Editor’s Note: We first covered VAL 0.00%↑ in a write-up back in March 2025. We have made it public to all readers.

By: Jon Costello

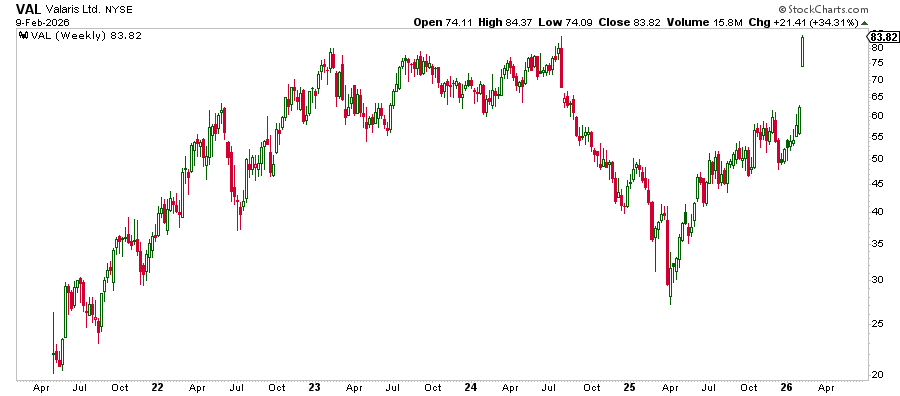

Earlier today, Transocean (RIG) announced it will acquire Valaris (VAL) in an all-stock deal valued at approximately $5.8 billion. Under the deal, Valaris shareholders will receive 15.235 Transocean shares for each Valaris share they owned as of February 6, before the announcement. This equals about $82.12 per Valaris share, reflecting a 31.6% premium over Valaris’s $62.41 pre-deal closing price.

Both stocks gained steadily throughout the day. Valaris closed at $83.82, and Transocean closed at $5.71, up 6.1% on the day.

Upon closing, Transocean will have an enterprise value of over $17 billion. Its shareholders will own 53% of the combined company, while Valaris shareholders will own the remaining 47%.

The deal marks a win for investors who purchased Valaris shares in the past eighteen months.

Since Transocean’s offer is for all stock, Valaris shares will swing around with Transocean’s share price until the deal closes. For investors seeking to maintain exposure to a recovering offshore market, it makes sense to hold onto the shares for the long term. I plan to hold all of my Valaris shares and exchange them for Transocean shares, which I expect to hold onto afterward.

The deal is also a win for Transocean shareholders in the near term, primarily because it supports the company’s efforts to delever its balance sheet. The additional operating cash flow from this deal reduces the combined entity’s interest burden relative to the legacy Transocean. Its shareholders will face less financial risk if dayrates were to turn down.

Management expects to realize $200 million in annual cost savings and aims for a leverage ratio of 1.5x Adjusted EBITDA 24 months after closing. The pro forma balance sheet based on the latest financial information shows $5.38 billion in net long-term debt, with $1.37 billion due within one year. Liquidity is strong, with $1.50 billion in pro-forma unrestricted cash and $859 million of pro-forma revolver availability, for total pro-forma of approximately $2.35 billion.

Once the deal closes, I expect management to begin considering reinitiating a dividend and/or share repurchases as the need to reduce debt diminishes.

The main negative for Transocean shareholders is the dilution from this deal. Transocean shareholders will own 51% of the combined entity on a fully diluted basis, resulting in nearly 100% dilution. Still, considering the reasonable price paid for Valaris—assuming the offshore market continues its recovery to new all-time highs—the enhanced earning power, improved market position, and lower risk effectuated by this deal make the dilution worthwhile.

This deal caught me by surprise, as I had agreed with the consensus view among many industry watchers that Valaris would be more likely to combine with Noble Corp. (NE) than with Transocean. Valaris and Noble have more similar fleets, which would yield greater relative competitive improvements and cost savings. However, as a shareholder of both Transocean and Valaris, I like this deal.

Late last year, I soured somewhat on Valaris’ management, particularly its weak capital-allocation performance. Share repurchases were a key part of my Valaris investment thesis, but the company failed to repurchase any shares during the first three quarters of the year, even though it had ample cash that was building over time, a conservative balance sheet, and shares trading at depressed levels. Repurchases made sense and would have been highly accretive. When no repurchases had been made, I was concerned that if management could botch capital allocation, it might botch other important areas of this business, which offers many opportunities for mistakes. I’m pleased that Transocean management will lead the combined entity.