EOG Resources (EOG) is the largest independent shale E&P, with an enterprise value of $73.8 billion. The company’s operations are diversified across the major shale basins, with its 1.029 million boe/d of production in the first quarter of 2024 comprised of 43.7% crude oil and condensate, 21.1% NGLs, and 35.2% natural gas. Its production is 96.7% in the U.S. and 3.3% in Trinidad.

Source: EOG 2023 Annual Report.

EOG intends to grow production in the mid-single-digits percent annually. Growth is being driven by its Permian basin operations. In the first quarter, production grew by 6% over the previous year. Management is guiding for 6% production growth in 2024.

The company’s acreage is the legacy of Mark Papa’s leadership over the 1999-2014 timeframe. In 1999, Papa led the separation of scandal-ridden Enron’s E&P business, which was called “Enron Oil & Gas” and was later changed to EOG.

Several years through Papa’s tenure as CEO, he recognized that oil production would be more profitable than natural gas production over the long term. At the time, EOG was a pioneer in horizontal drilling, which provided it with a more robust opportunity set for prospective acreage and development than its less-sophisticated peers. Papa famously leased huge tracts of oily acreage in Texas, all the while keeping EOG’s activity under wraps. In doing so, the company successfully used its first-mover advantage to secure some of the most desirable acreage in the core of the Eagle Ford. Over subsequent years, EOG expanded its operations into the Permian, Powder River Basin, Bakken, and other shale oil and gas plays.

A Top-Tier Shale Operator

Papa departed from EOG in December 2014. Nevertheless, the company has maintained its managerial excellence. EOG has clearly articulated goals with regard to returns on capital, production, and overall company strategy. The company considers its mission to achieve “sustainable value creation through industry cycles.” It intends to achieve this objective through capital discipline and operational excellence.

Management values an integrated model that involves ownership of gathering and processing infrastructure. Its most recent acquisition, made in the first quarter, involved $267 million of gathering and processing infrastructure in South Texas and the Powder River Basin.

Operationally, EOG has increased its well productivity over the past few years, which has lowered its breakeven cost per barrel and increased returns for shareholders. The company has wrung efficiencies out of its production by continuously improving its completions design and increasing laterals.

In the Delaware Basin, EOG’s wells are among the most productive.

Source: EOG Q1 2024 Investor Presentation.

EOG’s Utica wells are also among the most productive in that basin, with some regions boasting well productivity on par with EOG’s Permian wells.

In addition to operations, EOG has proven superb at marketing. Approximately 140,000 boe/d of its oil production is linked to Brent pricing, which fetches a premium to WTI. A portion of EOG’s natural gas production is linked to the U.S. Gulf Coast gas index, which fetches a premium to Henry Hub and intra-basin benchmarks.

EOG has also entered into sales agreement with LNG producers. Its LNG feedstock sales will grow from 140,000 MMBtu/d to 420,000 MMBtu/d over the 15-year term of the contract. The contract is linked to the Japan Korea Marker LNG price benchmark and has generated $1.1 billion of additional revenue for EOG versus the revenues generated from domestic benchmarks.

These natural gas supply agreements will grow in importance to the company beginning in 2026.

With its production mix weighted 35.2% to natural gas, increased pricing realizations will significantly boost free cash flow.

Capital Allocation Favors Dividends

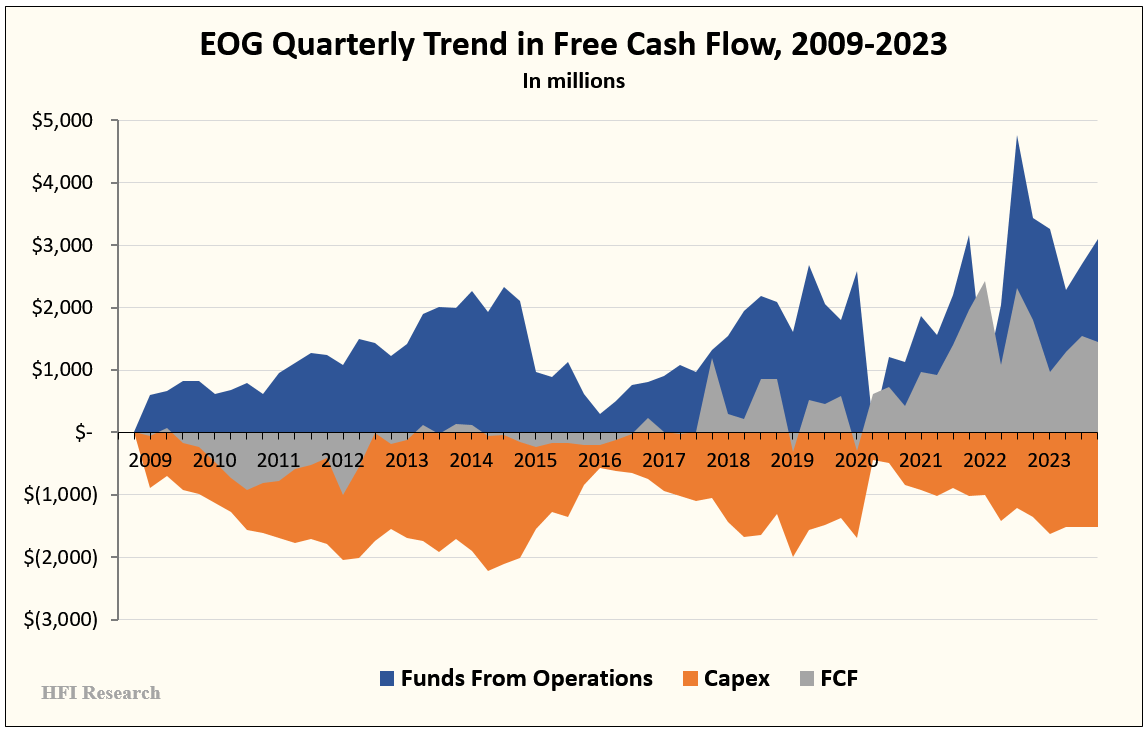

EOG inflected to significant free cash flow generation beginning in 2020. The chart below shows FCF sustainably higher since then.

During this period, management used the free cash flow to reduce net debt and distribute capital to shareholders primarily through dividends.

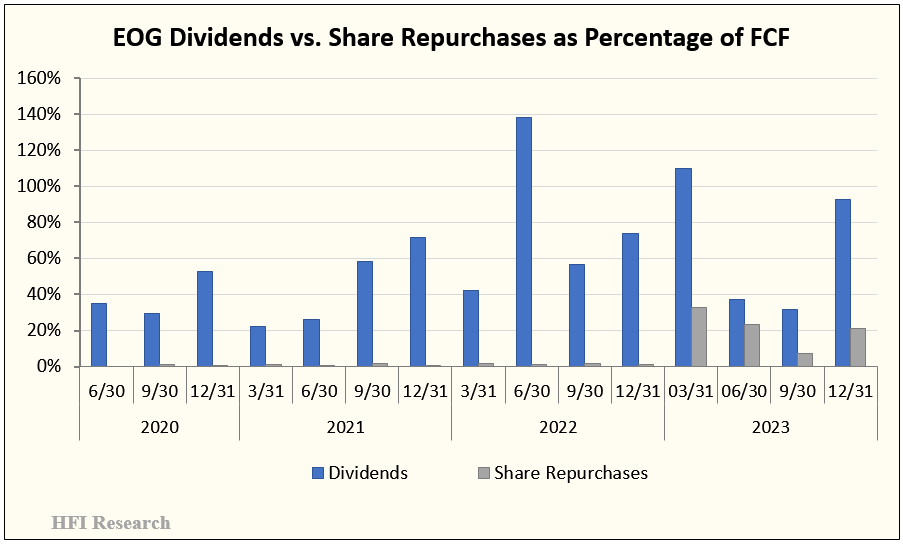

Share repurchases have comprised a smaller part of the capital return equation, as shown below. This is positive for shareholders, as EOG shares are fully valued and trade at a premium to large E&P peers.

EOG’s current $0.91 per share base dividend generates a 2.8% yield on its $130 stock price. However, recurring special dividends have significantly boosted the yield in recent years. Total payouts in 2023 amounted to $5.80 per share, equivalent to a 4.5% dividend yield on the current share price.

Source: EOG.

If oil prices are sustained above $90 per barrel, the company could return significant sums to shareholders through increased base and special dividends.

Management intends to distribute 50% of free cash flow to shareholders through dividends and, to a lesser extent, share repurchases. The company repurchased 6.4 million shares for $750 million at an average price of $118 in the first quarter.