By: Jon Costello

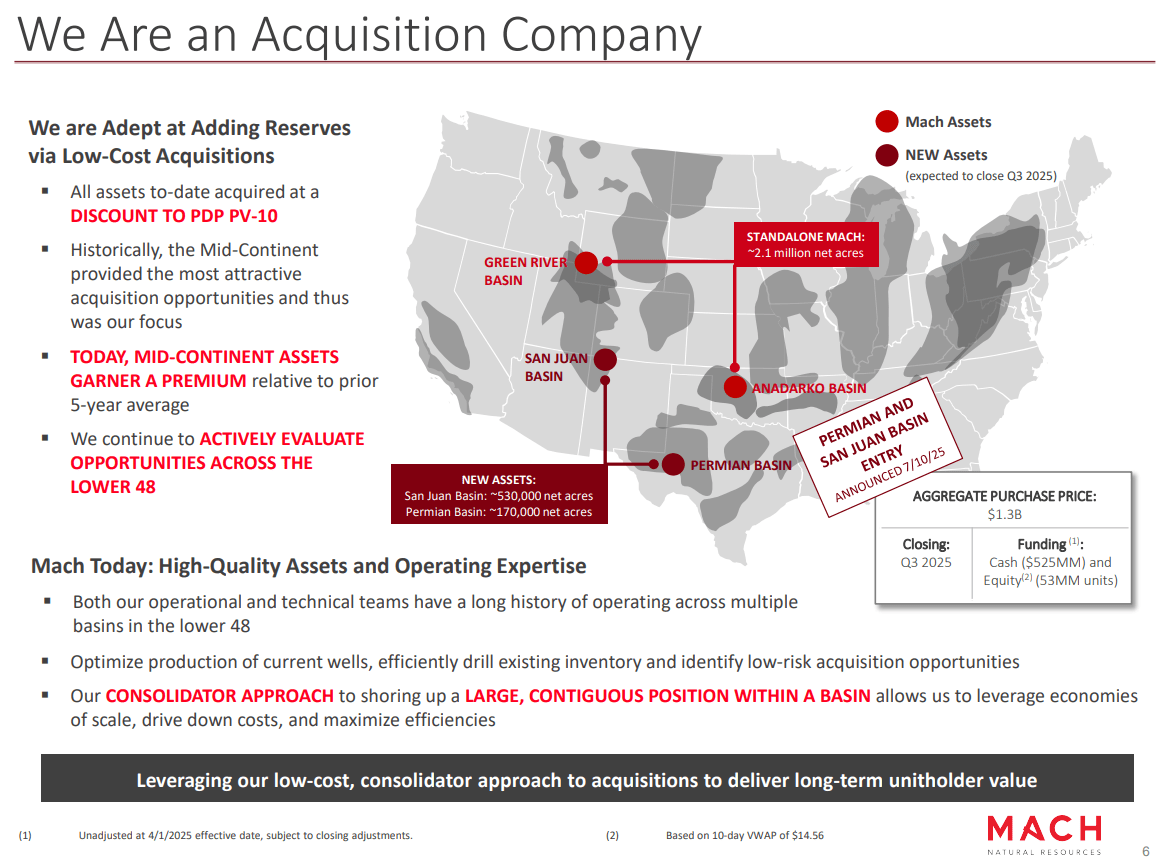

Mach Natural Resources’ (MNR) operations were previously focused exclusively in the mid-continent region before it announced two transformative asset acquisitions on July 10. The acquired assets expanded the company’s footprint into the San Juan and Permian Basins. An overview is shown below.

Source: Mach Natural Resources Q2 Earnings Presentation, August 2025.

The post-acquisition entity will produce approximately 151,000 boe/d comprised of 20% crude oil, 15% NGLs, and 65% natural gas.

The recently acquired assets extend MNR’s reserve life from 8 to 10 years. Their most notable feature is the low decline rate. The company states that the San Juan and Permian assets possess a base decline of only 10% and 8%, respectively, compared to the pre-acquisition entity’s 20%. After integration, these assets will bring MNR’s base decline rate down to 15%, making it one of the lowest among its U.S. E&P peers.

MNR’s new low-decline assets will enhance its capital efficiency and financial flexibility, which is crucial for an E&P that aims to maximize payouts to equity owners.

With the new assets, MNR can keep its reinvestment needs relatively low, allowing it to distribute a large portion of its cash flow to equity owners. The low-decline assets also boost the company’s cash flow potential amid higher oil and natural gas prices.