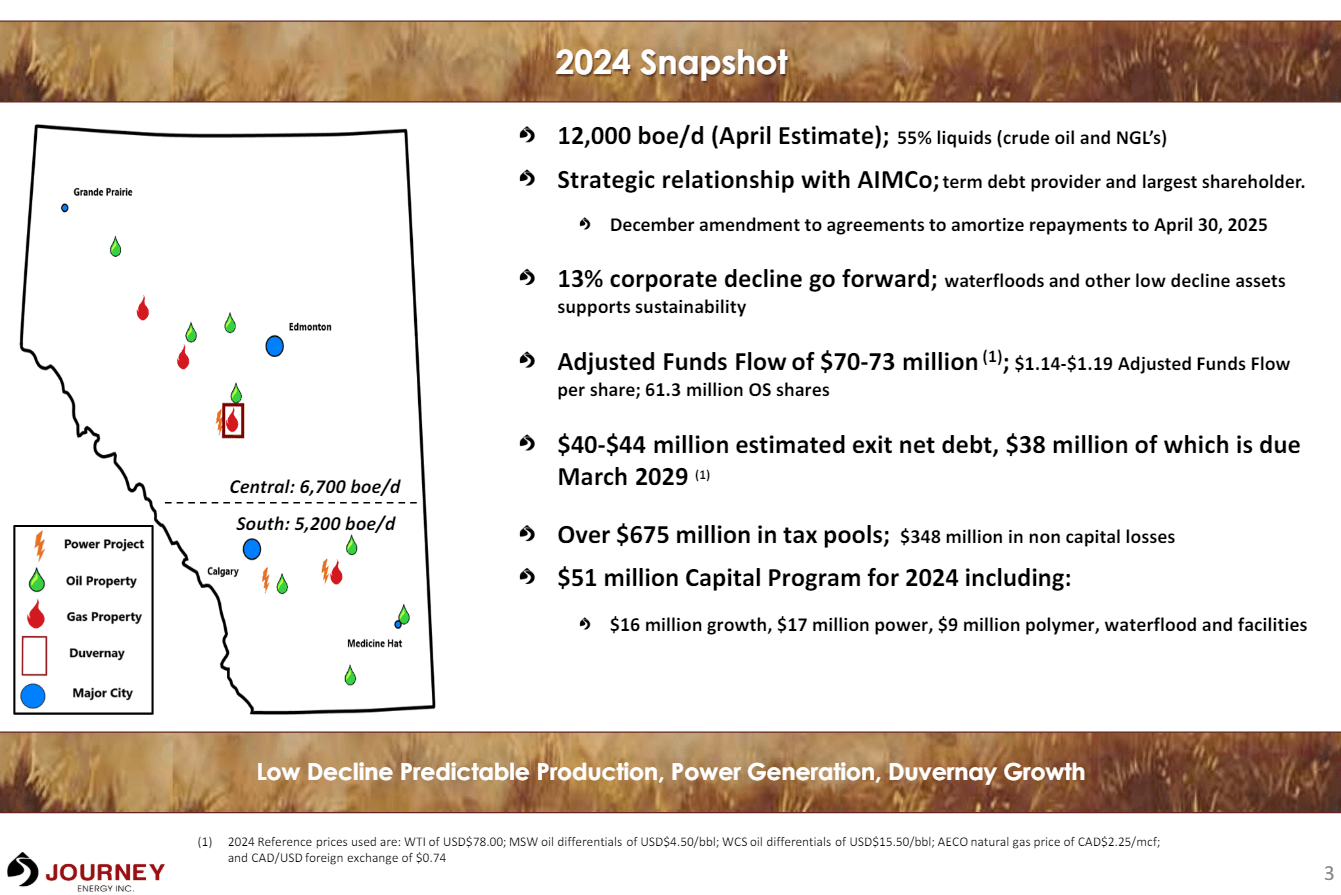

Journey Energy's (JOY:CA) stock has taken a beating over recent months. At its current price, we view it as an attractive long-term buy. The company produces approximately 12,000 boe/d, consisting of 27% light crude, 17% heavy crude, 10% NGLs, and 46% natural gas in Alberta, Canada. Journey’s operating footprint is shown below.

Source: Journey Energy May 2024 Investor Presentation.

The company sports a low 13% corporate decline rate due to secondary recovery techniques. Its CEO, Alex Verge, is the former CEO of NuVista Energy (NVA:CA). His career in the Canadian oil patch spans some 40 years. Verge displays unusual candor with shareholders, sitting for long interviews and posting his phone number on social media sites to field investor inquiries. Verga owns $24 million of Journey stock, so he’s clearly incentivized to perform for shareholders. He has publicly stated that he’s never sold a single share.

Journey has been challenged by its entry into the natural gas power plant business in 2020. Since then, it has acquired three plants, shown below.

Source: Journey Energy May 2024 Investor Presentation.

We were skeptical when we first learned about Journey’s power investments. The move struck us as a needless attempt at “diworsificaiton” that could distract management and ultimately detract from shareholder value. However, as we dug deeper into Journey’s unique situation, we began to appreciate management’s rationale for entering the business.

To date, however, that rationale has failed to yield the expected benefits. The power plants have become an albatross for Journey as completion schedules faced delays while requiring significant ongoing investment. They consumed cash flow that is at risk of growing scarce amid low commodity prices and a lack of hedges. Journey spent $9.3 million on the plants' development in the fourth quarter of 2023 alone.

Journey's power segment will continue to drain cash flow until the three plants are placed into service. This pattern of ongoing investment quarter after quarter without a corresponding cash flow benefit has frustrated many shareholders—understandably so, in our view.

Management justifies the power plant investments, first, by reference to their low acquisition cost. Journey’s Mazeppa plant, for example, was originally built for $32 million, but Journey acquired it for $5 million. The plant will only require an additional $10 million of investment after acquisition.

Management also views the power plant revenues as a hedge to Journey’s E&P operations. The company’s E&P activities entail unusually high power costs due to their use of secondary recovery techniques. Management is confident that Journey’s ability to add power to the grid can help offset its high power costs.

In 2022 and 2023, Journey’s power costs were $22 million and $23 million, respectively, comprising approximately 25% of its total operating costs. Operating costs ranged from $17.02 to $23.64 per boe on a quarterly basis over the past two years, so any material reduction or offset to operating costs can increase Journey's netback and cash flow.

Lastly, management is optimistic about the long-term free cash flow generation potential of the power assets beginning in 2025.

Journey’s Stock Falls as Risks Increase

In late 2023, the combination of falling WTI prices and elevated capex related to the power plants caused Journey’s stock to sell down to multi-year lows, where it stands today.

The company’s recent troubles stem from a combination of lower commodity prices, the cost and terms of its debt, the ongoing financial commitments to its power plants, and production declines over recent quarters. They can be traced back to Journey's poorly-timed acquisition of assets from Enerplus (ERF) in July 2022, in which it paid $140 million for assets that produced 4,000 boe/d of 55% liquids. Enerplus had originally paid $114 million for the assets in 2016.

Journey underwrote the acquisitions at oil prices lower than the $100+ per barrel that prevailed at the time, but no doubt the $32,000 per flowing barrel it paid for the acreage was more than it would have paid if oil prices were significantly lower and commodity markets weren’t as ebullient.

While the price Journey paid wasn’t cheap, the quality of the acquired asset was good. Production on the acreage has a low decline rate due to the use of polymer floods. However, the acreage had been neglected by Enerplus in the years before the sale and consequently required significant investment from Journey.

To finance the deal, Journey issued 3 million shares at $4.76 and took on a $45 million vendor-take-back loan from Enerplus. The vendor loan bears interest at 10% annually and has repayment terms tied to oil prices, with a greater amount of principal to be repaid at higher oil prices.

In the quarters after the deal closed, management missed its production guidance several times. Also, Journey’s quarterly production declined from 12,900 boe/d to 11,900 boe/d.

In the fourth quarter of 2023, oil and gas prices sold off, putting pressure on Journey’s cash flow and its ability to fund its drilling capex and power investments. Meanwhile, the company faced the looming maturity of its secured debt held by Alberta Investment Management Corporation (AIMCo), which is also its largest shareholder.

In December 2023, Journey amended the terms of its AIMCo loan to reduce a balloon payment and further extend the loan’s repayment schedule. At year-end, Journey had $33.7 million of its $43.6 million AIMCo loan—as well as $17 million outstanding on its Enerplus loan—coming due at various times throughout 2024. It was clear that if commodity prices and cash flow generation remained low, Journey’s shareholders would face a high risk of loss.

In March of 2024, commodity prices remained at low levels. With few available financing options, Journey entered into a $38 million bought-deal private placement of convertible debentures. It made the deal to alleviate the risks stemming from debt repayment in 2024 and to fund its capital program. The convertible debentures bear interest of 10.25% annually. They become eligible for conversion in March 2029, at which point they convert into 7.6 million common shares at $5.00. If the shares are converted, they will increase Journey's current share count by 11%.

The convertible deal was expensive and is being panned by prominent Journey shareholders. Management justified it on the grounds that it removed risk to shareholders in the event commodity prices remained low. It also allows the company to fully fund its drilling capex and ensure that it can complete its power plant investments by year-end, at which point it expects them to generate free cash flow.

Despite the deal's purported benefits, it had the effect of creating a battleground atmosphere around Journey’s stock. It soured investor sentiment toward the name further.