reduce costs. There is always a risk that costs will get out of hand in capital-intensive, expansionary companies like ET, which are constantly building new projects and acquiring new assets. Fortunately for ET’s equity owners, there is good reason to believe that management has become more disciplined and can address the cost issue.