MEG Energy (MEG:CA) is one of our favorite E&P stocks for long-term holding. The company is among the highest-quality names we cover. It features a strong balance sheet, captial efficient production, significant production growth, and operational simplicity relative to other E&Ps. Its Christina Lake asset is one of the highest-quality large-scale thermal oil sands operations in the world, with a reserve life spanning multiple decades even assuming long-term production growth. The company is close to achieving its net debt target, at which point it will distribute 100% of its free cash flow to shareholders. As a sign of its intentions, it recently announced its inaugural base quarterly dividend of C$0.10 per share.

The following slide presents MEG’s corporate snapshot:

Source: MEG Energy August 2024 Corporate Presentation.

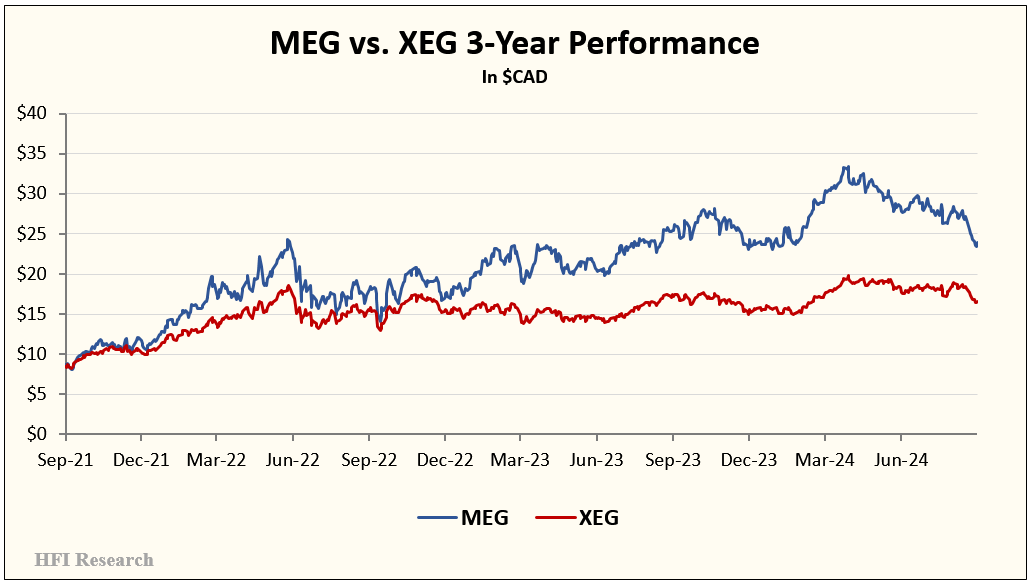

Despite MEG’s attractive attributes, its shares have been clobbered in the latest oil market downturn. The chart below shows MEG’s outperformance over the past three years versus the XEG, the Canadian oil and gas E&P ETF.

Since MEG and XEG hit their highs on April 10, MEG shares are down 27.5%, while the XEG has fallen by only 15.2%. We view MEG’s relative underperformance as an attractive buying opportunity.

Given MEG’s high quality and consistently strong performance, at current prices, its shares offer the combination of low risk and high returns that is rare in the energy space. As such, its shares are appropriate for conservative and aggressive investors alike.