By: Jon Costello

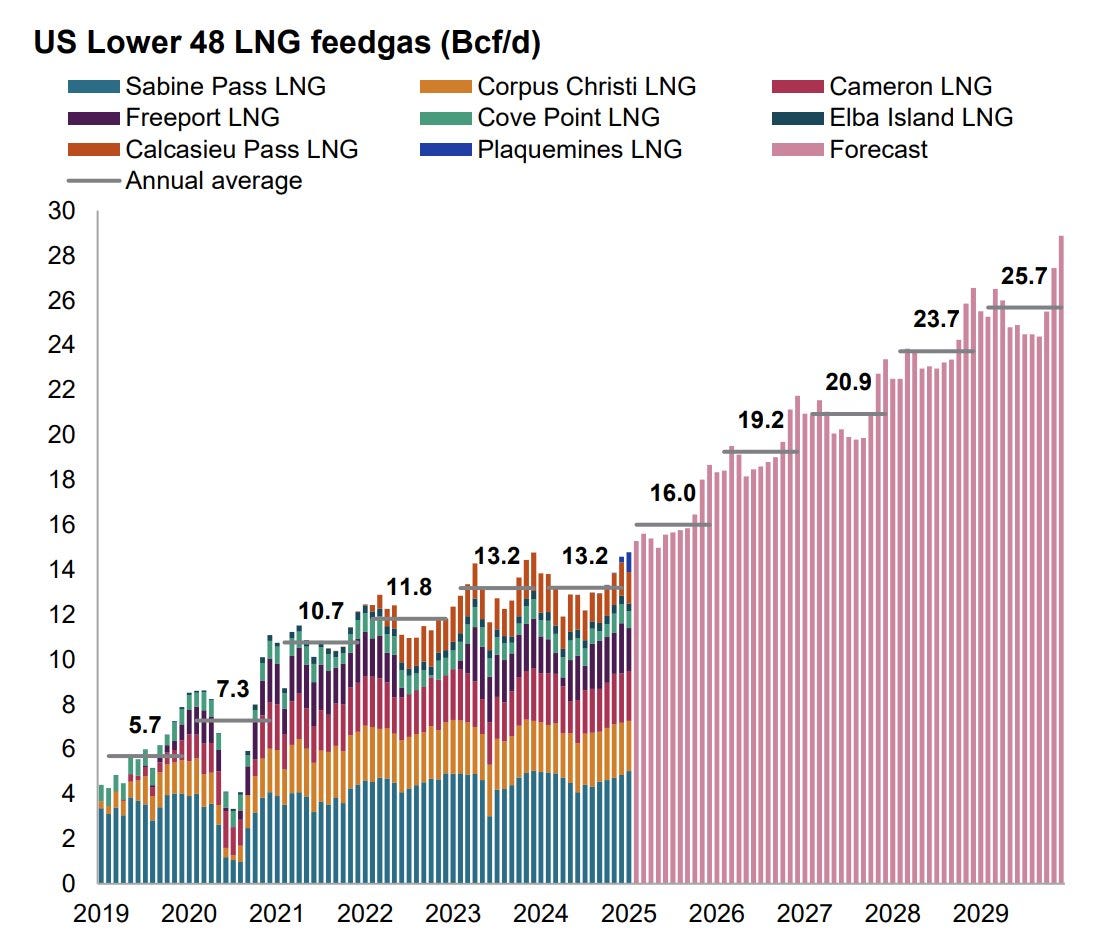

We recently discussed our bullish thesis on natural gas in an article that can be found here. In it, we make the case that the 14.6 bcf/d demand increase from LNG will drive prices significantly higher. The demand outlook is captured in the following graphic.

Source: S&P

U.S. natural gas E&Ps are the most direct way to play the natural gas bull market. These companies have direct and heavy exposure to Henry Hub natural gas prices.

Henry Hub is the NYMEX natural gas futures contract on which most LNG supply agreements are based. LNG operators typically price their product to customers at a margin above the Henry Hub price to limit the cash flow volatility that would occur if they were exposed to the commodity price.

E&Ps in the U.S. gassy basins—namely, the Haynesville and the Marcellus/Utica—both have access to Henry Hub pricing. In Canada, some operators receive Henry Hub pricing, but due to the marketing and transportation requirements involved in sending gas from Canada to the U.S. Gulf Coast, these agreements come at a greater cost compared to their U.S. peers. Moreover, most Canadian natural gas operators are exposed to the regional AECO benchmark, which typically trades at a steep discount to Henry Hub due to oversupply and egress constraints.

The dependence on Henry Hub pricing for the U.S. relative to Canadian names makes it easier to model the cash flows. Below, we discuss the commodity price sensitivities and our long-term price targets for U.S. gas-weighted E&Ps. Our price targets assume a natural gas price of $5.50 per mcf.