(Idea) Hemisphere Energy

Note: Dollar references are to Canadian dollars unless specified otherwise.

It isn’t easy to find North American E&Ps that generate a 20%+ free cash flow yield on their enterprise value with WTI in the mid-US$70s per barrel. Hemisphere Energy (HME:CA) (OTCQX:HMENF) is a unique standout. The company’s 22% free cash flow yield at current oil prices is among the highest we’ve come across. Moreover, nearly all of its free cash flow is distributed to shareholders through dividends and share repurchases. These characteristics give HME shares some of the best return prospects at current oil prices.

With robust cash flow generation and shareholder-oriented capital allocation, we rate HME as a Buy with a $2.00 price target that implies 58.7% upside from HME’s current $1.26 market price.

Uniquely Attractive Economics

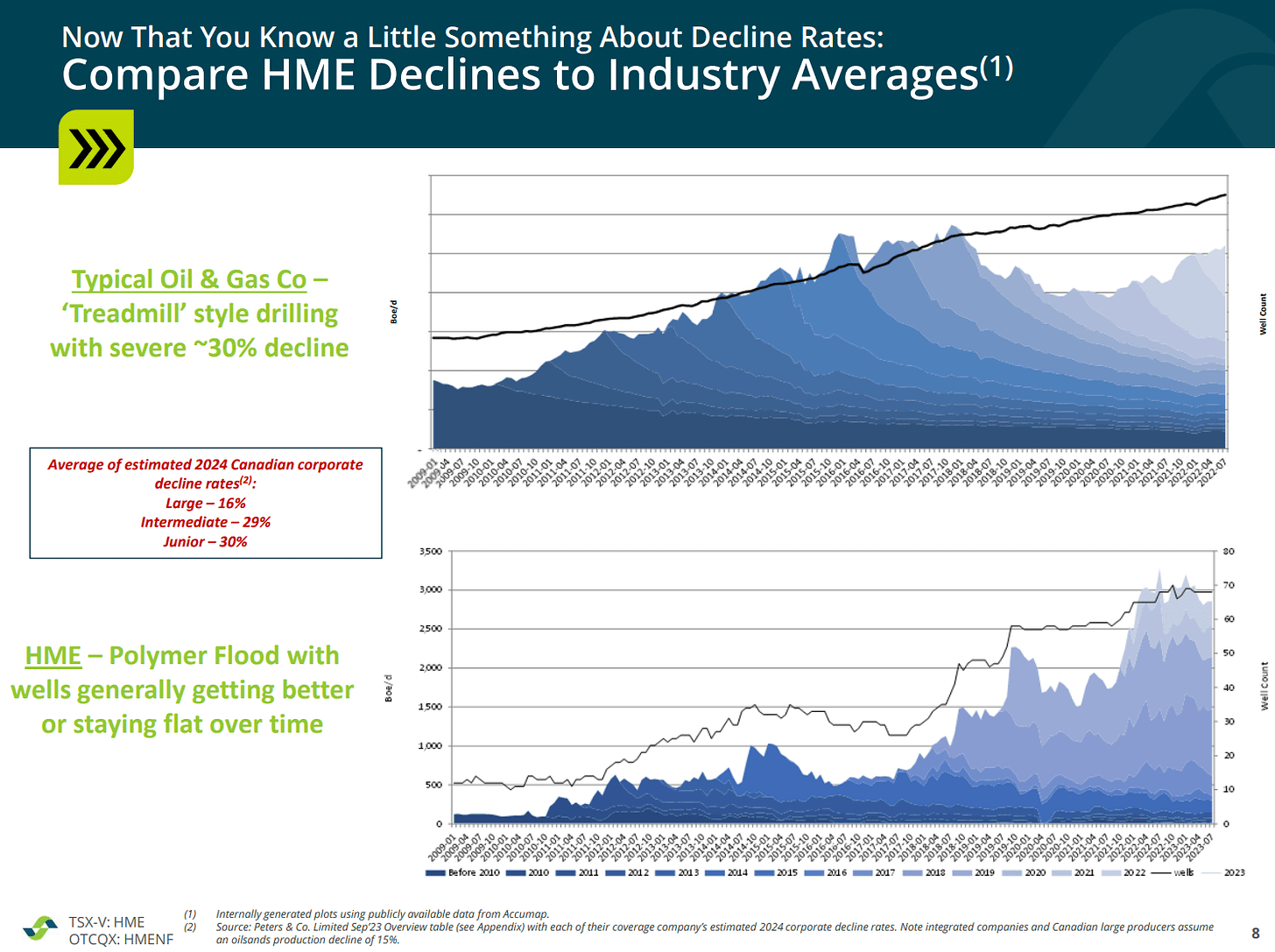

HME stands apart from its peers because nearly 100% of its production is comprised of oil, and its production is subject to an extremely low decline rate. These features allow it to maintain flat production at a very low cost per barrel. They also create some of the highest cash flow torque to higher oil prices among North American E&Ps.

HME accomplishes this feat by targeting high-quality reserves in the Manville F& G pools in Southeast Alberta, in which it owns a 100% working interest. It produces the oil using polymer flooding, which involves injecting polymers and water into the oil reservoir to displace crude and increase oil recovery. HME’s favorable geology and effective use of enhanced recovery reduce the decline rate of its wells to minimal levels, as shown below.

Source: Hemisphere Energy, December 2023 Investor Presentation.

A low decline rate on HME’s production base translates into greater capital efficiency: it costs HME significantly less than its peers to bring new production online. Its production per dollar of capex causes more cash to flow to the bottom line for shareholders.

While HME boosted capex in the third quarter to increase production heading into year-end, we estimate it can keep production flat by spending $18 million on capex. Consider that with WTI at US$75 per barrel, the company can generate $48.1 million of free cash flow. After capex, $30.1 million of free cash flow is left for shareholders. On a per-share basis, that equates to $0.28 of free cash flow, a 22% yield on HME’s $1.26 share price.

That’s an impressive amount of free cash flow at such a low oil price. Shareholders also benefit from HME’s more than $20 million of tax pools, which will shield it from cash taxes for years.