(Idea) Marathon Oil

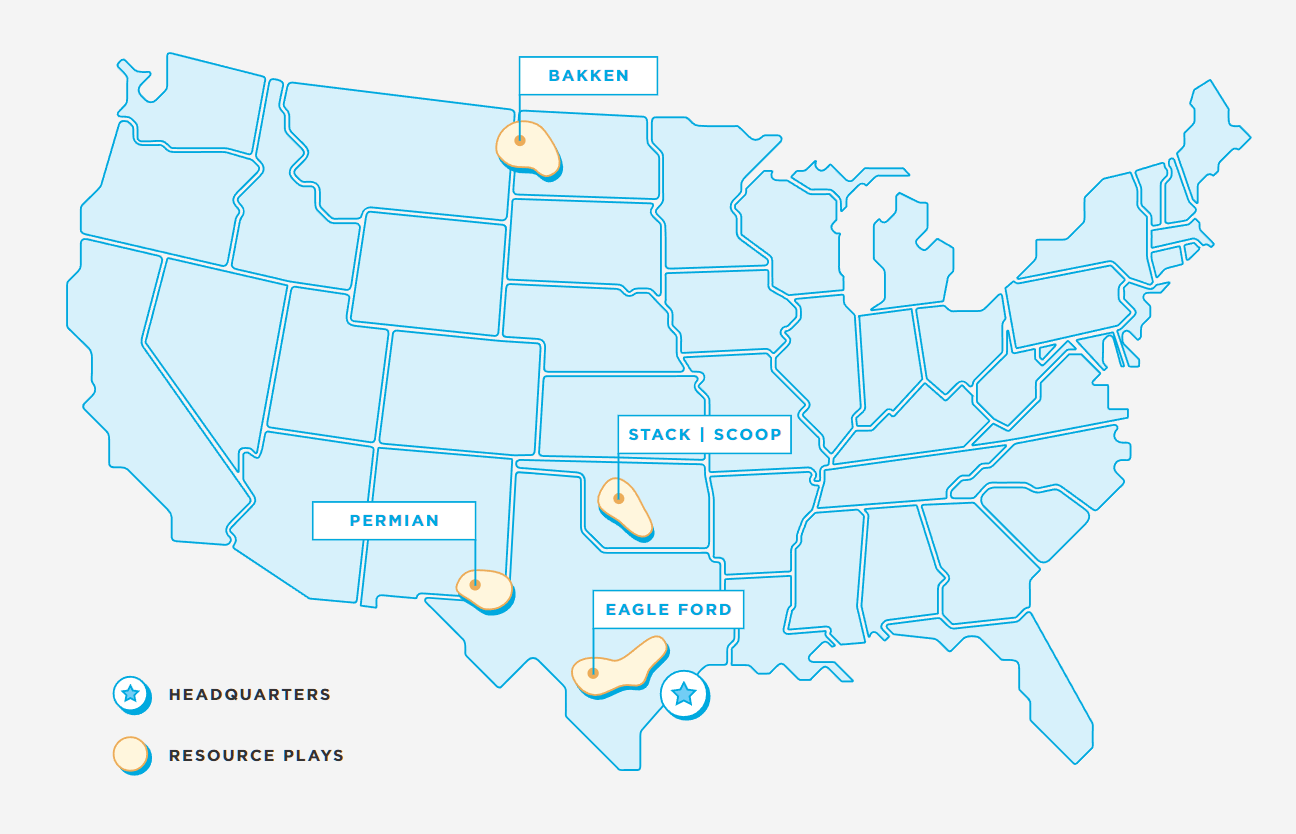

Marathon Oil (MRO) is a U.S. E&P that produces approximately 405,000 boe/d with a production mix of 50.4% crude oil, 24.2% NGLs, and 25.4% natural gas. It operates in major U.S. shale basins and Equatorial Guinea, where it produces primarily natural gas. Its U.S. operations are shown below.

MRO is not to be confused with Marathon Petroleum Corp. (MPC), the refiner that is also the sponsor of MPLX (MPLX).

MRO is one of the best-managed E&Ps in the U.S. It achieves sector-leading metrics in terms of free cash flow generation, capital efficiency, breakeven cost per barrel, and production growth per share. The company can reliably maintain production by reinvesting slightly less than 40% of its cash flow. It therefore generates huge sums of free cash flow to distribute to shareholders.

The company’s cash-generating ability is coupled with an unmatched commitment to return capital to shareholders.

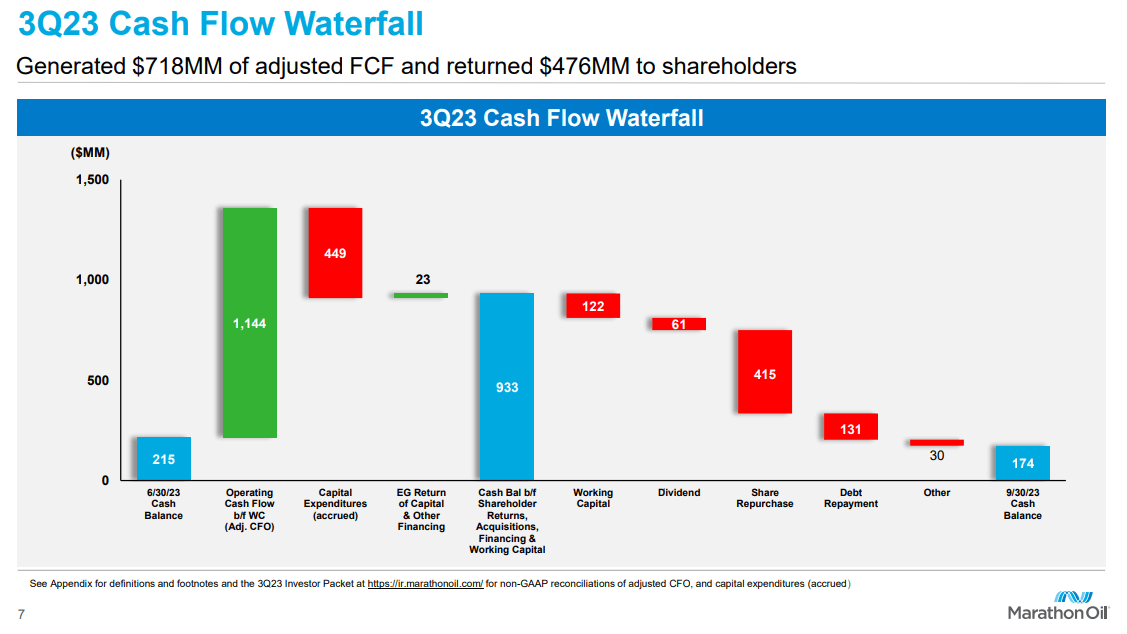

Recent results speak for themselves. In the first three quarters of 2023, MRO returned $1.34 billion to shareholders through $1.15 billion of share repurchases and $186 million of dividends. During that time, it also reduced debt by $450 million through early November. This $1.79 billion of share repurchases, dividends, and debt reduction over three quarters was accomplished while spending $1.66 billion on capex.

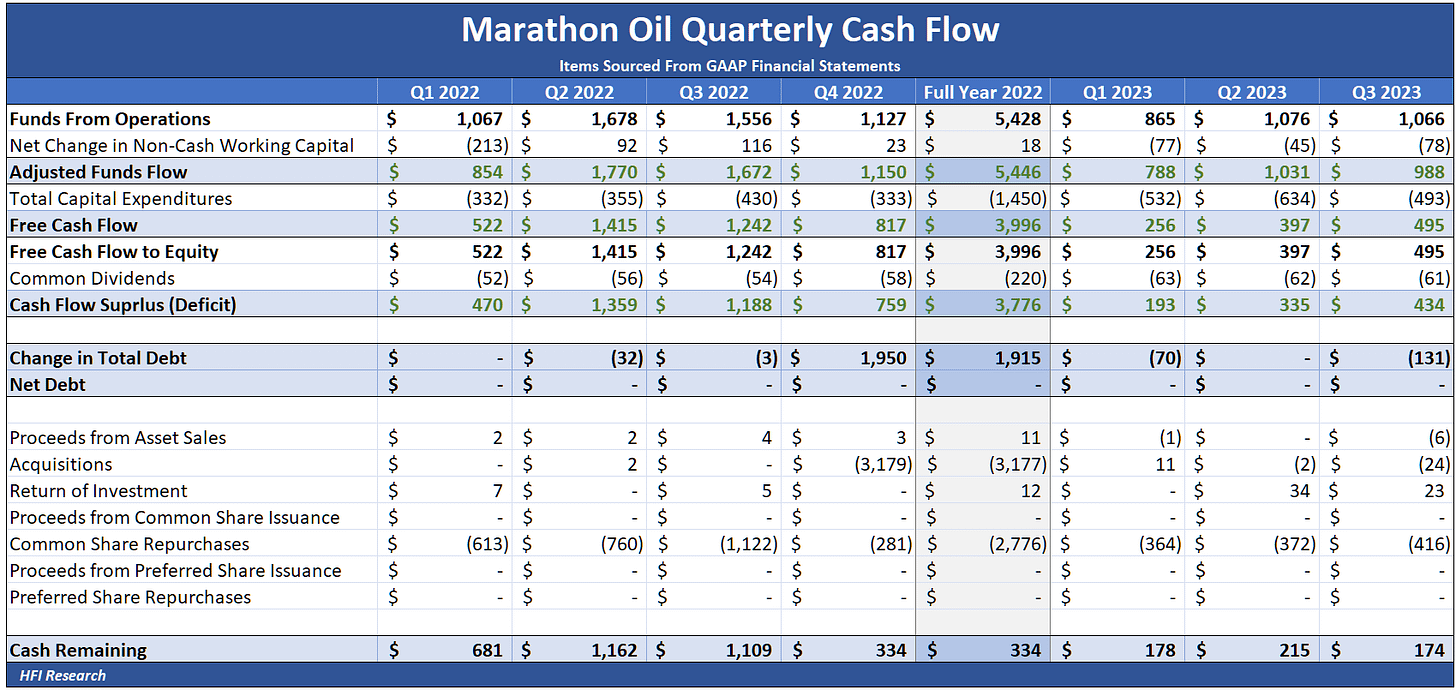

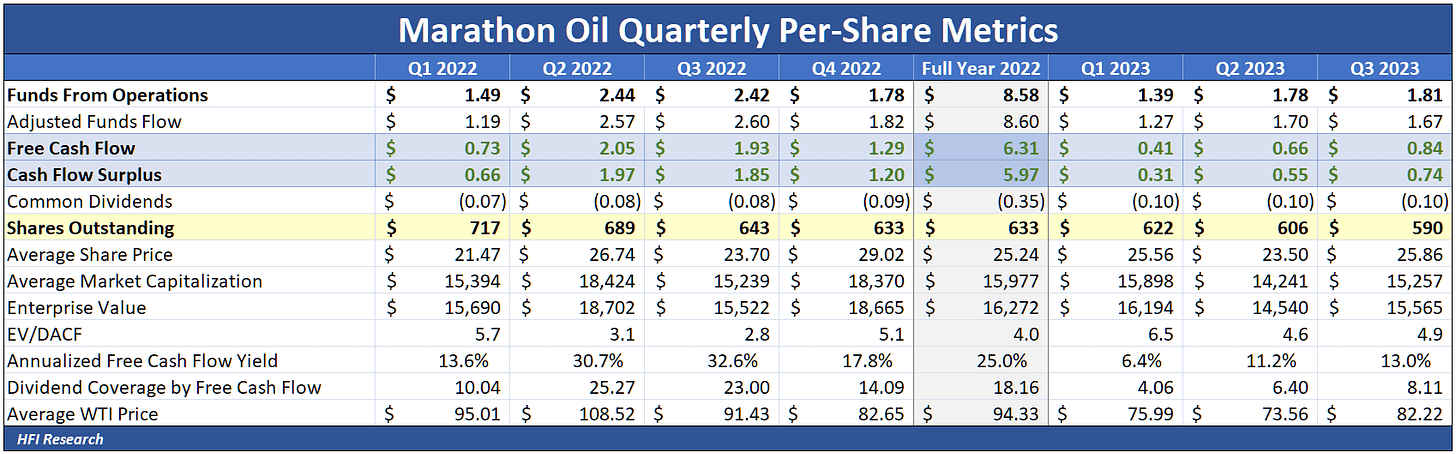

MRO’s high-quality asset base, strong balance sheet, and robust cash flow generation allow it to be programmatic in its approach to returning capital to shareholders. It can maintain a relatively steady pace of capex, pay a modest base dividend that it regularly increases, and allocate the remaining cash flow to share repurchases. The table below demonstrates the company’s consistency across different commodity price regimes.

Share repurchases stand out among MRO’s capital allocation policies. Over the past eight quarters ending September 30, the company repurchased 26% of its shares outstanding. These repurchases have facilitated increases to the base dividend, which were made in nine of the past 13 quarters. The most recent was a 10% dividend increase in the third quarter. The repurchases are highlighted in the table below.

The following waterfall chart shows how operating cash flow (in green) was split among various capital allocation initiatives, with share repurchases receiving the highest priority.

Source: Marathon Oil Q3 2022 Earnings Conference Call Slide Presentation, Nov. 1, 2023.

MRO’s leverage is conservative. Debt stands at $5.5 billion, approximately 1-times EBITDA at current oil prices. Management’s goal is to gradually reduce debt to the $4 billion range, at which point it would be 1-times EBITDA at $50 per barrel WTI.

MRO’s financial strength allows it to take an opportunistic approach to acquisitions. In November of 2022, it announced its acquisition of Ensign Natural Resources, a private Warburg Pincus portfolio E&P, for $3 billion. Ensign was one of the best performers among Eagle Ford E&Ps in oil-equivalent well productivity and capital efficiency. It also had large tracks of undrilled acreage. The deal increased MRO’s scale in the Eagle Ford, significantly increased its production of oil, NGLs, and natural gas, and was immediately accretive to cash flow at oil prices above $60 per barrel. It also holds the prospect of achieving additional gas from the re-fracking of early-vintage wells. By all appearances, this was an attractive acquisition for MRO shareholders.

The repurchases, along with the Ensign acquisition, have led to significant gains in production growth per share without major increases in organic production. MRO ranks as one of the best performers among large North American peers in the metric.