(IDEA) MPLX - One Of The Best MLPs

MPLX (MPLX) reported the strongest second quarter among large-cap midstream companies. The results are consistent with the company’s superb execution and its prudent, steady approach to growth. MPLX's approach offers a refreshing contrast to Energy Transfer’s (ET) scattershot manner of pursuing growth for growth's sake, which was on display today in its $7.1 billion all-equity acquisition of Crestwood Equity Partners (CEQP).

MPLX stands out for its remarkably stable EBITDA and cash flow that reliably grows at a low-single-digit rate annually. It consistently earns one of the highest returns on equity in the sector, in the mid-20% range. It routinely grows throughput and free cash flow over the long term through low-risk projects. Its long-haul pipeline segment—which accounts for two-thirds of companywide EBITDA—requires remarkably low capex. It maintains a conservative balance sheet, with net debt at 3.5 times Adjusted EBITDA. And yet, despite all these positives, its units trade at a low 9.2-times EV/EBITDA multiple and a 13.2-times P/E to yield 8.9%.

This peculiar mix of characteristics makes MPLX units among the most attractive in the entire midstream sector, let alone among its large-cap midstream peers. We consider it a must-own for conservative accounts looking for a safe, large, and inflation-resistant income stream.

An Admirable Q2 Performance

MPLX continued to chug along in the second quarter, posting results that were better than the large-cap MLPs Enterprise Products Partners (EPD) and Energy Transfer.

Like its large-cap peers, operating results were strong. Total throughput volumes ticked 0.5% higher, but even more importantly, given today’s macro environment, the average pipeline tariff rate surged by 8.5%, a big boost for assets that feature low capex requirements. The increase indicates the inflation resistance of MPLX’s long-haul pipelines.

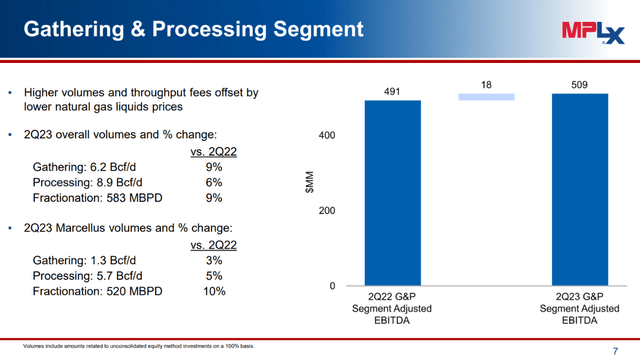

We were particularly impressed with MPLX’s Gathering and Processing segment results. Gathering, processing, and fractionation volumes all posted large increases due to organic growth and the impact of new growth projects.

Source: MPLX Q2 2023 Earnings Conference Call Presentation, Aug. 1, 2023.

The results support the company’s decision to allocate additional growth capex to its Permian and Marcellus G&P systems. Management said that the production outlook among producer customers remains unchanged in spite of year-to-date commodity price volatility.

Unlike its large-cap peers, its financial results didn’t feel a heavy negative impact from lower oil and NGL prices during the quarter. Management reported a $50 million headwind for EBITDA, which was significantly less on a percentage basis than ET and EPD. MPLX's insulation from commodity price swings, along with tariff rate increases, allowed it to post an impressive 5.1% year-over-year Adjusted EBITDA over the year-ago level, while EPD and ET posted declines.

One of the Best-Managed Midstreamers

For MLPX, the most reliable indicators of managerial quality are long-term return on capital employed and return on equity. Return on capital employed has held steadily above 10% since 2017, with the only interruption caused by the severe downturn in 2020. The stable results are attributable to MPLX’s supportive relationship with its sponsor, Marathon Petroleum Corp. (MPC), and management’s success at securing recurring revenue streams that generate attractive margins through fee-based contracts. Return on capital, which now regularly tracks above 12%, is one of the highest in the midstream sector.