(Idea) Headwater Exploration

Note: Dollar references are to Canadian dollars unless otherwise specified.

Headwater Exploration (HWX:CA) is the best pure-play oil production growth story among North American E&Ps. Its stock’s appeal is based on the successful track record of Neil Roszell, its Chairman and CEO, and his team. Since Roszell assumed control of the company in January 2020, HWX has grown production more than six-fold. On a per-share basis, production over that time has grown at a compound annual rate of 86%. Free cash flow per share has compounded at 78% annually.

The drawback of HWX shares is their premium valuation. At their current price, they discount either WTI in the high-US$80s per barrel range, significant future production growth, or some of both. As such, HWX shares are only worthy as a bet on management. As long as they fail to discount oil at $80 per barrel or below—thereby providing some margin of safety for buyers—we will rate them as a Hold.

Since an investment in HWX stock is essentially a bet on management, it’s important to consider some history before appraising its future prospects.

Background on HWX and its Management

Roszell and his team have a long track record of successfully increasing production through the drill bit. With Wild River Resources, they successfully grew production from zero to 2,000 boe/d in two years before they sold the company in 2009. Shortly thereafter, they built Wild Stream Exploration from 350 boe/d to 6,400 boe/d before selling it in 2012.

Their next venture was even more successful. Roszell and his team grew Raging River Exploration, a light oil producer in the Viking play in Saskatchewan, from 1,000 boe/d in 2012 to 24,000 boe/d in 2018, when it was acquired by Baytex Energy (BTE) for $2.8 billion. For several years, Raging River was one of the best-performing public E&P stocks in North America.

The notable feature of Roszell’s business experience is that he built primarily by successful exploration, mostly from the ground up. Headwater is the current iteration of his model.

In January 2022, Roszell and his team partnered with a junior Canadian E&P, Corridor Resources, with the approval of Corridor’s board and management. Corridor produced approximately 7,800 mcf/d of natural gas in New Brunswick and offshore in the Gulf of St. Lawrence. Its legacy operations were generating $8 million of operating cash flow. The company also had $160 million of tax pools that would shield its future income.

Corridor’s prospects revolved around a moratorium on horizontal drilling and hydraulic fracturing that had been enacted by the New Brunswick government in 2019. The moratorium put the company’s future in doubt and caused its stock to trade at low levels relative to its reserve value. However, if the moratorium was reversed, Corridor’s shares could regain their value, and its natural gas production could increase to satisfy growing local demand.

At the same time Roszell partnered with Corridor, the company announced an expanded mission. Instead of pinning its hopes on a reversal of the New Brunswick drilling moratorium, the company would now seek to “take advantage of mispriced assets and unlock the value of the assets through disciplined capital allocation and greenfield development.” Among its new priorities were “generating strong earnings, return on capital employed, and free cash flow.”

Roszell’s first order of business was to arrange two private placement equity transactions at $0.92 per share, raising $50 million in proceeds. Combined with Corridor’s existing $60 million working capital surplus, the company would have a $110 million war chest to fund future growth.

After the private placements closed in March 2020, Roszell became Chairman and CEO, and Corridor changed its name to Headwater Exploration.

HWX Begins Its Growth

In November 2020, HWX announced it would acquire all of Cenovus Energy’s (CVE) assets in the Marten Hills area of Alberta. As consideration in the deal, HWX issued CVE 50 million common shares and 15 million warrants to purchase common shares for three years, exercisable at $2.00 per HWX share. When the deal closed in December 2020, CVE owned 31% of HWX’s outstanding shares. CVE would end up exercising its HWX warrants a year later and selling down its entire equity stake at a substantial gain.

HWX’s Marten Hills acquisition made it into the growth story it has become. The assets added 3,300 barrels per day of heavy oil to its legacy natural gas production in New Brunswick. By the end of the first quarter of 2021, HWX was producing 4,805 boe/d in total. And by the end of 2021, production more than doubled to 10,449 boe/d.

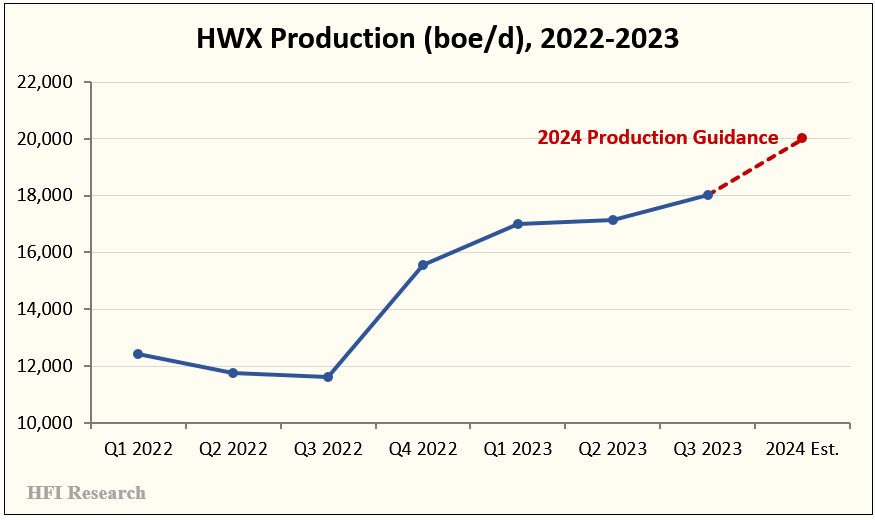

Production has run higher from there. In the fourth quarter of 2022, production averaged 15,546 boe/d. The chart below shows the growth since then. It also shows management’s full-year 2024 guidance, which, at 20,000 boe/d, is 11% higher than the 18,022 boe/d produced in the third quarter of 2023.

Management intends to grow production after 2022, though how it will do so remains to be seen.

A Continued Focus on the Clearwater

Roszell and his team were among the first to recognize the potential of the Clearwater, which over the past two years has become the fastest-growing new play in North America. The acreage purchased from CVE included some of the highest-quality Clearwater acreage, smack dab in the core of the play.

Management estimates that HWX’s Clearwater acreage possesses 3.9 billion of original oil in place. Clearly, it sees ample scope for increasing HWX’s proved and probable reserves, which stood at 34.3 million barrels.

HWX’s strategy is straightforward: maximize production out of producing reserves while discovering new reserves. In 2024, development activity will be focused on the Clearwater. HWX’s current development strategy is shown below.

Source: HWX December 2023 Corporate Presentation.

Throughout 2023, HWX has added 65 sections of prospective acreage in the inner Clearwater and 141 sections of prospective acreage in oil fairways outside the Clearwater. The company is focusing its exploration capital on the Greater Peavine and West Nipisi, where HWX has drilled multiple successful exploration wells since 2022.

On its producing Marten Hills acreage, HWX is implementing waterfloods as a secondary recovery to boost production and reduce the decline rate of its producing wells. The company expects to implement waterfloods on all producing Marten Hills wells by the end of 2024. Meanwhile, it intends to add incremental prospects through strategic land acquisitions and accretive M&A.