(Idea) Greenfire Resources - One Of Our Favorite Energy Names

At US$75 per barrel WTI and production at 21,500 bbl/d, GFR can generate C$120 million in free cash flow, or ~20% FCF yield.

By: Jon Costello

Greenfire Resources (GFR) (GFR:CA) is in the bull’s eye of what today’s market dislikes. It’s a microcap Canadian oil-sands producer that has been beset by management upheaval and operational mishaps since it came public in September 2023. The most recent headwind for GFR shares was the company’s dilutive rights offering, which increased the share count by 78% overnight on December 16.

Despite all the negatives, GFR’s prospects over the next few years are bright if oil prices increase as we expect. The fact is that energy investors today confront the difficult reality that E&P stocks are priced to reflect WTI in the low-US$70s per barrel, while the benchmark trades below US$60. Given the mispricing of so many of these stocks, investors who believe higher prices are imminent and that WTI will average more than US$70 per barrel over the long term may find GFR to be an attractive E&P alternative.

Background

GFR came public through a SPAC merger on September 21, 2023. The company was run by a team that appeared competent on paper but proved unable to meet its production objectives.

In September 2024, the Waterous Energy Fund (WEF) acquired a 43% stake in GFR’s common stock, primarily by acquiring blocks of shares from large shareholders. Waterous and the affiliates of the SPAC sponsor waged a proxy battle that ultimately ceded control to WEF, which emerged with a controlling 56.5% ownership interest in GFR’s common shares in late 2024.

WEF replaced GFR’s management team over the subsequent months, installing its own candidates, including Colin Germaniuk as President. Germaniuk is an engineer by training who possesses extensive experience in managing SAGD assets. His qualifications include being one of the earliest employees at Serafina Energy. Serafina owned and operated SAGD assets in Saskatchewan, growing production from zero to 40,000 boe/d over eight years. It was subsequently acquired by the WEF-controlled Strathcona Resources (SCR:CA) in August 2022 for $2.3 billion.

GFR currently trades at a market cap of $798 million based on its 125.4 million shares outstanding. In recent weeks, it completed a $300 million rights offering and redeemed its $237.5 million in 12% Senior Secured Notes due 2028. I assume it also used the offering to pay off the $50 million balance on GFR’s revolving credit facility. Combined with the $114.7 million in cash on the balance sheet at the end of the third quarter, the transactions have left the company with a large net cash balance and an enterprise value well below its market cap. The rights offering has de-risked the balance sheet, improved the company’s cash flow profile, and enhanced its operational flexibility.

After the rights issue, WEF owned 71.1% of GFR equity. Since WEF gained control of GFR, a major unresolved issue for GFR shareholders was what it planned to do with the company after having taken control. Was it going to fold GFR into Strathcona, or operate it as a standalone company and as a separate investment in one of its private equity funds?

Management’s comments suggest it plans to operate the business as a standalone entity and keep its public stock listing. I suspect it is doing so because GFR’s assets are not necessarily a proper fit within the larger Strathcona entity. Also, GFR presents relatively more upside given its smaller size, more focused operations, and greater torque to oil prices than Strathcona. The WEF also benefits from GFR’s public listing by providing a means to incentivize management and offering liquidity to the limited partners in its Waterous Energy Fund III fund, which holds GFR shares.

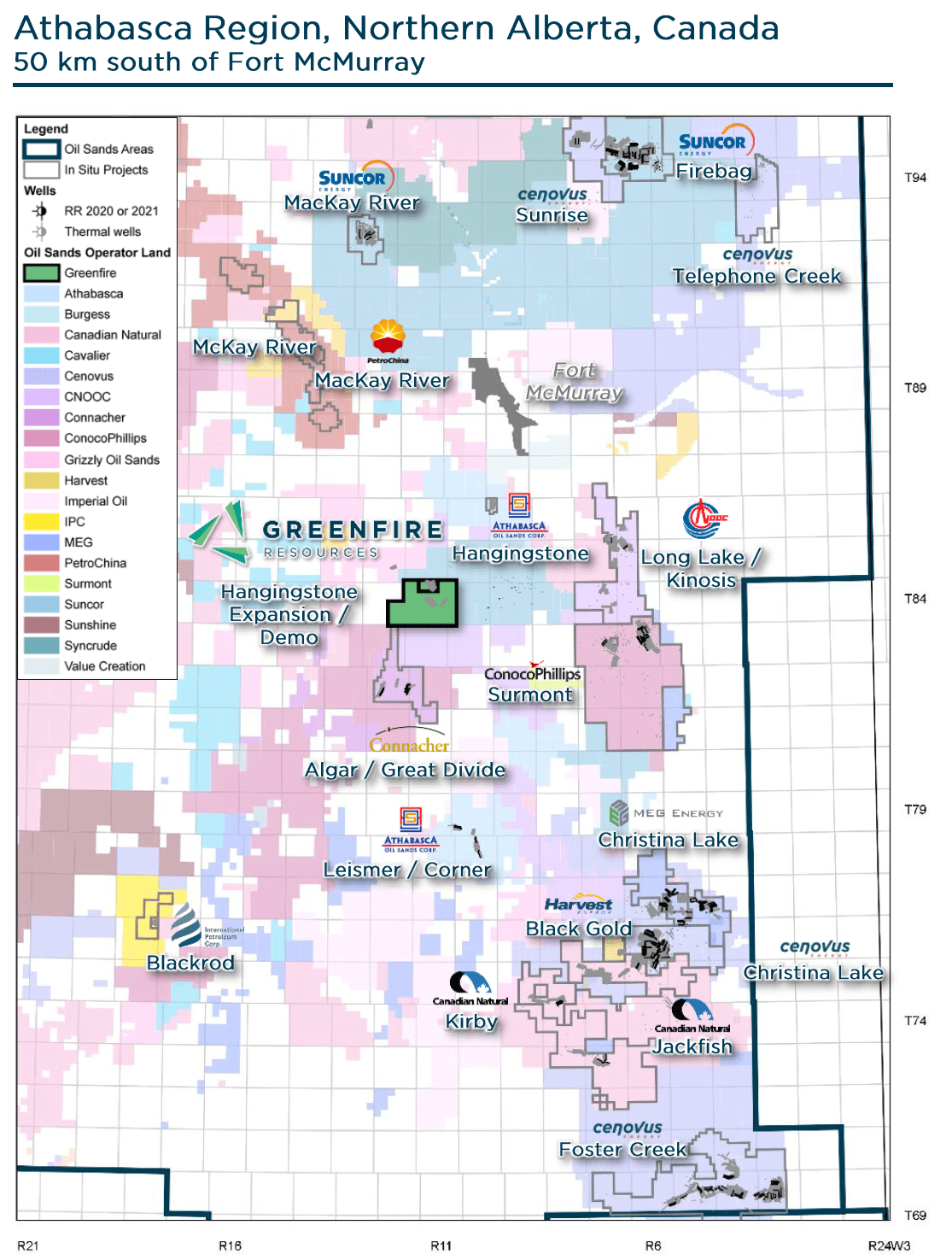

My previous GFR articles discuss GFR’s Expansion and Demo assets in the Hangingstone area of the Athabasca region in Alberta. The assets are located in the heart of oil sands country:

Source: Greenfire Resources Aug. 2024 Corporate Presentation.

While GFR’s Hangingstone assets aren’t of the highest quality among Canadian SAGD assets, they are among the highest quality of the SAGD assets not already owned by a larger operator.